Global-E Online Ltd. (NASDAQ:GLBE) reported better-than-expected third-quarter results and raised its FY24 outlook on Wednesday.

Sales grew 32% year over year to $176 million, beating the analyst consensus estimate of $169.16 million.

Adjusted EBITDA rose to $31.1 million from $22.1 million a year ago. The company's operating loss narrowed to $21.0 million from $35.6 million. Loss per share was 13 cents, beating the consensus loss of 15 cents.

For the fourth quarter, Global-e Online projects GMV of $1.615 billion – $1.685 billion and revenue of $243 million and $255 million vs. $246.27 million estimate. The company raised its FY24 revenue guidance to $732.9 million – $744.9 million (from $710 million – $750 million), vs. the consensus of $730.72 million.

For the fourth quarter, Global-e Online projects GMV of $1.615 billion – $1.685 billion and revenue of $243 million and $255 million vs. $246.27 million estimate. The company raised its FY24 revenue guidance to $732.9 million – $744.9 million (from $710 million – $750 million), vs. the consensus of $730.72 million.

Founder and CEO Amir Schlachet said, "We report today the results of another very strong quarter, with growth of GMV accelerating to 35% year over year and many new merchants going live ahead of the holiday season, including the iconic luxury department store Harrods."

Global-E Online shares gained 4% to trade at $49.78 on Thursday.

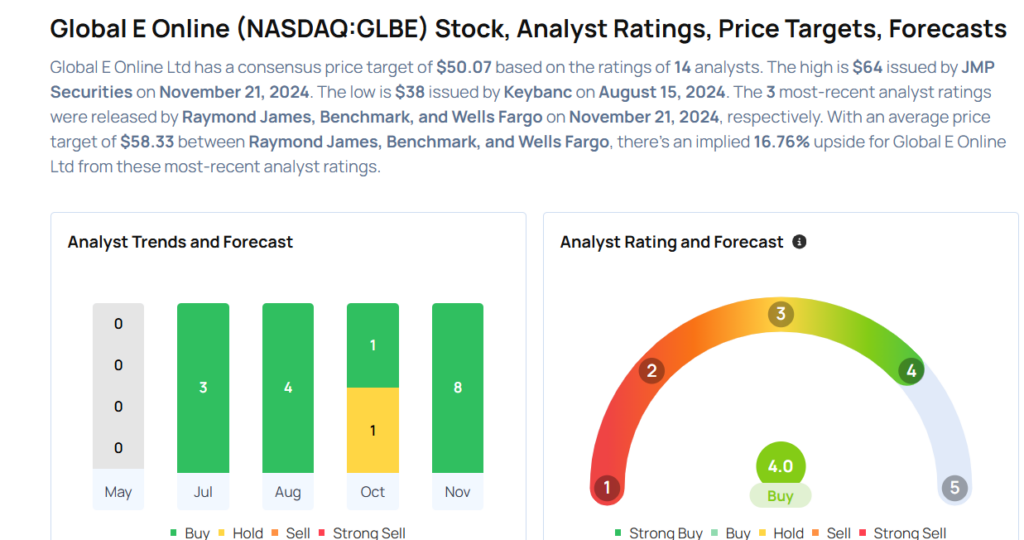

These analysts made changes to their price targets on Global-E Online following earnings announcement.

- Piper Sandler analyst Brent Bracelin reiterated Global E Online with an Overweight and raised the price target from $44 to $63.

- JMP Securities analyst Patrick Walravens maintained the stock with a Market Outperform and raised the price target from $46 to $64.

- Benchmark analyst Mark Zgutowicz maintained the stock with a Buy and raised the price target from $45 to $60.

- Wells Fargo analyst Andrew Bauch maintained the stock with an Overweight rating and increased the price target from $45 to $60.

- Raymond James analyst Brian Peterson maintained Global E Online with an Outperform rating and boosted the price target from $41 to $55.

Considering buying GLBE stock? Here's what analysts think:

Read This Next:

- This Palo Alto Networks Analyst Turns Bullish; Here Are Top 5 Upgrades For Thursday