① The funds that Huaxing Yuanchuang participated in the establishment of this time are not included in the scope of its consolidated statements. The source of investment funds is own funds, and the amount contributed accounted for 0.18% of its total audited assets in the most recent year; ② Previously, Huaxing Yuanchuang had invested in three private equity investment funds, all of which were invested in semiconductors, optoelectronics and other related fields.

“Science and Technology Innovation Board Daily”, November 22 (Reporter Qiu Siyu) Yesterday evening (November 21), Huaxing Yuanchuang announced that the company participated in the establishment of the private equity fund Zhiyuan Weixin, which mainly invests in the semiconductor industry chain, new materials, new energy and other industries.

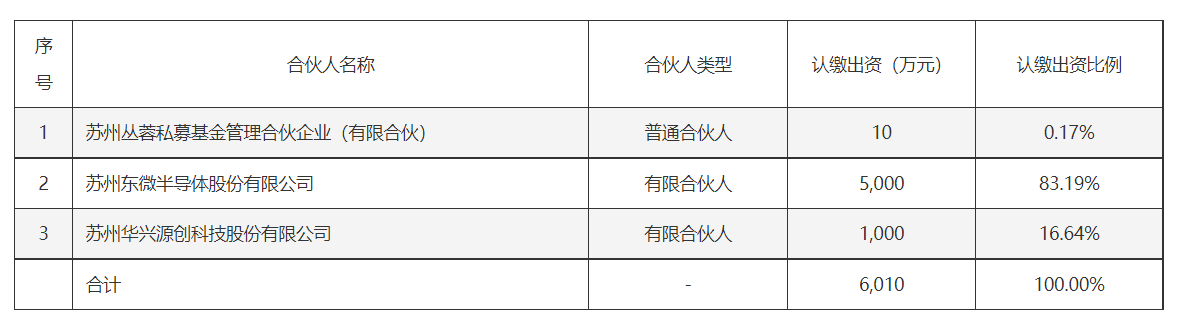

As a limited partner, Huaxing Yuanchuang subscribed RMB 10 million with its own capital, accounting for 16.64% of the fund's share. The operating period of the Zhiyuan WeChat Business Registration is 10 years. The product operation period is 7 years from the date of establishment of the partnership product. After expiration, it can be continued with the general partner's proposal and approval.

Compared to public funds, private equity funds are established to raise funds from specific investors through private methods. They have the characteristics of non-disclosure, specific fund-raising targets, high investment threshold, flexible operation, and high risk. Generally speaking, investing in private equity funds has a long investment cycle and low liquidity.

Compared to public funds, private equity funds are established to raise funds from specific investors through private methods. They have the characteristics of non-disclosure, specific fund-raising targets, high investment threshold, flexible operation, and high risk. Generally speaking, investing in private equity funds has a long investment cycle and low liquidity.

Huaxing Yuanchuang also clearly stated in the announcement that the company's investment in Zhiyuan Weixin has no capital guarantee and minimum return. Its investment behavior is affected by various factors such as policies and regulations, macroeconomics, industry cycles, and the operation and management of the investment target, and there may be a risk that it will not be able to achieve the expected returns or withdraw in a timely and effective manner.

It should be noted that the funds that Huaxingyuanchuang participated in the establishment of this time are not included in the scope of its consolidated statements. The source of investment funds is own funds, and the investment amount accounts for 0.18% of its total audited assets in the most recent year. It stated that this investment was an investment decision made on the premise of ensuring the normal development of the company's main business. It will not affect the normal operation of its production and operation activities, will not have a significant impact on the company's annual operations and financial situation, and will not harm the interests of the listed company or all shareholders.

The “Science and Technology Innovation Board Daily” reporter noticed that another investor in Zhiyuan Weixin is also Dongwei Semiconductor, a company listed on the Science and Technology Innovation Board.

According to Huaxing Yuanchuang's announcement, Dongwei Semiconductor has pledged an investment of 50 million yuan, and the pledged investment ratio is 83.19%.

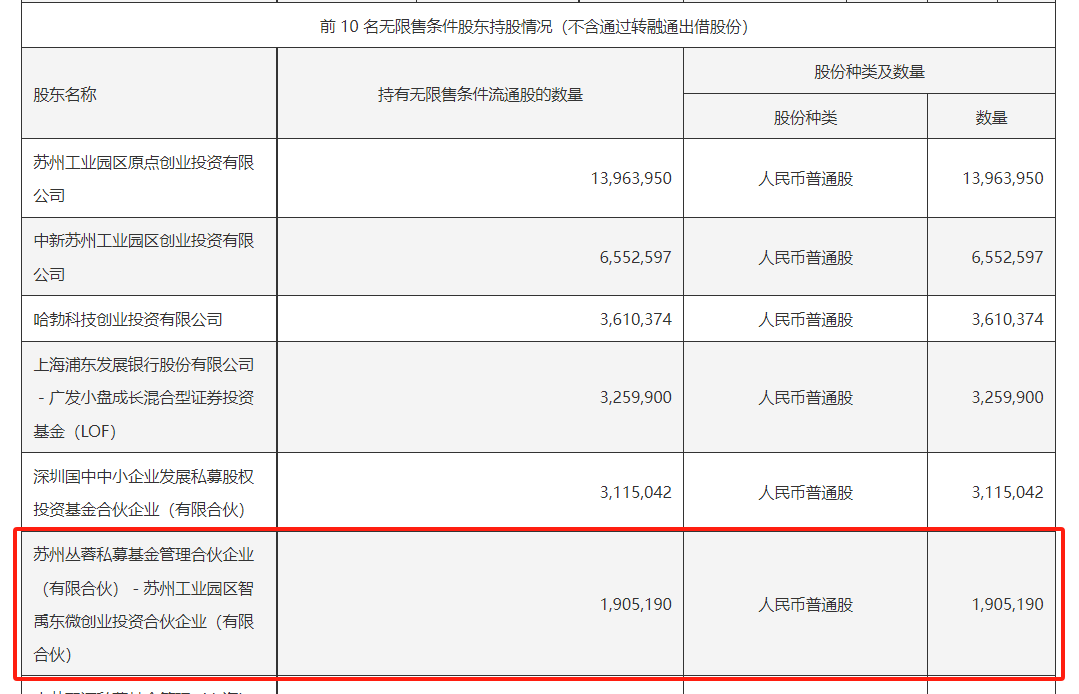

It is worth mentioning that, according to Dongwei Semiconductor's third quarterly report, Suzhou Congrong Private Equity Fund Management Partnership (Limited Partnership) - Suzhou Industrial Park Zhiyu Dongwei Venture Capital Partnership (Limited Partnership) holds a total of 1.9052 million shares, ranking sixth among the company's top ten shareholders with unlimited sales conditions.

Meanwhile, Suzhou Congrong Private Equity Fund Management Partnership (Limited Partnership) is the general partner and executive partner of Zhiyuan Weixin, and acts as the fund manager.

Looking back at Huaxing Yuanchuang, the company is a provider of industrial automated testing equipment and complete line system solutions. Its products are mainly used in LCD and OLED flat panel displays, new micro displays, semiconductor integrated circuits, smart wearable devices, and new energy vehicles.

Huaxing Yuanchuang's performance declined significantly this year. In the first three quarters, it achieved operating income of 1.276 billion yuan, a year-on-year decrease of 4.57%; net profit to mother was -51.13 million yuan, a year-on-year decrease of 126.79%.

Regarding the reason for the decline in performance, Huaxing Yuanchuang said that it is mainly due to weak demand from some of the company's customers, which has led to fluctuations in gross margin of some orders. At the same time, some of its investment projects are still in the phase of climbing production capacity, depreciation of new assets, increased amortization expenses, and rising costs of some raw materials.

Looking back at Huaxing Yuanchuang's foreign investment process, this is not the first time that the company has subscribe/ participated in investing in private equity funds.

Among them, in October of last year, the company subscribed to the private equity fund Suzhou Kaifeng Chuangxin Venture Capital Partnership (Limited Partnership) (hereinafter referred to as “Kaifeng Chuangxin”), which mainly invests in high-growth unlisted companies in the integrated circuit sector, focusing on seed or angel round financing companies.

Huaxing Yuanchuang revealed the specific investment situation of its private equity funds in this year's semi-annual report:

It is easy to see that Huaxing Yuanchuang Investment's private equity funds are investing in industries related to their main business. In August 2022, it invested 20 million yuan in Shanghai Cornerstone Materials Private Equity Fund Partnership (Limited Partnership). The fund has already invested in 7 companies in the semiconductor industry; in the same month, the Suzhou Qingshan Zhiyuan Venture Capital Partnership (Limited Partnership), which it invested in, also added 8 companies in the optoelectronics industry. Kaifeng Chuangxin has invested in 9 semiconductor industry companies and 1 company in the optoelectronics industry.

相对于公募基金,私募基金通过非公开方式面向特定投资者募集资金而设立,具有非公开性、募资对象特定、投资门槛较高、运作灵活、风险较高的特点。通常来看,投资私募基金的投资周期长、流动性较低。

相对于公募基金,私募基金通过非公开方式面向特定投资者募集资金而设立,具有非公开性、募资对象特定、投资门槛较高、运作灵活、风险较高的特点。通常来看,投资私募基金的投资周期长、流动性较低。