It is hard to get excited after looking at Guangxi Guiguan Electric PowerCo.Ltd's (SHSE:600236) recent performance, when its stock has declined 4.9% over the past three months. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. Specifically, we decided to study Guangxi Guiguan Electric PowerCo.Ltd's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Guangxi Guiguan Electric PowerCo.Ltd is:

11% = CN¥2.6b ÷ CN¥24b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.11 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Guangxi Guiguan Electric PowerCo.Ltd's Earnings Growth And 11% ROE

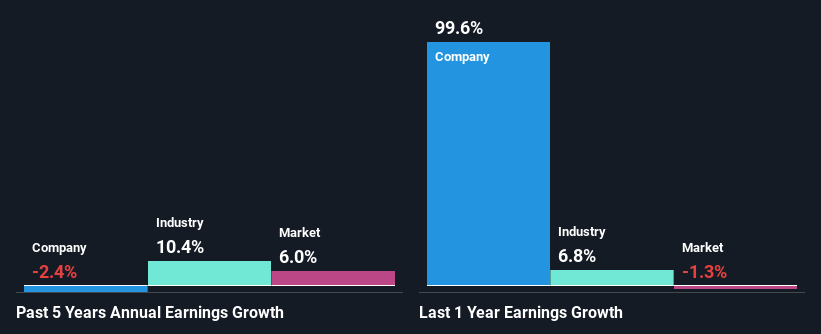

On the face of it, Guangxi Guiguan Electric PowerCo.Ltd's ROE is not much to talk about. Although a closer study shows that the company's ROE is higher than the industry average of 7.7% which we definitely can't overlook. But then again, seeing that Guangxi Guiguan Electric PowerCo.Ltd's net income shrunk at a rate of 2.4% in the past five years, makes us think again. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. So that could be one of the factors that are causing earnings growth to shrink.

That being said, we compared Guangxi Guiguan Electric PowerCo.Ltd's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 10% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for 600236? You can find out in our latest intrinsic value infographic research report.

Is Guangxi Guiguan Electric PowerCo.Ltd Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 76% (implying that 24% of the profits are retained), most of Guangxi Guiguan Electric PowerCo.Ltd's profits are being paid to shareholders, which explains the company's shrinking earnings. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. Our risks dashboard should have the 2 risks we have identified for Guangxi Guiguan Electric PowerCo.Ltd.

In addition, Guangxi Guiguan Electric PowerCo.Ltd has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth.

Conclusion

Overall, we have mixed feelings about Guangxi Guiguan Electric PowerCo.Ltd. Specifically, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return. Investors may have benefitted, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.