Although the list of winners for TGA 2024 will be announced in a month, many people in china may have already awarded the crown to the "chosen one."

On August 20, the launch of "Black Myth: Wukong" brought an exciting collision of Chinese traditional culture and modern industrial aesthetics to many gamers, and this Chinese aesthetic art can be seen at various gaming exhibitions, press conferences, offline experience centers, and thematic venues. Different occasions may have different solutions for achieving the perfect presentation effect, but there is almost astonishing consistency in the display segment, which is the LED display, or more precisely, the MLED.

MLED, known as the future display technology, seems far away from us.

But in fact, the future may have already arrived.

But in fact, the future may have already arrived.

1. The ceiling of MLED continues to rise.

MLED is a collective term for Mini LED and Micro LED, which through reducing the size of LEDs increases the display brightness, contrast, and resolution, while lowering power consumption, marking the progress in the field of display technology.

Compared to traditional LED displays, MLED displays have characteristics such as high brightness, high contrast, high resolution, low power consumption, high integration, and high stability, thus being regarded as the next generation display solution. According to Futuresource Consulting, the current global MLED penetration rate is about 5%, and it is expected to rise to 10% by 2027.

In addition, MLED displays can achieve seamless splicing, meaning they can be spliced into any size large screen without gaps, creating a more complete picture. This seamless splicing technology enhances the visual effect of MLED displays, solves the sense of fragmentation in large size displays, achieving a more continuous and complete display effect, and also means that MLED can be widely applied in any display occasion from the smallest to the largest size.

In other words, MLED can advance along two application paths simultaneously, namely ultra-large-size displays and ultra-small-size micro-displays. Whether in command centers, exhibition halls, home theaters, and other scenarios that require the use of ultra-large-size displays, or in smartwatches, AR, VR, and other scenarios that need ultra-small-size micro-displays, the widespread application of MLED can be seen. This advantage is difficult for other display media to replace.

This also brings a high degree of imagination for the long-term growth space of MLED. For example, an important consumer application scenario for MLED is business meetings. According to third-party data, there are 0.1 billion conference rooms globally, and the number of conference rooms in china exceeds 27 million, among which 5% of the conference rooms exceed 120 square meters, which means that even if each large conference room is equipped with a display screen worth 0.1 million yuan, there is a market scale of 135 billion yuan just in china. If measured by the global market dimension, it is not difficult to reach a market scale of 500 billion yuan.

And this is just the market increment brought by a single scenario of business meetings. If we consider more heavyweight consumer markets such as in-car screens and AR glasses, a trillion-level blue ocean market is already clearly visible.

In recent years, relevant supporting policies have frequently emerged, clearly proposing support for the development of MLED new display technology. At least 17 provinces and cities have developed MLED-related policy plans in their 14th Five-Year Plan. Such an attractive track naturally attracts many 'gold diggers,' and in the past two years, many leading manufacturers have been ramping up their布局 in this area.

In February 2023, the production line project for the 6th generation new semiconductor display devices by BOE was launched in peking Economic and Technological Development Area, with a total investment of 29 billion yuan, mainly used for the production of VR panels, miniled backplanes and other high-end display products. Unilumin group invested 2.2 billion yuan to start the construction of an intelligent manufacturing base in Zhongshan, covering MLED's research and development, production, sales, and display businesses.

In March 2023, ZhaoChi planned to invest 5 billion yuan in the high-tech zone of nam cheong to invest in the construction of a Mini LED chip and RGB small-pitch LED display module project. The construction of the T5 factory of wuhan huaxing, covering an area of more than 600,000 square meters, has basically been completed. This factory is used for the TCL Huaxing Optoelectronics to expand the production line of the '6th generation semiconductor new display devices,' among which MLED backlight display products are included, with an expected project investment of 15 billion yuan.

On October 18, 2024, Mianyang Fucheng District signed a site agreement with Huike Co., Ltd. to invest 10 billion yuan in the Mini-LED project and high-power chip heat dissipation packaging project. The ultra-thin electronic glass project at Qingdao Optoelectronics Industrial Park held product offline and ignition production activities, with a total investment of over 10 billion yuan. The ultra-thin electronic glass project produced this time mainly plans to build Mini LED backplane glass production lines and 3D automotive cover protective glass production lines.

According to incomplete statistics from LEDinside, 15 Mini/Micro LED projects have been signed nationwide this year, with a total investment amount of 68.895 billion yuan. Leading manufacturers are increasing their investment, further accelerating the scaling process of the MLED industry.

2. The penetration rate of the COB route is accelerating.

In the miniled industry chain, the packaging stage is in the midstream position, serving as a bridge between upstream raw materials and downstream applications, with mainstream technical routes like COB and SMD. Although different technical routes each have their advantages and application scenarios, the comprehensive advantages of COB are accelerating its level of recognition.

COB, which stands for chip on board, involves directly soldering the light-emitting chip onto the PCB, forming a unit module with an overall coating, and finally splicing it into a complete LED screen.

Thanks to this, COB can achieve smaller pixel pitches and higher arrangement densities, significantly enhancing the pixel density and overall reliability of LED display systems. Additionally, since the light source becomes a surface light source after scattering and refracting through the coating, the highlighted display effect of the screen will be superior. Moreover, the overall coating of COB helps with waterproofing, moisture protection, and impact resistance, and as COB primarily employs a flip chip process, the unobstructed light source results in lower power consumption at the same brightness.

Despite the superior comprehensive performance of COB, the relatively high costs in the production process have previously deterred many manufacturers. In fact, this is primarily due to the high technical barriers of COB itself and the insufficient number of manufacturers capable of related R&D. Considering that downstream manufacturers will increasingly compete on image display effects in the future, COB is likely an unavoidable path, which also compels more manufacturers to engage in the technological development of COB.

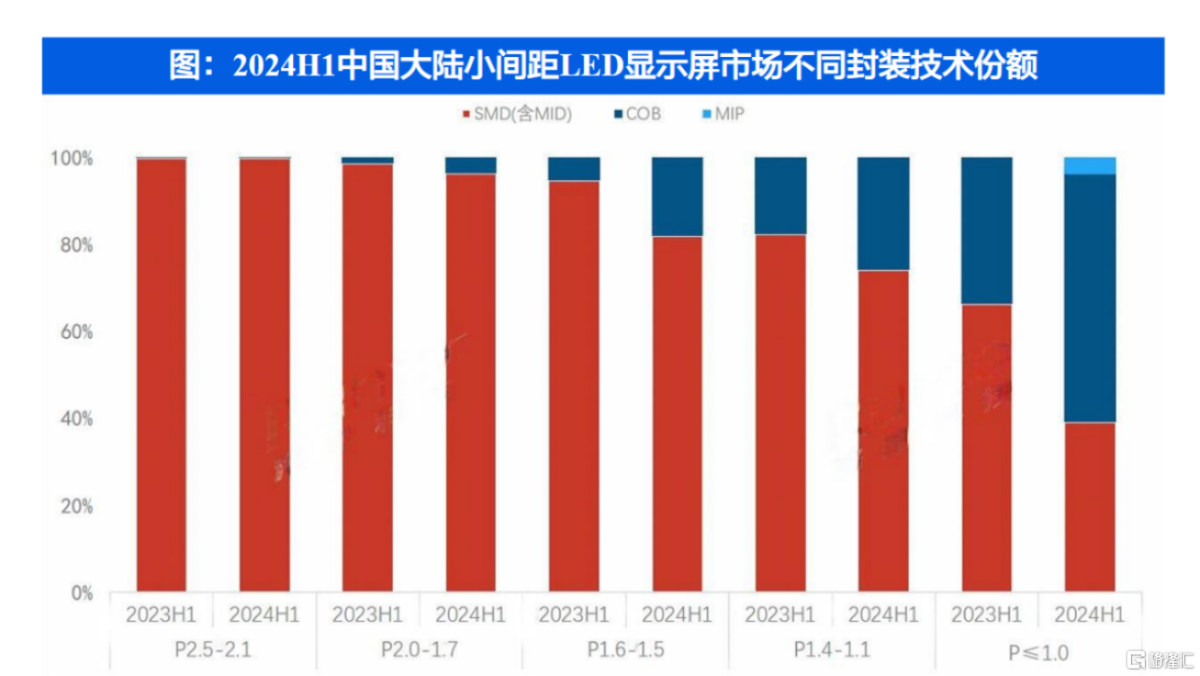

Sealand pointed out in its research report that the theoretical production cost of COB is lower than that of SMD, and it is expected to become mainstream in the micro-pitch LED screen market. In fact, in the indoor small pitch market of P1.0 and below, COB technology has already surpassed traditional SMD technology in terms of cost performance, and the market penetration rate of COB in products below P1.2 has already exceeded 50%.

(Source: Sealand)

Currently, the penetration rate of COB is still accelerating.

According to Dixin Consulting's forecast, by 2024, the overall monthly production capacity of the COB display market will exceed 50K square meters (calculated based on P1.2mm), showing a double growth compared to the market capacity in 2023. Industry insiders predict that the COB shipment volume will reach 0.35 million square meters in 2024, far exceeding initial expectations.

In terms of a longer time dimension comparison, according to GGII's research data, in 2022, domestic COB display sales exceeded 1.5 billion yuan, accounting for 8.5% of the small pitch market share. Dixin Consulting predicts that this figure will surpass 40% by 2028.

Three, core technology creates a core position.

So, in such a high-growth track as MLED, it is evident that the listed leading companies are worth paying attention to, such as Nova Star.

From the perspective of performance, Nova Star stands out exceptionally. From 2020 to 2023, Nova Star's revenue grew from 0.985 billion yuan to 3.054 billion yuan, with a compound annual growth rate of 45.82%. During the same period, the company's net income rose from 0.111 billion yuan to 0.607 billion yuan, achieving a compound growth rate of 76.18%. In the first three quarters of 2024, the company achieved revenue of 2.371 billion yuan, a year-on-year increase of 10.60%; net income of 0.461 billion yuan, a year-on-year increase of 10.03%.

In recent years, the complex macro environment has posed high challenges to the development of various industries, and it is remarkable that Nova Star can achieve continuous high growth in such a severe environment. The strongest support still comes from the company's excellent technical strength.

From 2020 to 2023, Nova Star's R&D investment was 0.156 billion, 0.213 billion, 0.319 billion, and 0.442 billion respectively, averaging over 14.5% of total revenue.

The substantial investment has brought a solid technology reserve to Nova Star Cloud. By the end of June 2024, the company holds 1,101 domestic patents (including 607 invention patents), 23 overseas patents (including 20 invention patents), 214 software copyrights, and 13 integrated circuit layout designs.

Powerful technical strength has positioned Nova Star Cloud's products and services at the forefront of the industry.

For example, in the field of display control systems, Nova Star Cloud is one of the standard setters for 8K ultra HD video in china; in the area of video processing systems, Nova Star Cloud has redefined video control products by replacing the past model of 'video processor + controller' with a single device, and has pioneered super stitching control, integrating hundreds of devices into a very compact unit at a cost only one-third of traditional products; in cloud computing services, Nova Star Cloud provides customers with hardware-based cloud-connected multimedia players and software-based cloud services to achieve screen display monitoring and content distribution.

More importantly, Nova Star Cloud has proposed feasible solutions to many pain points and difficulties that exist during the long-term development of the industry.

For instance, Nova Star Cloud's core testing equipment integrates an automatic lighting machine, an automatic repair machine, an automatic calibration machine, a multi-angle testing machine, and an ink color sorting machine, addressing mass production difficulties such as 'MLED display consistency', 'ink color consistency', 'side viewing angle consistency', and 'quality inspection and repair of massive transfers', realizing detection and quick repair of luminous chips, which helps customers improve yield rates and removes technical barriers for the standardization and large-scale manufacturing of MLED displays.

In addition, Nova Star Cloud's core integrated circuit solutions are also focused on MLED research and innovation. The industry’s first MLED display ASIC control chip it developed enhances performance while reducing costs by half and power consumption by 70%.

Currently, Nova Star Cloud's equipment and chips have gained recognition from industry leaders such as Zhaochi Crystal Display, which will help it maintain its leading position in the industry in the future.

IV. Conclusion

With the continuous advancement of technology, MLED not only demonstrates excellent performance in brightness, contrast, and resolution but also holds significant advantages in power consumption and stability. These characteristics are enabling MLED technology to gradually penetrate more extensive application fields.

In this process, leading companies that master core technologies, represented by Nova Nebula, are the main driving forces behind the accelerated development of MLED and will also be the core beneficiaries of this transformation.

但其实,未来或许已然到来。

但其实,未来或许已然到来。