The company responded: no substantial impact.

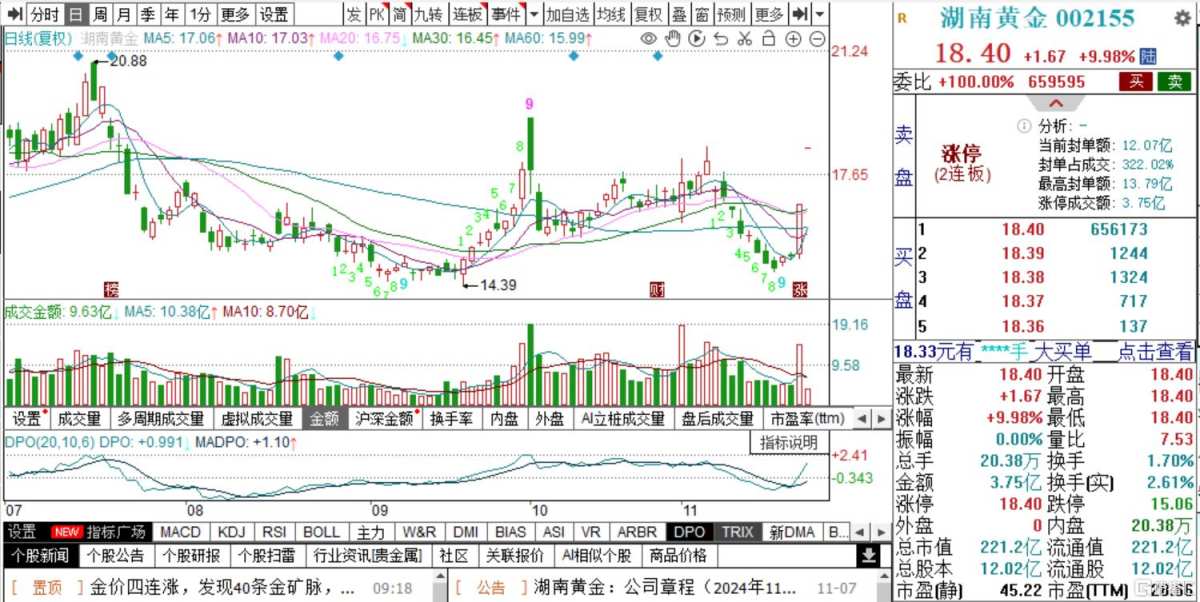

Today, hunan gold corporation hit the daily price limit, achieving a second consecutive trading limit, trading at 18.4 yuan/share, with a total market value of 22.11 billion yuan, and the highest buy order amounting to 1.379 billion yuan.

On the news front, international gold prices have rebounded, and a super-large gold mine was discovered in hunan pingjiang.

Hunan has discovered over 40 gold veins.

On November 21, the hunan provincial geological institute announced a major breakthrough in exploration at the wanku gold mine field in hunan pingjiang.

On November 21, the hunan provincial geological institute announced a major breakthrough in exploration at the wanku gold mine field in hunan pingjiang.

After years of efforts by the hunan provincial geological disaster investigation and monitoring institution under the hunan provincial geological institute, over 40 gold veins have been discovered at depths exceeding 2000 meters in the wanku gold mine field, with the highest gold grade reaching 138 grams per ton, and a cumulative gold resource amount of 300.2 tons has been explored in the core exploration area.

Experts believe that the Wangu Gold Mine has a super-large scale, predicting over 1000 tons of gold reserves at depths exceeding 3000 meters, with the resource value amounting to 600 billion yuan at current gold prices.

In response, hunan gold corporation stated that the minerals mentioned in the relevant news are held by the company's controlling shareholder, but this news does not have a substantial impact on the company.

In August of this year, hunan gold corporation indicated that the Wangu mining area, which is being cultivated by the controlling shareholder, plans to be injected into the listed company in the future, and the company will have the right of first refusal once the project matures. The resource integration work of the Wangu mining area is being carried out in an orderly manner.

On October 10, hunan gold corporation indicated in a communication that apart from the Wangu mining area, hunan gold group's gold resource reserves are basically within the listed company.

Additionally, it should be noted that there is a gap between the amount of gold explored and the amount that can actually be mined.

Industry insiders believe that the news about '1,000 tons' should be viewed rationally. Industry insiders analyzed:

Deep drilling over 2,000 meters that has discovered gold mines, strictly speaking, cannot yet be classified as reserves, as there are strict standards for the definition of reserves.

Another aspect is depth; several holes have been drilled to two or three thousand meters, but the enterprises' mining currently operates at around four to five hundred meters. Although several holes have been drilled deeper and there is indeed ore, this is a preliminary estimate, and it still needs further exploration and verification to ascertain how much (reserves) is below.

Based on the current cumulative gold resource amount of 300 tons discovered in the core exploration area, some of this has already been mined, and the predicted value of 1,000 tons does not have much relation to mining enterprises because it is too deep.

In addition, due to the escalation of tensions between Russia and Ukraine, international gold prices have started to rise, achieving four consecutive days of gains.

On Thursday at the New York close, spot gold rose by 0.73%, trading at $2669.96 per ounce; COMEX gold futures increased by 0.71%, trading at $2670.50 per ounce.

Moreover, institutions both domestically and internationally are generally bullish on the medium to long-term outlook for gold, believing thatthe gold price is expected to break through $3000 per ounce in the future.。

It is expected to benefit from the upward movement of the price center for gold and antimony.

According to information, hunan gold corporation focuses on the dual main businesses of gold and antimony, and has a full industry chain layout that includes mining, selection, smelting, refining, and deep processing.

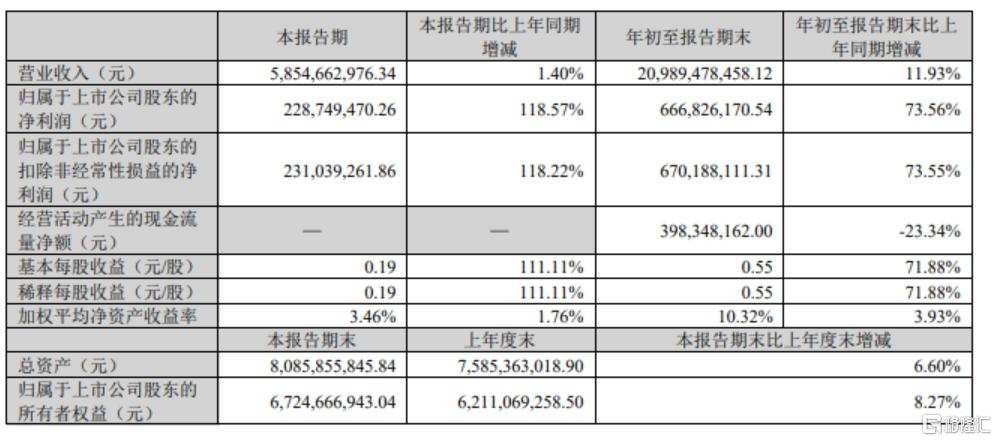

In the first three quarters of this year, hunan gold corporation achieved revenue of 20.989 billion yuan, a year-on-year increase of 11.93%; the net income attributable to shareholders was 0.667 billion yuan, a year-on-year increase of 73.56%.

In the third quarter, revenue was 5.855 billion yuan, a year-on-year increase of 1.4%; net income attributable to listed company shareholders was 0.229 billion yuan, a year-on-year increase of 118.57%.

hunan gold corporation stated that the increase in net income was mainly due to the year-on-year increase of 19.36% in the sales price of the gold product and a 43.33% year-on-year increase in the sales price of the refined antimony product.

Looking ahead, china merchants believes that hunan gold corporation's performance is expected to benefit from the upward trend in the price center of gold and antimony. It is covered for the first time with a "strong buy" investment rating.

Minsheng Securities believes that hunan gold corporation possesses high-quality domestic gold and antimony mine resources, and its performance is expected to benefit from the upward trend of price centers. It maintains a "recommend" rating.