① Citron Research, a well-known shorting agency, decided to short MicroStrategy, believing that its trading volume has completely separated from the fundamentals of Bitcoin; ② MicroStrategy is the listed company that holds the most Bitcoin in the world. Due to shorting news, its stock price closed down more than 16% on Thursday, while Bitcoin rose 4.32% on the same day; ③ Currently, MicroStrategy's holdings have reached 0.3312 million units, and the stock's trading volume became the largest in the US stock on Tuesday.

Finance Association, November 22 (Editor Zhou Ziyi) Citron Research (Citron Research), a well-known shorting agency, posted news on social media platform X on Thursday (November 21) that the company has decided to short the “Big Bitcoin” Microstrategy (Microstrategy) company and believes that the company has transformed itself into a Bitcoin investment fund.

MicroStrategy is the publicly traded company that holds the most bitcoins in the world. With the US election results settled, President-elect Donald Trump's crypto-friendly policy boosted the price of Bitcoin. MicroStrategy's stock price was supposed to rise along with it, yet its stock price closed down by more than 16% on Thursday, and even plummeted 31% from the intraday high.

In comparison, Bitcoin rose 4.32% on the same day, and the intraday high was once close to 0.1 million dollars.

In comparison, Bitcoin rose 4.32% on the same day, and the intraday high was once close to 0.1 million dollars.

MicroStrategy is “overheated”

The decline in MicroStrategy's stock price was mainly due to a post by the well-known shorting agency Citron Research on the social media platform X.

Citron pointed out, “It's now easier than ever to invest in Bitcoin. Judging from MicroStrategy's trading volume, it's completely detached from the fundamentals of Bitcoin.” However, while shorting MicroStrategy, Citron remains bullish on Bitcoin.

The post also stated, “I respect Michael Saylor (founder of MicroStrategy), but even he must know that this company is overheated.”

Citron isn't the first company to suggest shorting micro-strategies to hedge bullish Bitcoin positions. In March of this year, another well-known agency, Kerrisdale Capital Management, pointed out that while it was going long on Bitcoin, it was shorting MicroStrategy stocks, and pointed out that MicroStrategy stocks are an alternative investment product to Bitcoin, and that their stock price has shown an unreasonable premium compared to Bitcoin, which drives its value.

According to reports, MicroStrategy's stock price has soared by more than 600% so far this year (as of Wednesday), while Bitcoin's increase over the same period was only slightly over 120%.

Under founder and executive chairman Saylor, MicroStrategy has been raising capital throughout the year to get more Bitcoin. The most recent increase in positions was this Wednesday. The company plans to issue another $2.6 billion worth of convertible bonds and use the proceeds to continue to increase its Bitcoin position.

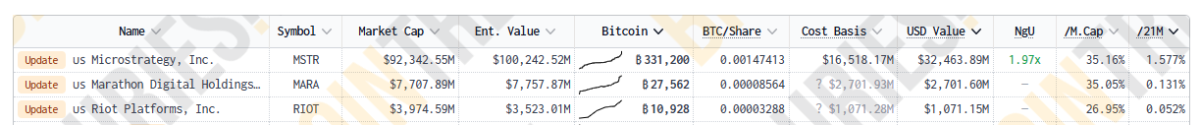

According to the latest statistics from BitcoinTreasury, in the context of continuing to issue convertible bonds this year and continuing to increase its Bitcoin holdings, MicroStrategy's Bitcoin holdings have reached 0.3312 million, with a position value of 32.464 billion US dollars.

It is worth mentioning that MicroStrategy became the most traded stock in the US stock market this Tuesday (November 20), surpassing Nvidia and Tesla. ETF analyst Eric Balchunas said on the same day that no one stock has traded more than these two stocks for many years.

对比来看,当日比特币上涨4.32%,日内高点一度接近10万美元。

对比来看,当日比特币上涨4.32%,日内高点一度接近10万美元。