Damo believes that by 2030, the size of China's instant retail market will grow to 2 trillion yuan. Alibaba and JD are losing their share of this market. Meituan is the company most likely to seize this opportunity. Currently, the price of Meituan's Hong Kong stock still needs to rise 75.64% from the HK$300 per share forecast in Damo.

Damo said that Meituan Hong Kong stocks will still rise 75%.

On November 21, Morgan Stanley stock analyst Yu Kaijie and his team released a report saying that currently, China's consumption prospects are uncertain. Under the benchmark situation, the government launches a 2-3 trillion yuan incentive plan every year. Meituan's compound annual profit growth rate (CAGR) is expected to reach 35.7% from 2024 to 2026, making it the fastest growing company among Chinese internet giants.

If the situation is more optimistic, the government introduces an annual consumer incentive plan of 10 trillion yuan, and Meituan's operating profit CAGR is expected to reach 39.4% from 2024 to 2026; if the government introduces an annual consumer incentive plan of 1 trillion yuan, this figure is 26.9%.

If the situation is more optimistic, the government introduces an annual consumer incentive plan of 10 trillion yuan, and Meituan's operating profit CAGR is expected to reach 39.4% from 2024 to 2026; if the government introduces an annual consumer incentive plan of 1 trillion yuan, this figure is 26.9%.

Damo believes that with China's outstanding delivery capabilities, cheap and high-quality inventory units (SKUs), and innovative business models, China's instant retail market will grow at a CAGR of 20% to 2 trillion yuan by 2030.

Currently, Alibaba and JD are losing instant retail market share, and Meituan is the company most likely to seize this opportunity. Therefore, under the benchmark scenario, the instant retail business will bring Meituan an incremental operating profit of 20 billion yuan, and under the optimistic scenario, it will bring 30 billion yuan.

Currently, Damo maintains the target price of Meituan Hong Kong stocks at HK$215 per share, but by 2025, according to the SOTP valuation method, Damo believes that the upper price limit for Meituan Hong Kong stocks can reach HK$300 per share, and this probability is even higher.

Damo estimates that in the Meituan business in 2025, the valuations of food takeout and in-store, hotels and travel (IHT), and instant retail (Meituan flash sales and baby elephant supermarkets) will be worth 110 billion dollars (HK$135 per share), 75 billion dollars (90 HKD/share), 32 billion dollars (40 HKD/share), plus 28 billion US dollars (HK$35 per share) in discounted net cash and investment, which is just HK$300 per share.

If Meituan's overseas expansion business and Meituan Preferred Business achieve results, there is still room for further rise in stock prices.

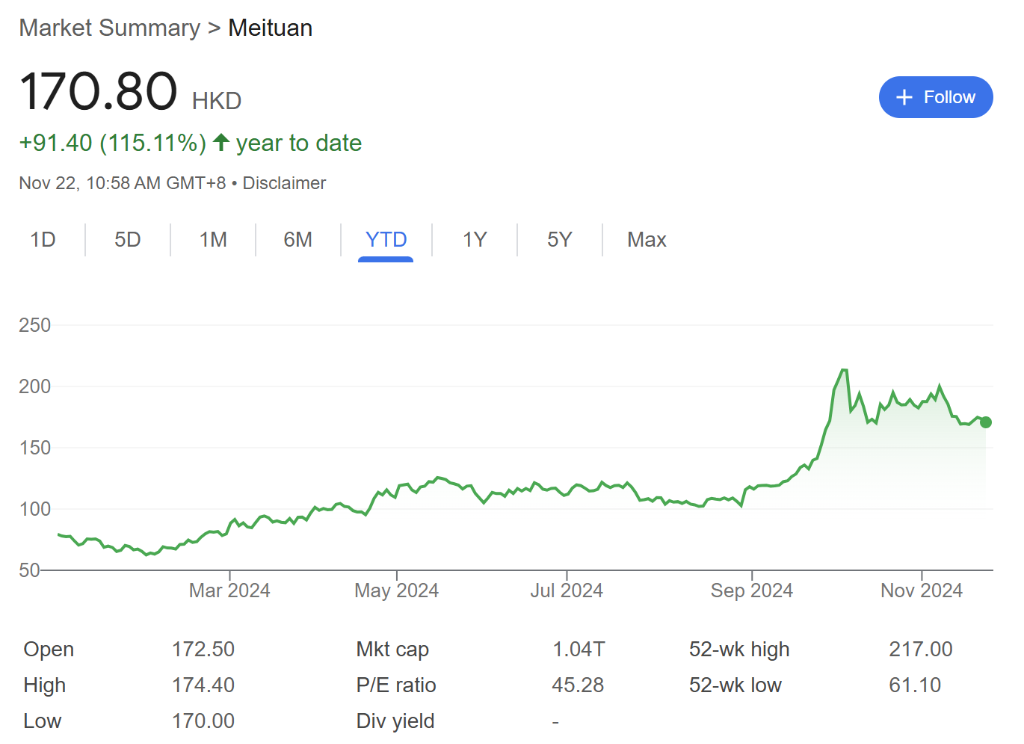

As of press release, Meituan Hong Kong shares reported HK$170.80 per share, up 75.64% from Damo's forecast of HK$300 per share. Since this year, Meituan Hong Kong stocks have risen more than 115%.

Authors: Yu Kaijie, Liu Songyan, Fei Yifan. Article source: Morgan Stanley, original title: “Towards HK$300”

如果情况更加乐观,政府推出每年10万亿元的消费刺激计划,预计美团2024至2026年的营业利润CAGR有望达到39.4%;如果政府推出每年1万亿元的消费刺激计划,这一数字则为26.9%。

如果情况更加乐观,政府推出每年10万亿元的消费刺激计划,预计美团2024至2026年的营业利润CAGR有望达到39.4%;如果政府推出每年1万亿元的消费刺激计划,这一数字则为26.9%。