Bitcoin reached a new high, but MSTR experienced a frightening moment of sharp decline. According to the analysis, MSTR's stock price has risen as much as 3000% in the past five years, but the symbiotic relationship with Bitcoin has cast the shadow of a “Ponzi scheme.” Now that the test is upon us, will the company announce victory and exit in due course, or will it continue this high-risk “financial game”?

As Bitcoin approached a new high of 0.1 million dollars, MicroStrategy (MSTR), the “major Bitcoin holder”, experienced a frightening moment: the stock price plummeted 30% for a while.

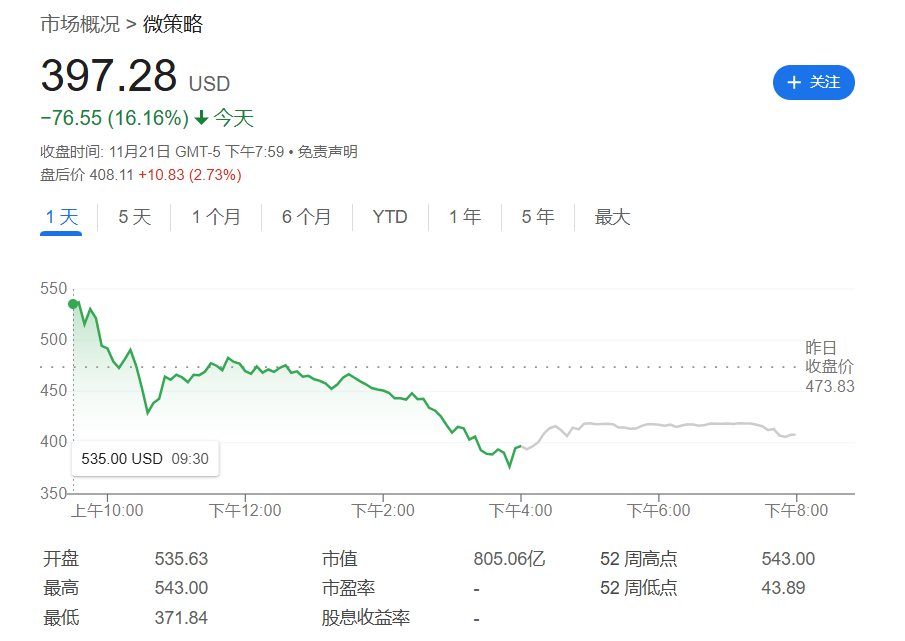

Yesterday, in early trading, MSTR continued its previous sharp rise, surging 14% to a record high of $543. However, the MSTR stock price reversed its two poles in the intraday period, retraced more than an astonishing 31% from its high intraday low, and eventually fell by more than 16%.

At a time when Bitcoin was at its peak, MSTR's “myth of making wealth” was hit hard. The Wall Street News website mentioned that there is a “symbiotic relationship” between MSTR and Bitcoin: the purchase of bitcoins through stock issuance and bond financing drives up the price of Bitcoin, and the rise in Bitcoin in turn further boosts MSTR's stock price.

At a time when Bitcoin was at its peak, MSTR's “myth of making wealth” was hit hard. The Wall Street News website mentioned that there is a “symbiotic relationship” between MSTR and Bitcoin: the purchase of bitcoins through stock issuance and bond financing drives up the price of Bitcoin, and the rise in Bitcoin in turn further boosts MSTR's stock price.

However, this relationship suddenly fell apart last night, what does that indicate? Is this sharp drop in MSTR a brief adjustment or a sign before the storm?

On November 20, Cullen Roche, founder of the fund company Discipline Funds, commented that MSTR is probably the most successful “investment bank” in the world; it is either the greatest innovation in financial history or the most reckless thing.

According to Roche, MSTR's crazy coin buying practice was indeed very successful, but to some extent it looked like a Ponzi scheme. If it were him, “I'd definitely want to pack up and leave, declare victory, and go buy... whatever I want.”

Citron Research is currently shorting MSTR and claims that the company has actually turned into a Bitcoin investment fund. He respects MSTR CEO Saylor very much, but he must also know that MSTR is overheated.

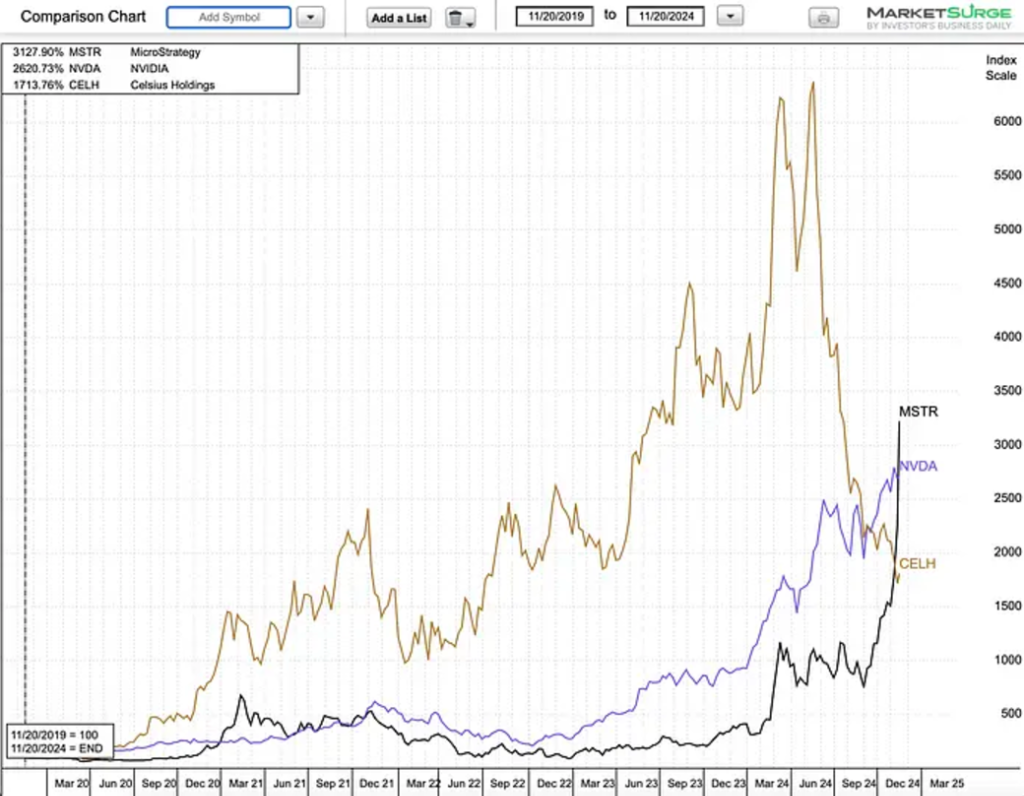

A sharp increase of 3000%! The most successful stock in the past 5 years, is it time for MSTR to announce its victory and exit?

On his website, Discipline Funds founder Roche discussed the relationship between MSTR and Bitcoin and stated in a half-joking tone that the company's approach was both extremely smart and extremely risky. In a way, it looks a lot like a Ponzi scheme.

Is MSTR the most successful “investment bank” in financial history, or is it the most reckless? Roche was baffled, but he hinted that this might be the moment Saylor announced his triumphant exit.

When it comes to MicroStrategy — I really can't stop loving this story. I've been saying this for years; this is either the greatest thing in financial history, or the most reckless thing. I don't know what kind it is, but in my opinion, there really is no middle ground. In a way, it looked a lot like a Ponzi scheme. MSTR bought Bitcoin by selling bonds to finance, and these purchases drove up the price of Bitcoin, which in turn enabled MSTR to issue more bonds. This is all very smart; as long as the price of Bitcoin continues to rise, the glory will continue. As long as it continues to rise.

I once joked that MSTR has become the most successful investment bank in the world, except that they're not helping capital formation, but financing “digital growth.” Look, so far, this approach has really been very successful. Saylor (CEO of MSTR) won. In fact, you could even say he's already won. Now he can quit and then announce “I've won the whole financial industry forever.” MSTR has increased 3000% over the past 5 years. It's hard to wonder — if Saylor is right, the cost of capital is 15% per year, then MSTR has generated revenue over the past 5 years roughly equivalent to 24 years of returns. And when should I stop and say “I won”? Or can you just stop?

I don't know the right answer. I'm just an old school traditional financier. But personally — I'd definitely want to pack up and leave, declare victory, and go buy... whatever I want.

MSTR's cumulative increase in the past 5 years once reached 3000%. Due to the sudden sharp decline, the company's cumulative increase is now 2520%. But it's still the best performing stock in the past 5 years, even surpassing Nvidia and Celsius Holdings.

According to Roche, MSTR's investment strategy in Bitcoin is not only full of risks, but also brings huge rewards, and also brings out the flavor of financial speculation.

Citron shorts MSTR

Currently, Andrew Left's Citron Research is shorting MSTR, believing that MSTR has actually become a Bitcoin investment fund, and its stock price is overheated “out of the basics.” It posted on X:

As investing in Bitcoin has become easier than ever, MSTR's trading volume has completely moved away from Bitcoin fundamentals. Although Citron is still bullish on Bitcoin, we have hedged by shorting MSTR's positions. Very respectful to Saylor, but even he must know that MSTR is overheated.

From a fundamental perspective, the market value of MSTR is nearly three times the value of Bitcoin holdings. MSTR investors actually paid 0.25 million dollars for each bitcoin, while the market price was less than 0.1 million dollars. Citron is also not the first company to suggest shorting MSTR to hedge bullish Bitcoin positions. In March of this year, Kerrisdale Capital Management, another well-known agency, made a similar proposal, saying that it would go long on Bitcoin but short MSTR shares.

Going back in the history of MSTR, Bitcoin once pulled this company out of the abyss.

MSTR was a typical casualty of the 2000 internet bubble, and its stock price plummeted from $300 to $0.42. In 2020, Saylor, the founder of the company, made a fateful decision to transform the company into a cryptocurrency investment platform: All in Bitcoin, and called Bitcoin “the most valuable asset in the world.” This formal decision has created MSTR's current glory.

However, with last night's sharp drop, is the time to test MSTR?

比特币最为狂热之际,MSTR的“造富神话”却迎来一记重击。华尔街见闻网站提到,MSTR与比特币之间的“共生关系”:通过发行股票、债券融资购买比特币,推动比特币价格上涨,比特币上涨反过来进一步助推MSTR股价。

比特币最为狂热之际,MSTR的“造富神话”却迎来一记重击。华尔街见闻网站提到,MSTR与比特币之间的“共生关系”:通过发行股票、债券融资购买比特币,推动比特币价格上涨,比特币上涨反过来进一步助推MSTR股价。