The New Zealand dollar fell to a two-year low against the Australian dollar due to growing speculation that the New Zealand Federal Reserve will cut the official cash rate by more than 50 basis points next week.

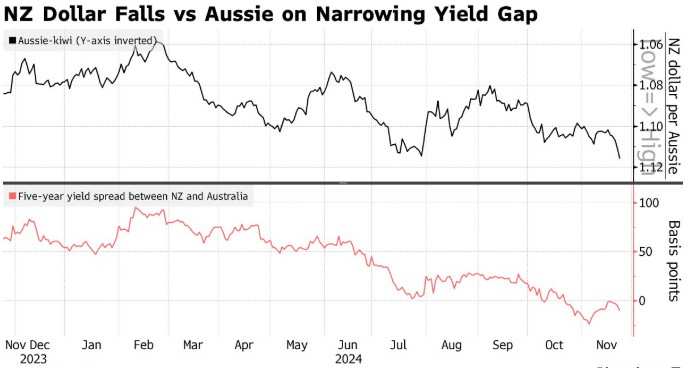

Zhitong Finance learned that the New Zealand dollar fell to a two-year low against the Australian dollar because outsiders increasingly speculate that the New Zealand Federal Reserve will cut the official cash interest rate by more than 50 basis points next week. The New Zealand dollar once fell 0.6% against the Australian dollar to 1.1180, the lowest level since October 2022. The New Zealand dollar also fell to a one-year low against the US dollar, and the yield on New Zealand short-term treasury bonds also declined. The New Zealand dollar once fell 0.5% against the US dollar to 0.5829, the lowest level since November 2023. The yield on New Zealand's 5-year Treasury bonds fell 7 basis points to 4.09%.

Overnight index swaps show that the market is betting that the New Zealand Federal Reserve will almost likely cut interest rates by 50 basis points on November 27, and the probability of cutting interest rates by 75 basis points is 22%. New Zealand's economic growth has been difficult due to restrictive monetary policies. The ANZ Group estimates that the country's economy fell into recession in the third quarter.

ANZ economist and strategist Sharon Zollner wrote in a report that cutting interest rates by 50 basis points “is clearly the path of least resistance”; but considering the New Zealand Federal Reserve's confidence in inflation prospects and the unusually long gap before the next meeting, cutting interest rates by 75 basis points seems more likely than cutting interest rates by 25 basis points.

ANZ economist and strategist Sharon Zollner wrote in a report that cutting interest rates by 50 basis points “is clearly the path of least resistance”; but considering the New Zealand Federal Reserve's confidence in inflation prospects and the unusually long gap before the next meeting, cutting interest rates by 75 basis points seems more likely than cutting interest rates by 25 basis points.

New Zealand Federal Reserve Chairman Adrian Orr told reporters earlier this month that the impact of high interest rates on corporate investment and employment is still showing. He said that although interest rates are currently falling, the real economy is still lagging behind.

David Forrester, senior strategist at Credit Agricole CIB (Credit Agricole CIB), said: “Investors are going long on AUD/NZD until the RBNZ cuts interest rates sharply again next week.”

澳新银行经济学家和策略师Sharon Zollner在一份报告中写道,降息50个基点“显然是阻力最小的路径”;但考虑到新西兰联储对通胀前景的信心,以及在下次会议之前的异常长时间差距,降息75个基点似乎比降息25个基点更有可能。

澳新银行经济学家和策略师Sharon Zollner在一份报告中写道,降息50个基点“显然是阻力最小的路径”;但考虑到新西兰联储对通胀前景的信心,以及在下次会议之前的异常长时间差距,降息75个基点似乎比降息25个基点更有可能。