① Novogratz predicts that Bitcoin will break through 0.1 million dollars, but then it may fall 20% to 0.08 million dollars; ② He believes that since the cryptocurrency community's leverage has reached its limit, adjustments are inevitable, and pointed out that heavily leveraged stocks and ETFs may also face trouble.

Financial Services, November 22 (Editor Zhao Hao) -- Michael Novogratz (Michael Novogratz), an American billionaire and well-known cryptocurrency investor, said that Bitcoin will inevitably break through the 0.1 million dollar mark, but it may fall back as much as 20% later.

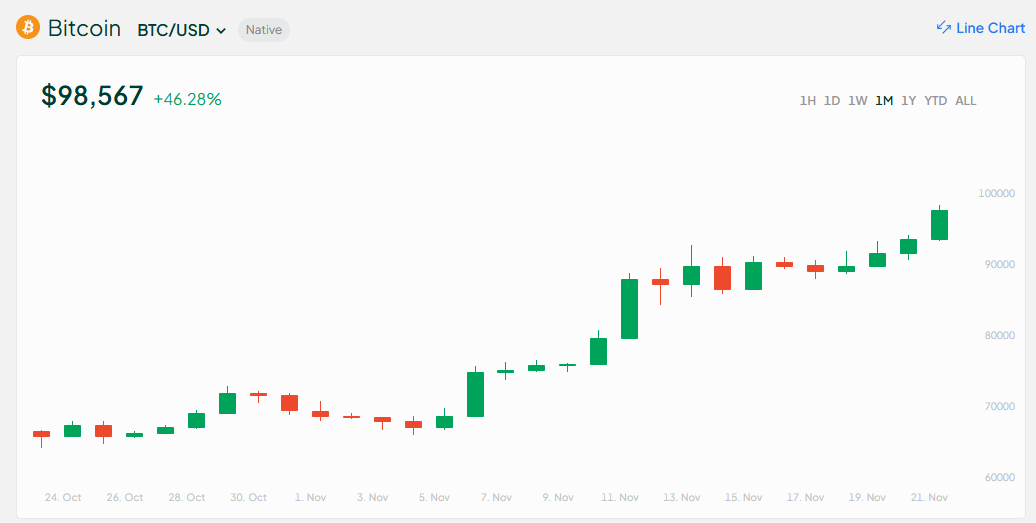

According to Bitstamp's quote, during the European session on Friday (November 22), Bitcoin once reached a record high of $99,500, continuing to reach a record high and continuing to approach the 0.1 million dollar integer mark. The day before, Bitcoin successively broke through the 0.095 million, 0.096 million, 0.097 million, and 98,000 marks.

Novogratz told the media that Bitcoin is breaking through a series of records and reaching high levels, and investors should prepare for a short pullback. He acknowledged that it was “inevitable” that Bitcoin hit $0.1 million, but it could fall back as much as 20% as investors lift leveraged bets.

Novogratz told the media that Bitcoin is breaking through a series of records and reaching high levels, and investors should prepare for a short pullback. He acknowledged that it was “inevitable” that Bitcoin hit $0.1 million, but it could fall back as much as 20% as investors lift leveraged bets.

Novogratz is the founder and CEO of the cryptocurrency commercial bank Galaxy Digital. “There is a lot of leverage in the current system,” he said. “The cryptocurrency community's leverage has reached its limit, so adjustments will occur.”

Novogratz pointed out that the price of Bitcoin could drop to $0.08 million/coin — which he believes will be the absolute bottom. Based on 0.1 million dollars, Novogratz believes that Bitcoin's upcoming adjustment will reach a maximum of 20%.

Novogratz also mentioned that heavily leveraged stocks and ETFs also seem to face trouble. He mentioned MicroStrategy as an example. “There will definitely be some drastic adjustments, especially those stocks with higher leverage ratios than the underlying commodity itself.”

Overnight, MicroStrategy closed down more than 16%, plummeting from 650% to 529% during the year. According to the shorting agency Citron Research, “It's now easier than ever to invest in Bitcoin. Judging from MicroStrategy's transaction volume, the company has completely broken away from fundamentals.”

Although Novogratz anticipates a sharp correction to come, he still believes that Bitcoin will eventually regain its footing and continue to rise higher, as he believes that US President-elect Donald Trump has brought about a “paradigm shift” in crypto regulation.

“Almost the entire cabinet holds bitcoin and is a supporter of digital assets,” he added, “so the people around that table are very supportive of this field. They support innovation, support digital assets, and support Bitcoin.”

Novogratz mentioned that the world has noticed this. The Middle East region has experienced a massive buying boom, and there is also “inexhaustible demand” in the open stock market.

A number of digital asset industry executives revealed that numerous crypto companies, such as Ripple, Kraken, and Circle, are vying for a seat on the cryptocurrency advisory board promised by Trump to seek a say in their planned policy reforms.

诺沃格拉茨告诉媒体,比特币正突破一系列的纪录创下高位,投资者应该为短暂的回调做好准备。他承认,比特币触及10万美元是“不可避免的”,但随着投资者解除杠杆押注,可能会回落多达20%。

诺沃格拉茨告诉媒体,比特币正突破一系列的纪录创下高位,投资者应该为短暂的回调做好准备。他承认,比特币触及10万美元是“不可避免的”,但随着投资者解除杠杆押注,可能会回落多达20%。