Further Weakness as Akso Health Group (NASDAQ:AHG) Drops 26% This Week, Taking Three-year Losses to 70%

Further Weakness as Akso Health Group (NASDAQ:AHG) Drops 26% This Week, Taking Three-year Losses to 70%

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Akso Health Group (NASDAQ:AHG), who have seen the share price tank a massive 70% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the share price decline continued over the last week, dropping some 26%.

If the past week is anything to go by, investor sentiment for Akso Health Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Given that Akso Health Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Akso Health Group grew revenue at 18% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 19% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

Over three years, Akso Health Group grew revenue at 18% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 19% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

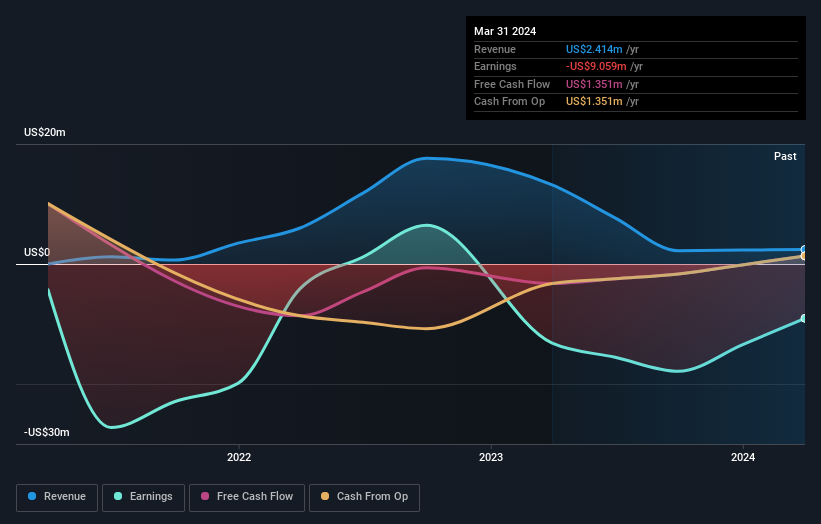

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Akso Health Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Akso Health Group shareholders are down 13% for the year, but the market itself is up 33%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Akso Health Group (including 2 which don't sit too well with us) .

We will like Akso Health Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.