Ceragon Networks Ltd. (NASDAQ:CRNT) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 81%.

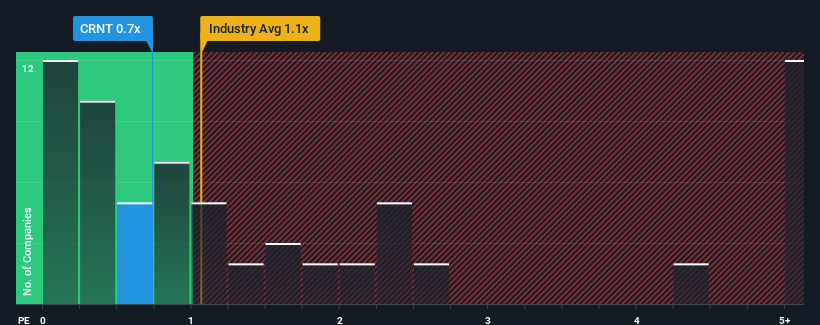

Even after such a large jump in price, there still wouldn't be many who think Ceragon Networks' price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in the United States' Communications industry is similar at about 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Ceragon Networks Has Been Performing

Recent times have been advantageous for Ceragon Networks as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Ceragon Networks' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ceragon Networks' to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ceragon Networks' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. This was backed up an excellent period prior to see revenue up by 32% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 9.0% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 10%, which is not materially different.

With this in mind, it makes sense that Ceragon Networks' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Its shares have lifted substantially and now Ceragon Networks' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Ceragon Networks' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Ceragon Networks with six simple checks.

If these risks are making you reconsider your opinion on Ceragon Networks, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.