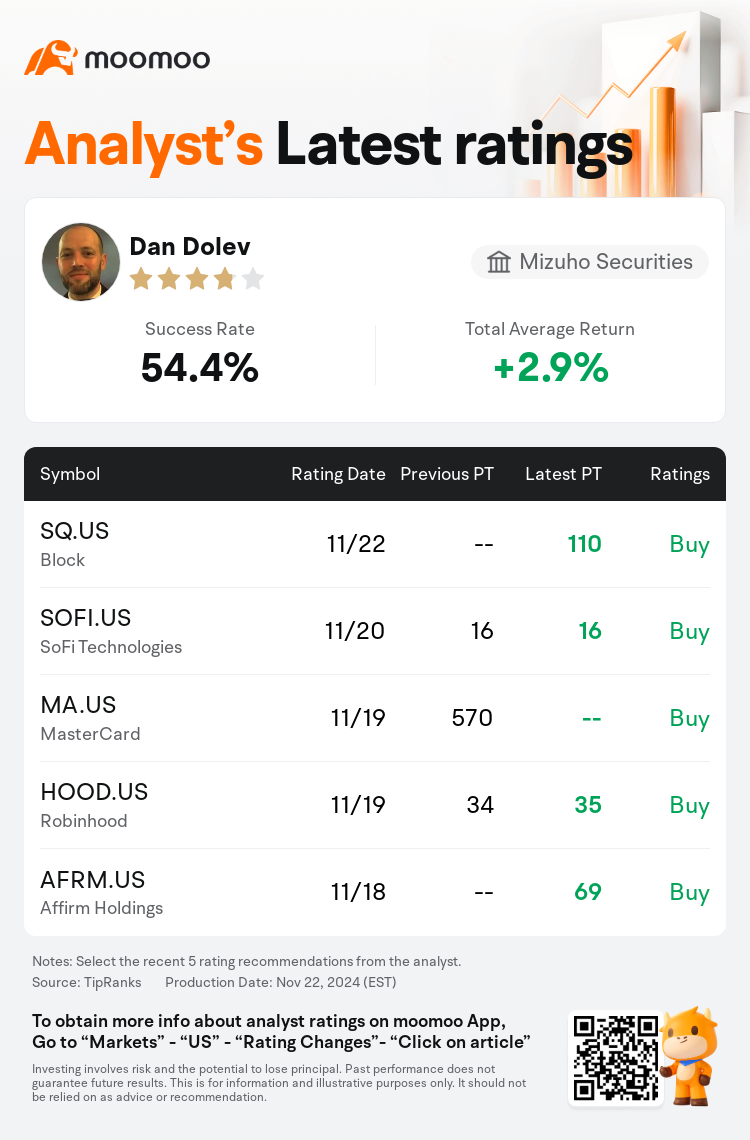

Mizuho Securities analyst Dan Dolev maintains $Block (SQ.US)$ with a buy rating, and sets the target price at $110.

According to TipRanks data, the analyst has a success rate of 54.4% and a total average return of 2.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Block (SQ.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Block (SQ.US)$'s main analysts recently are as follows:

While some investors have shown skepticism regarding Block's ambition of no less than 15% profit growth by 2025, analyses suggest a more favorable outcome is plausible for the firm's three main ecosystems. Cash App, with the exclusion of buy-now-pay-later, might achieve mid-teen profit increase rates annually by adding approximately 1 million monthly active users while moderating monetization rate growth. Furthermore, anticipated initiatives in verticalization and streamlined merchant onboarding may see Square's profits increase by 12%. Additionally, a potentially high twenties percentage growth is projected for the company's buy-now-pay-later profits by 2025. Collectively, these assessments underpin a forecast of at least 16% growth in Block's total gross profits for 2025.

The company's growth is noted to be slowing after recent share rallies. Analysts express a more cautious view concerning Cash App, alongside a mild downside risk to consensus estimates following the stock's rally over the last month.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

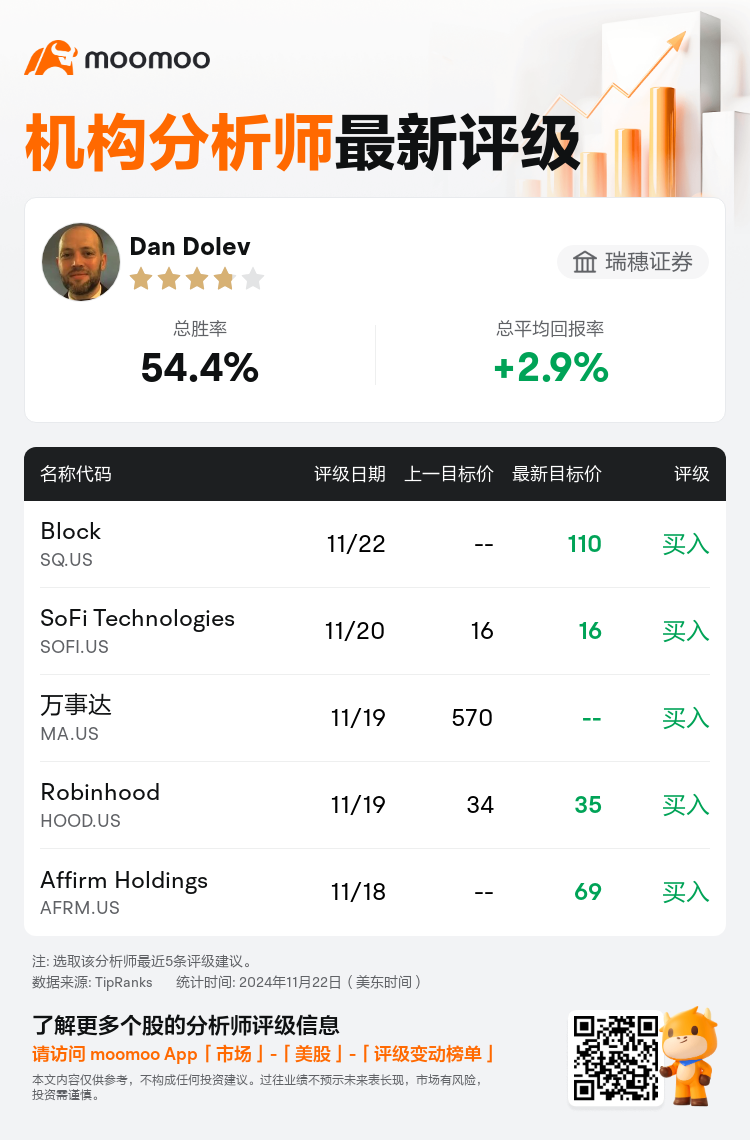

瑞穗证券分析师Dan Dolev维持$Block (SQ.US)$买入评级,目标价110美元。

根据TipRanks数据显示,该分析师近一年总胜率为54.4%,总平均回报率为2.9%。

此外,综合报道,$Block (SQ.US)$近期主要分析师观点如下:

此外,综合报道,$Block (SQ.US)$近期主要分析师观点如下:

尽管一些投资者对Block到2025年至少实现15%的利润增长的雄心表示怀疑,但分析表明,公司的三大生态系统可能会有更有利的结果。 Cash App,除去买入后付款,通过增加约100万月活跃用户,同时调节货币化速度增长,可能每年实现中青少年利润增长率。此外,垂直化和精简商家入驻的预期举措可能会使Square的利润增长12%。另外,公司的买入后付款利润有望在2025年实现高达二十年代的增长。总体而言,这些评估支撑了对Block 2025年总毛利至少增长16%的预测。

公司的增长被发现在最近的股价上涨之后有所放缓。分析师对Cash App表示更为谨慎的看法,加上最近一个月股价上涨后对共识估计存在轻微下行风险。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Block (SQ.US)$近期主要分析师观点如下:

此外,综合报道,$Block (SQ.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of