After the PMI data was released, EUR/USD fell more than 1% to $1.0335, the lowest level since November 2022. The market is betting that the possibility that the ECB will cut interest rates by 50 basis points next month jumped from around 15% yesterday to more than 50%. Interest rate traders expect interest rates to be cut by 150 basis points by the end of 2025.

The euro fell to its lowest level in two years on Friday afternoon. Traders expect Trump's broad global tariff plan to dampen EU growth and force the ECB to cut interest rates more aggressively.

Eurozone PMI data released in the afternoon was extremely bleak: in November, business activity in the Eurozone declined again, service and manufacturing PMIs both entered a shrinking region, and the German and French service industries contracted at an accelerated pace.

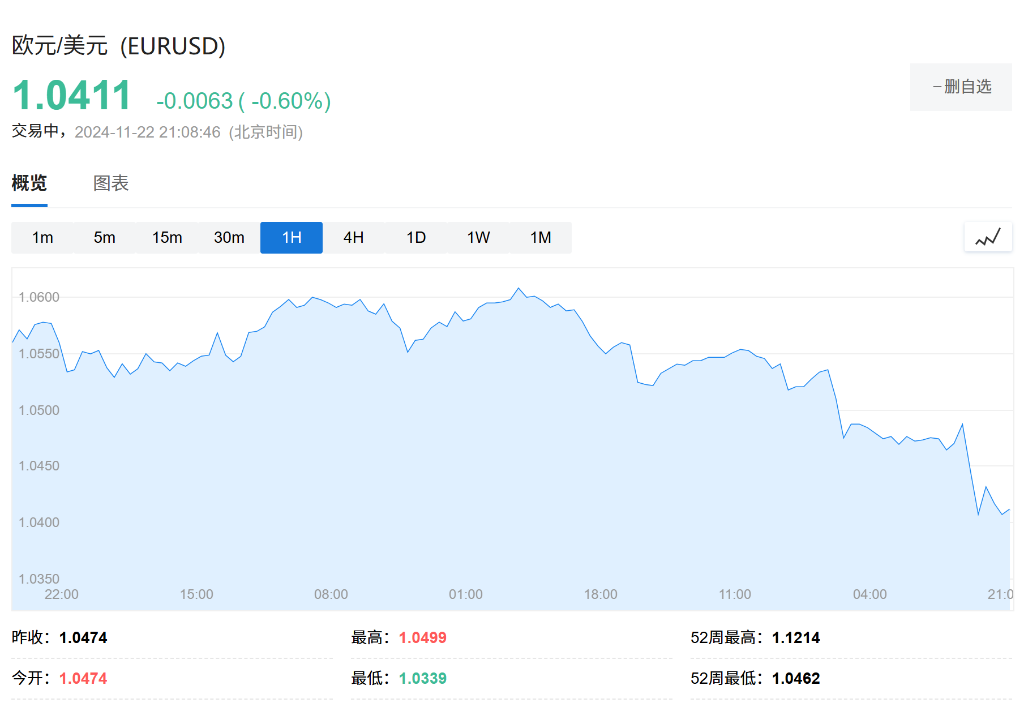

After the data was released, EUR/USD fell more than 1% to $1.0335, the lowest level since November 2022. EUR/USD is currently reported at EUR 1.0411. The market has drastically raised the ECB's bet that interest rates will be cut by 50 basis points next month. The possibility has jumped from about 15% yesterday to more than 50%.

After the data was released, EUR/USD fell more than 1% to $1.0335, the lowest level since November 2022. EUR/USD is currently reported at EUR 1.0411. The market has drastically raised the ECB's bet that interest rates will be cut by 50 basis points next month. The possibility has jumped from about 15% yesterday to more than 50%.

Matthew Landon, global market strategist at J.P. Morgan Private Bank, said:

“This report does put interest rate cuts of 50 basis points on the table, betting that the euro is the company's 'preferred short' trade in the foreign exchange market.”

The euro hit a two-year low. Analysis predicts that the euro may fall below parity against the US dollar in the future

The euro has been one of the worst performing currencies in the G10 over the past three months. Markets are worried that after Trump becomes President of the United States, he may carry out severe tariff attacks on export-dependent economies in the Eurozone.

Other analysts believe that at a time when Russian-Ukrainian relations are strained, the decline in the euro is also a response to the worsening geopolitical situation in Europe.

Chris Turner, head of global markets at ING, said that the rise in gas prices has raised concerns about commodity trade in the Eurozone and the chain reaction between the euros.

Looking ahead to the global foreign exchange market in 2025, Goldman Sachs believes that the euro will weaken further against the US dollar next year, and may even fall below parity. In the short term, Eurozone policymakers may adopt loose monetary policies to deal with tariff shocks, which will further depress the euro exchange rate.

Kristoffer Kjaer Lomholt, head of foreign exchange research at Danske Bank, said that the euro is “under tremendous pressure”:

“The PMI report raised widespread concerns in the market about the Eurozone's cyclical outlook, as well as the ECB's easing prospects.”

Will interest rates be cut sharply in December?

Today, compounded by the Eurozone economy falling into “stagflation,” policymakers must decide whether to speed up the pace of easing as economic headwinds intensify.

On Friday, ECB Governing Council member Mario Centeno said that Eurozone inflation has reached its target and the economy is facing challenges. He is inclined to cut interest rates in a gradual and steady manner.

“However, in the case of a downturn (in the economy), we can discuss more drastic interest rate cuts.”

On the same day, ECB Vice President Luis de Guindos said that the central bank is clearly on the path of cutting interest rates, but the path of cutting interest rates is more important than the extent of interest rate cuts.

“If our inflation forecast for next year does become a reality, then the path of monetary policy is clear. The question of whether we cut interest rates by 50 basis points or 25 basis points is less important.”

Outsiders generally expect that the ECB will cut interest rates for the fourth time since June at the last interest rate meeting in December. Based on the level implicit in the swap market, it is currently expected that the ECB will cut interest rates by 25 basis points each in the next four meetings. Interest rate traders expect interest rates to be cut by 150 basis points by the end of 2025.

数据公布后,欧元兑美元下跌逾1%至1.0335美元,为2022年11月以来的最低水平。目前欧元兑美元报1.0411欧元。

数据公布后,欧元兑美元下跌逾1%至1.0335美元,为2022年11月以来的最低水平。目前欧元兑美元报1.0411欧元。