Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

Macro Matters

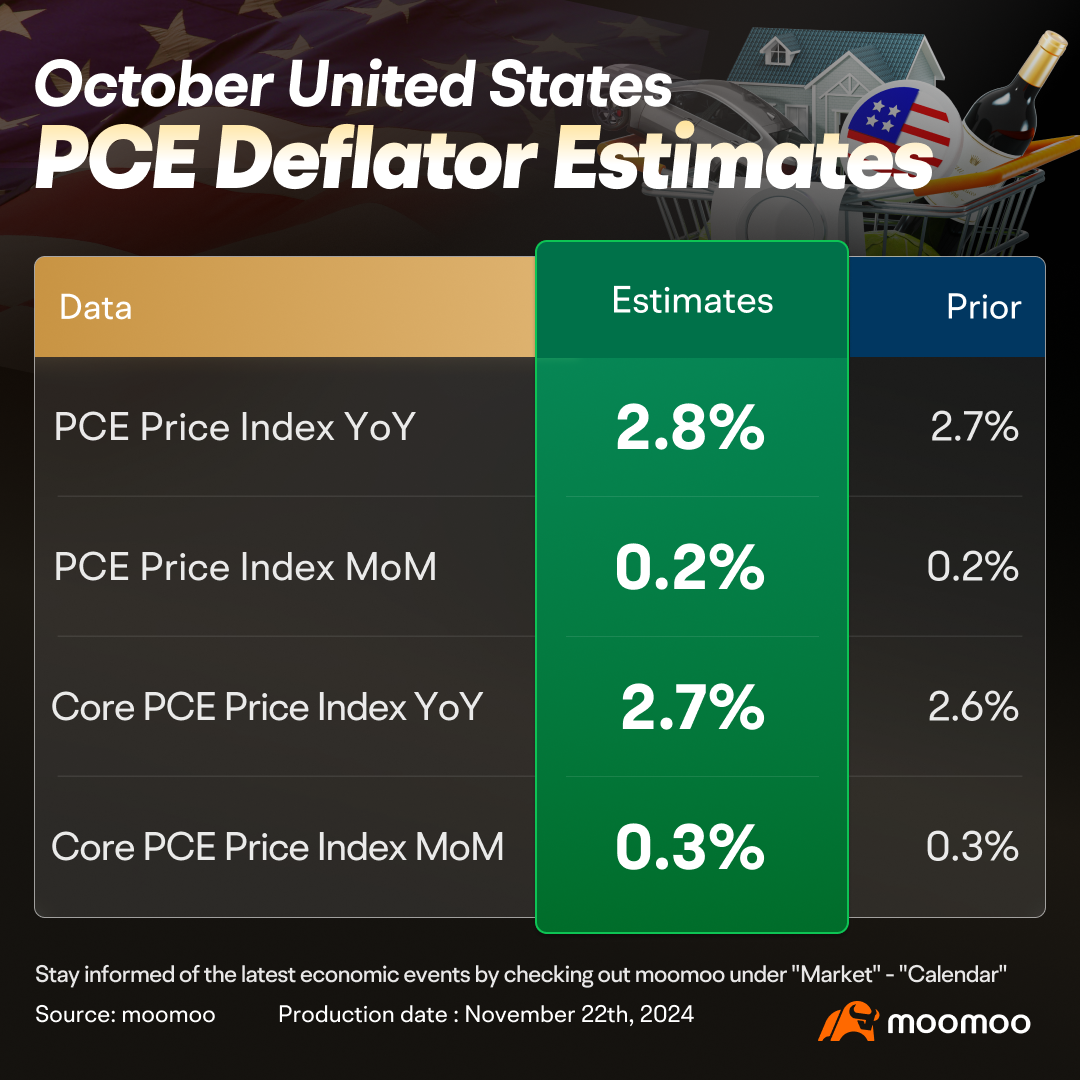

Economists Expect Core PCE Deflator in October to Rise

Economists anticipate that the core PCE deflator, which is the preferred inflation measure of the Federal Reserve, increased by 0.30% in October on a month-over-month basis, compared to a 0.25% increase previously. This rise is expected to push the annual rate to 2.8%, up from 2.7%, moving further from the Fed's target of 2%. The upcoming report, scheduled for release on November 27, along with projections of a potential increase to 2.9% in the annual rate in the coming months amid an equity market rally, might lead the Fed to decelerate its pace of rate cuts.

Fed to Release Nov. FOMC Minutes, Detailing Economic Outlook & Policy Decisions Next Week

Fed to Release Nov. FOMC Minutes, Detailing Economic Outlook & Policy Decisions Next Week

On November 26, the Federal Reserve is set to publish the minutes from its FOMC meeting held on November 6-7. At this meeting, officials decided to cut the federal funds rate by 25 basis points, a move that was largely anticipated but less than the 50-basis point reduction at their previous session.

The meeting commenced shortly after the U.S. election, but it is unlikely that the minutes will discuss the election results or their potential impact on monetary policy. The minutes are expected to indicate that both staff and policymakers saw reduced downside risks to economic activity and employment, based on data available during the period between meetings. Additionally, a higher core PCE inflation rate observed in the interim probably caused an upward adjustment in the year-end inflation forecast. Consequently, the tone of policymakers since the November meeting has suggested a more cautious approach to further easing.

Smart Money Flow

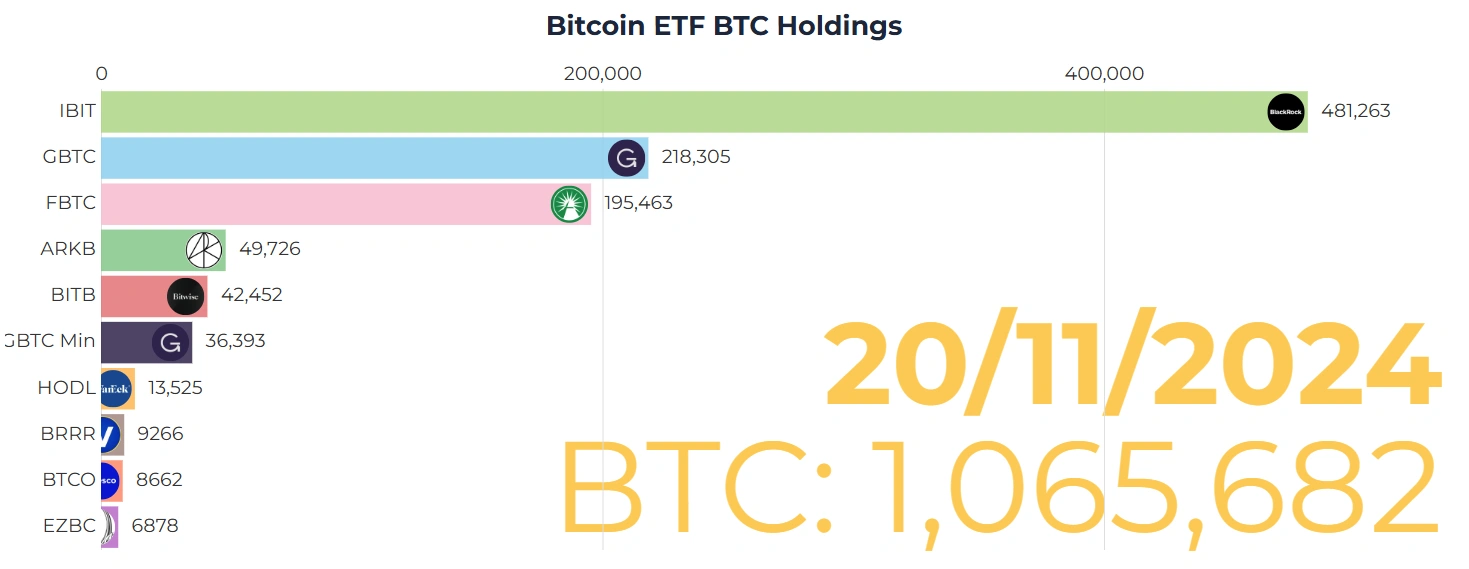

Bitcoin ETFs Reach $100B with Massive Inflows in 2024.

Bitcoin exchange-traded funds (ETFs) have surged past $100 billion in total assets, marking a significant milestone just 10 months after their debut in January. This group of 12 Bitcoin ETFs, issued by major financial institutions such as BlackRock and Fidelity Investments, has seen rapid growth, becoming one of the most successful fund category launches in recent history.

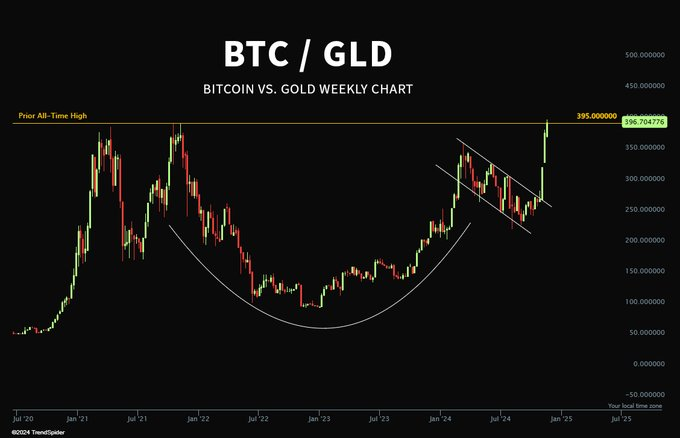

Bitcoin made a new all-time high relative to Gold on Friday.

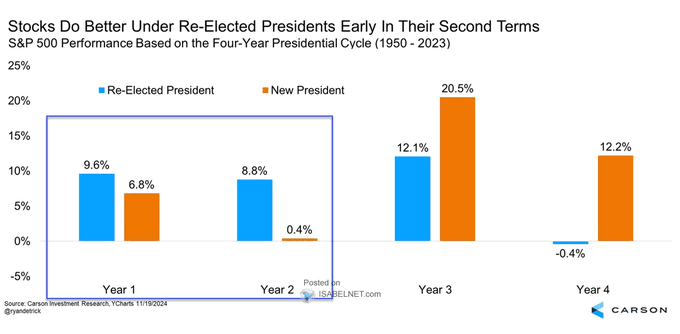

US stock markets generally perform better in the initial two years when a President is re-elected versus when a new President takes office.

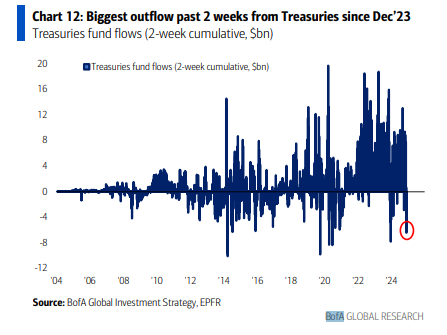

BoA: The past 2 weeks have seen the biggest outflows from US Treasuries this year.

Top Corporate News

Nvidia Says New Chip Remains on Track, Helping Soothe Investors.

Nvidia Corp. assured investors that its new product lineup will continue to fuel an artificial intelligence-driven growth run, while also signaling that the rush to get chips out the door is proving costlier than expected. Speaking after the release of quarterly results, Chief Executive Officer Jensen Huang said that Nvidia’s highly anticipated Blackwell products will ship this quarter amid “very strong” demand. But the production and engineering costs of the chips will weigh on profit margins, and Nvidia’s sales forecast for the current period didn’t match some of Wall Street’s more optimistic projections.

Huang said that Blackwell is now in “full production,” and there’s still an appetite for Hopper, the previous design. “Blackwell is now in the hands of all of our major partners,” he said during the conference call.

MicroStrategy Tumbles After Citron Research Shorts the Stock.

MicroStrategy Inc shares tumbled after Andrew Left’s Citron Research said in a post on X that it’s betting against the software company, which has effectively transformed itself into a Bitcoin investment fund.

The stock fell 16% to close at about $397, reversing a gain of nearly 15% from earlier in the session. The slump marked the stock’s worst day since April 30 and came despite the extended rally in Bitcoin, which rose to a record high.

Temu-Owner PDD’s Shares Dive After Warning of Worsening Profit.

PDD Holdings Inc.’s shares plunged after warning that its profitability will trend downward over time because of intensifying competition in its home market of China.

PDD, which competes with Alibaba Group Holding Ltd., said its team was struggling to catch up with unspecified rivals because of a lack of expertise. Executives also reiterated the company’s guidance from August that sales and profit growth will slow going forward. Its stock slid as much as 10% in early US trading.