Welcome to the weekly market review. This section is dedicated to providing Moomoo CAB members with this week's key investment highlights and insights, as well as a preview of the major events that will have an impact on the market in the coming week.

Macro trends

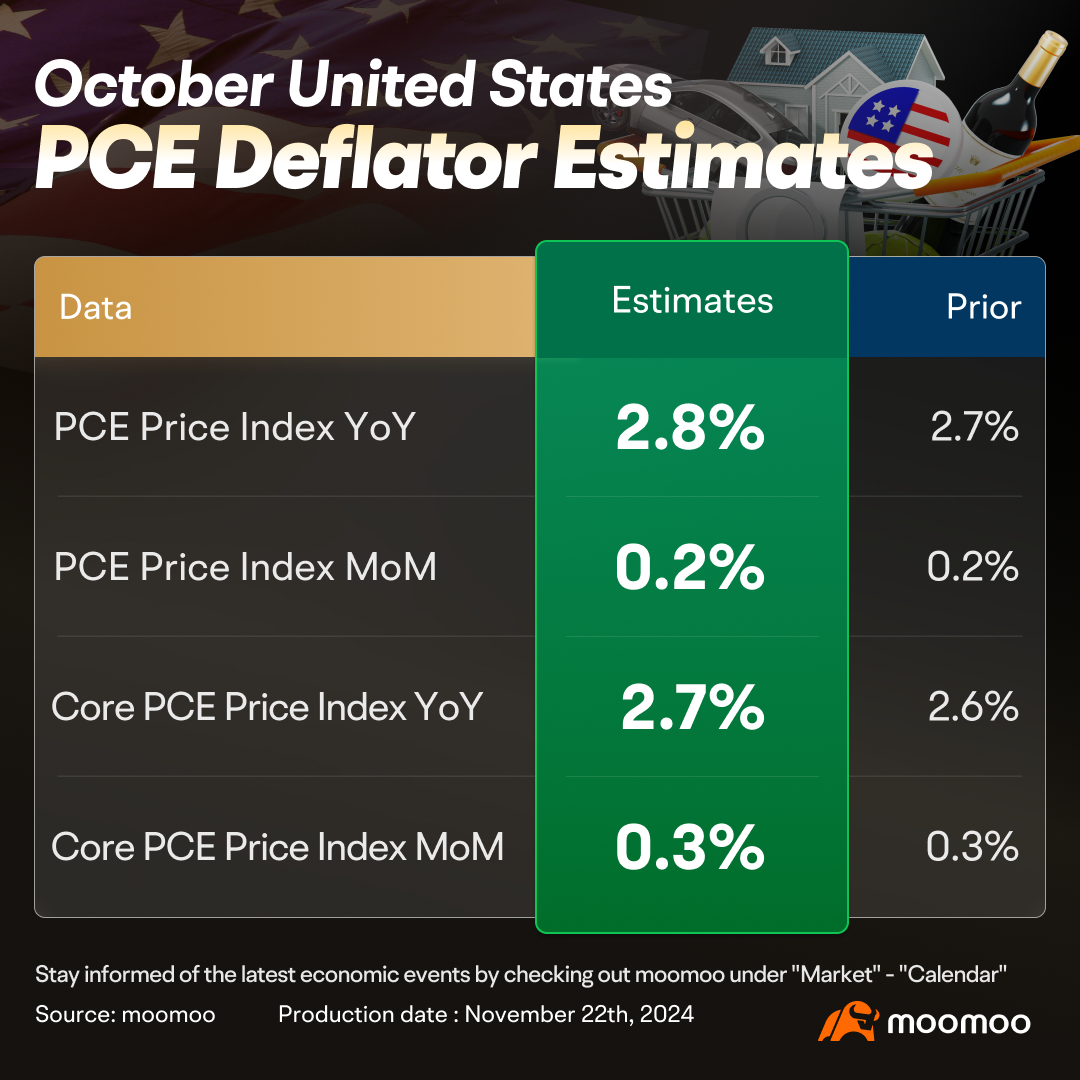

Economists expect the core PCE deflator to rise in October

Economists expect the Federal Reserve's preferred measure of inflation, the core PCE deflator, to increase 0.30% month-on-month in October, up from 0.25% previously. This increase is expected to raise the annual rate to 2.8%, higher than the previous 2.7%, and further deviate from the Federal Reserve's 2% target. Bloomberg economists expect the report to be released on November 27 may cause the Federal Reserve to slow down the pace of interest rate cuts.

Next week, the Federal Reserve will release the November FOMC meeting minutes detailing the economic outlook and policy decisions

Next week, the Federal Reserve will release the November FOMC meeting minutes detailing the economic outlook and policy decisions

On November 26, the Federal Reserve will release the minutes of the FOMC meeting to be held from November 6 to 7. At this meeting, officials decided to cut the federal funds rate by 25 basis points. This move was largely expected, but it was lower than the 50 basis point drop in the previous meeting.

The meeting began soon after the US election, but the minutes are unlikely to discuss the election results or their potential impact on monetary policy. The minutes of the meeting are expected to show that data during the conference showed a reduction in downside risks to economic activity and employment. Furthermore, the higher core PCE inflation rate observed during the period may lead to an increase in the year-end inflation forecast. As a result, since the November meeting, policymakers' statements have shown a more cautious attitude towards further policy relaxation.

Funding trends

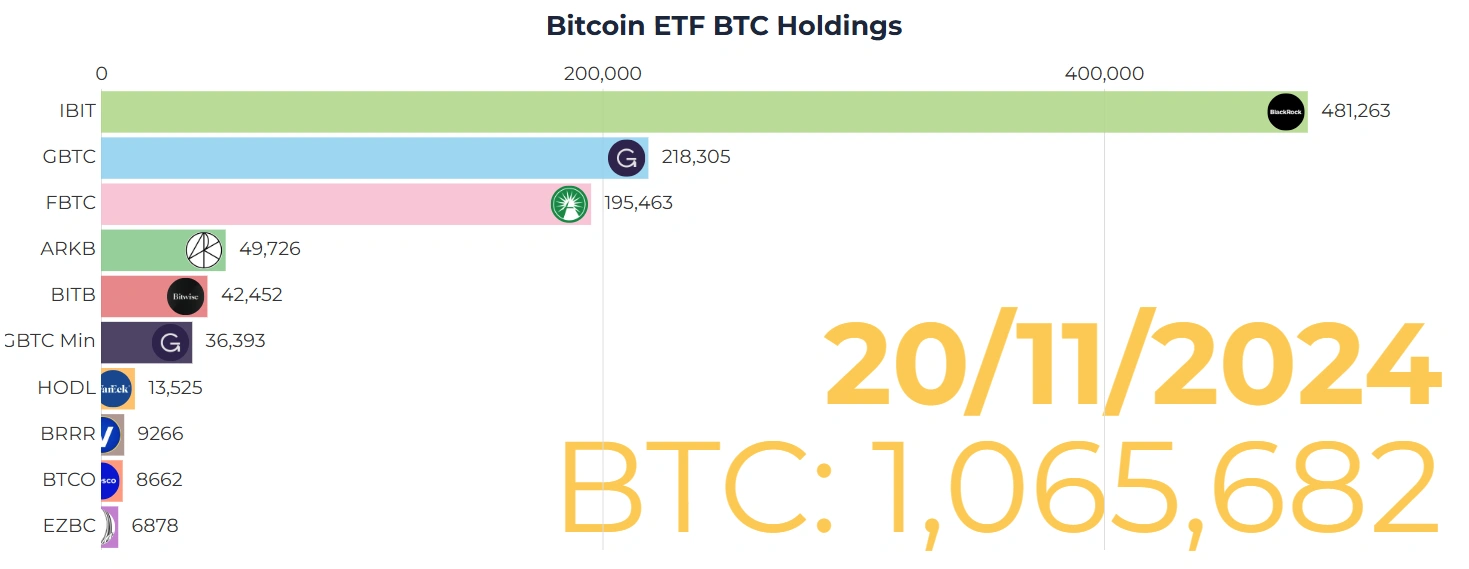

Bitcoin exchange-traded funds reached $100 billion in 2024, with significant capital inflows.

The total assets of Bitcoin exchange-traded funds (ETFs) surged above $100 billion, marking a major milestone just 10 months since their debut in January. This group of 12 Bitcoin ETFs issued by major financial institutions such as BlackRock and Fidelity Investments grew rapidly and became one of the most successful fund categories in modern history.

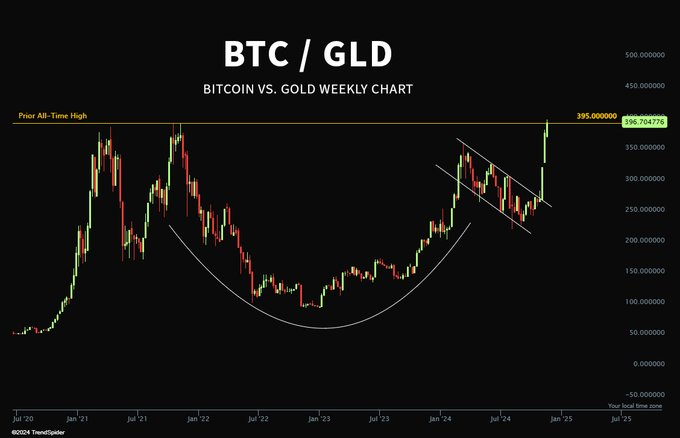

Bitcoin hit a new all-time high relative to gold on Friday.

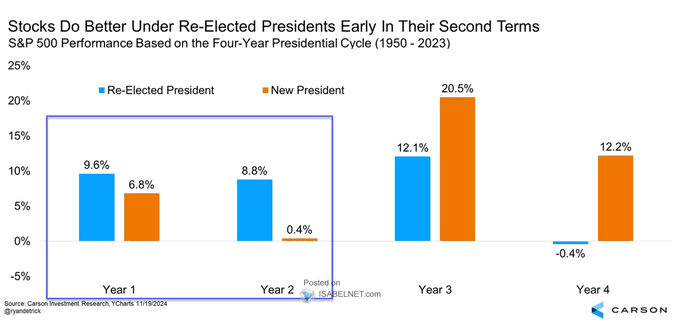

The US stock market generally performs better in the first two years of a presidential re-election than when a new president takes office.

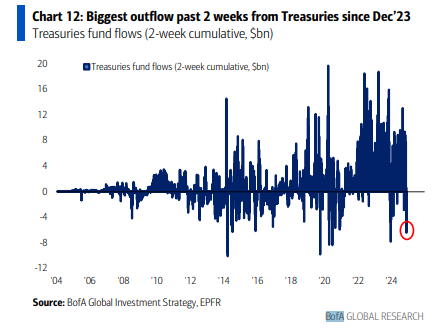

The past two weeks were the biggest outflow period for US Treasury bonds this year.

Company news

Nvidia said the new chip is still being planned to help reassure investors.

Nvidia assures investors that its new product lineup will continue to drive AI-driven growth, while also indicating that the boom in introducing chips is more expensive than expected. Following the release of quarterly results, CEO Wong In-hoon said Nvidia's highly anticipated Blackwell products will be shipped this quarter and demand is “very strong.” However, chip production and engineering costs will have an impact on profit margins, and Nvidia's current sales forecast does not match some of Wall Street's more optimistic predictions.

Mr Wong said Blackwell is now “in full production” and is still interested in the previous design Hopper. “Blackwell is now in the hands of all of our major partners,” he said on the conference call.

MicroStrategy plummeted after Citron Research shorted shares.

MicroStrategy Inc shares fell as Andrew Lift's Citron Research said in a post on X that it is betting against the software company, which has effectively turned itself into a Bitcoin investment fund.

The stock fell 16% to close at around $397, reversing a gain of nearly 15% in early trading. This drop marks the stock's worst day since April 30, despite Bitcoin's continued rise, reaching a record high.

PDD's stock plummeted after warning of deteriorating profits.

PDD Holdings Inc. shares plummeted after warning that its profitability would decline as competition intensifies in the mainland China market.

PDD, which competes with Alibaba Group Holdings Ltd., said its team is trying to catch up with unspecified competitors due to lack of expertise. Executives also reiterated the company's August guidelines that sales and profit growth would slow. Its stock fell 10% in early US trading.