A Closer Look at Wells Fargo's Options Market Dynamics

A Closer Look at Wells Fargo's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Wells Fargo.

有很多資金的鯨魚已經明顯看好富國銀行。

Looking at options history for Wells Fargo (NYSE:WFC) we detected 10 trades.

查看威爾斯法戈(紐交所:WFC)的期權歷史,我們發現了10筆交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 40% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,50%的投資者以看好的預期進行交易,40%則是看淡的。

From the overall spotted trades, 4 are puts, for a total amount of $459,983 and 6, calls, for a total amount of $1,644,858.

從所有發現的交易中,有4筆看跌期權,總金額爲459,983美元,6筆看漲期權,總金額爲1,644,858美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $105.0 for Wells Fargo during the past quarter.

分析這些合約的成交量和未平倉合約,似乎大型玩家在過去一季度關注威爾斯法戈的價格區間爲70.0美元至105.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

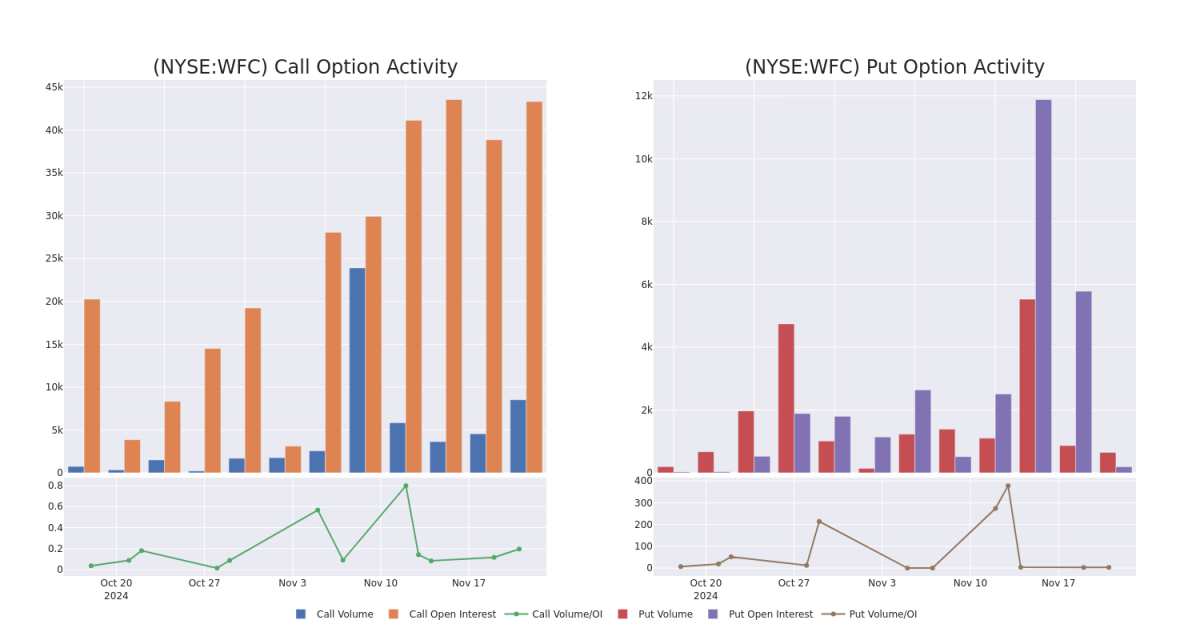

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Wells Fargo's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wells Fargo's whale trades within a strike price range from $70.0 to $105.0 in the last 30 days.

查看成交量和未平倉合約是進行期權交易的一個強有力的步驟。這些數據可以幫助您跟蹤威爾斯法戈在特定執行價格的期權的流動性和興趣。以下,我們可以觀察到過去30天內威爾斯法戈所有鯨魚交易在70.0美元到105.0美元的執行價格區間內的看漲和看跌期權的成交量和未平倉合約的演變。

Wells Fargo Option Volume And Open Interest Over Last 30 Days

富國銀行過去30天的期權成交量和持倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | TRADE | NEUTRAL | 01/17/25 | $2.62 | $2.58 | $2.6 | $77.50 | $1.0M | 10.1K | 4.1K |

| WFC | CALL | SWEEP | BULLISH | 01/17/25 | $1.65 | $1.63 | $1.65 | $80.00 | $430.2K | 15.4K | 2.6K |

| WFC | PUT | SWEEP | BULLISH | 01/15/27 | $9.25 | $9.05 | $9.05 | $72.50 | $161.9K | 793 | 179 |

| WFC | PUT | TRADE | BEARISH | 01/16/26 | $30.15 | $29.35 | $29.97 | $105.00 | $149.8K | 100 | 50 |

| WFC | PUT | TRADE | BULLISH | 12/06/24 | $5.1 | $4.9 | $4.92 | $80.00 | $98.4K | 222 | 200 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | 看漲 | 交易 | 中立 | 01/17/25 | $2.62 | $2.58 | $2.6 | $77.50 | $1.0M | 10.1K | 4.1千 |

| WFC | 看漲 | SWEEP | BULLISH | 01/17/25 | $1.65 | $1.63 | $1.65 | $80.00 | 430.2千美元 | 15.4K | 2.6千 |

| WFC | 看跌 | SWEEP | BULLISH | 01/15/27 | 9.25美元 | $9.05 | $9.05 | $72.50 | $161.9K | 793 | 179 |

| WFC | 看跌 | 交易 | 看淡 | 01/16/26 | $30.15 | $29.35 | $29.97 | $105.00 | 149.8K美元 | 100 | 50 |

| WFC | 看跌 | 交易 | BULLISH | 12/06/24 | $5.1 | $4.9 | $4.92 | $80.00 | $98.4K | 222 | 200 |

About Wells Fargo

關於富國銀行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富國銀行是美國最大的銀行之一,資產負債表資產約爲1.9萬億美元。該公司有四個主要業務板塊:消費銀行、商業銀行、公司和投資銀行以及財富和投資管理。它幾乎完全專注於美國市場。

After a thorough review of the options trading surrounding Wells Fargo, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

經過對富國銀行期權交易的徹底審查,我們轉而對公司進行更詳細的研究。這包括對其當前的市場地位和表現的評估。

Wells Fargo's Current Market Status

Wells Fargo的當前市場狀況

- Trading volume stands at 6,445,834, with WFC's price up by 1.14%, positioned at $75.68.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 54 days.

- 交易量爲6,445,834,WFC的價格上漲了1.14%,現報75.68美元。

- RSI指示股票可能已超買。

- 預計將在54天內宣佈盈利。

What Analysts Are Saying About Wells Fargo

關於Wells Fargo的分析師評論

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $79.5.

在過去一個月中,2位行業分析師分享了他們對這隻股票的見解,提出了平均目標價爲79.5美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Citigroup has decided to maintain their Neutral rating on Wells Fargo, which currently sits at a price target of $82. * Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Wells Fargo with a target price of $77.

Benzinga Edge的期權異動板塊在市場動向發生之前發現潛在的市場動因。查看大資金在您喜歡的股票上的持倉。點擊這裏獲取訪問權限。* 花旗集團的一位分析師決定維持對富國銀行的中立評級,當前目標價爲82美元。* 來自evercore ISI集團的一位分析師在對富國銀行的評估中保持跑贏市場評級,目標價爲77美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wells Fargo options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。敏銳的交易者通過持續教育自己、調整策略、監控多種因子並密切關注市場走勢來管理這些風險。通過Benzinga Pro實時警報,了解最新的Wells Fargo期權交易信息。

From the overall spotted trades, 4 are puts, for a total amount of $459,983 and 6, calls, for a total amount of $1,644,858.

From the overall spotted trades, 4 are puts, for a total amount of $459,983 and 6, calls, for a total amount of $1,644,858.