US inflation is unlikely to fall to the Fed's 2% annual target in 2025, but this is unlikely to change the Fed's current path of cutting interest rates

The Zhitong Finance App learned that it is unlikely that US inflation will fall to the Fed's annual target of 2% in 2025, but this is unlikely to change the Fed's current path of cutting interest rates.

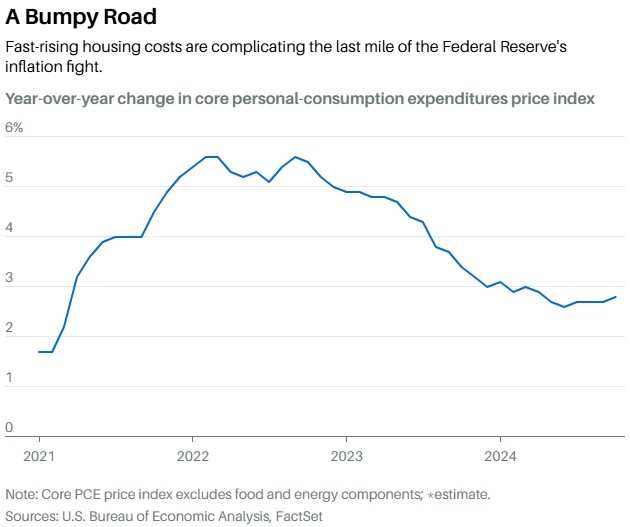

Inflation has been one of the main challenges for the Federal Reserve over the past four years. However, inflation has improved markedly. The year-on-year increase in the personal consumption expenditure (PCE) price index, the inflation indicator favored by the Federal Reserve, peaked at more than 7% in June 2022. At the time, the Federal Reserve had just begun raising interest rates close to zero to cope with the rapid rebound in prices after the COVID-19 economic freeze.

The initial progress was quite rapid: by June 2023, the annual increase in the PCE price index fell to 3.3%. The following month, the federal funds rate reached its highest level in 20 years, with a target range of 5.25% to 5.5%.

The initial progress was quite rapid: by June 2023, the annual increase in the PCE price index fell to 3.3%. The following month, the federal funds rate reached its highest level in 20 years, with a target range of 5.25% to 5.5%.

Since then, however, inflation has fluctuated repeatedly. After a further slowdown at the end of 2023, there was a recovery in early 2024. After experiencing a fall in inflation over the summer, progress came to a standstill again at the end of 2024. The core PCE price index (excluding volatile food and energy prices) has remained around 2.7% over the past six months.

The Federal Reserve's optimism

Federal Reserve Chairman Jerome Powell said on November 14: “I expect inflation to continue to fall towards our 2% target, although the path may be a bit rough.”

So why do policymakers seem to “declare victory” when inflation is still above target? This requires an in-depth understanding of the composition of the inflation index.

First, the 2% inflation target does not mean that the prices of all goods and services in the economy will grow at a rate of 2% at the same time. The consumer price index (CPI) basket includes about 0.08 million goods and services, some of which increased by more than 2% and others by less than 2%.

Three categories of inflation

Inflation can be divided into three main categories: goods, housing, and non-housing services. At the peak of post-pandemic inflation in 2022, all three types of prices experienced rapid increases. Supply chain disruptions and a boom in home shopping are driving up commodity prices; rents and housing prices soar as people reassess housing needs in the telecommuting era; and service prices are being driven by rising wages and labor shortages.

Today, commodity inflation is under control, and service inflation is easing as the labor market cools, but housing price inflation is still a problem.

Housing categories include rent paid to landlords and “landlord equivalent rent” (that is, the estimated cost required if the homeowner were to rent out the house). This category may also include utility costs such as utility bills. Housing accounts for about one-third of the CPI and weighs about 16% in the PCE price index.

As of September 2024, the cost of housing and utilities in the PCE price index rose 5% year over year, below the peak of more than 8% in mid-2022. In the same period, prices for non-housing services rose 3.3% year over year, while commodity prices fell 1.2%.

The housing inflation conundrum

Housing inflation is essentially an area of slow change, and the Federal Reserve is unable to significantly accelerate the pace of change by changing interest rates. Leases are usually renewed only once a year, and homes are sold less frequently. The central bank can neither directly build more housing to increase supply, nor can it get people to renew their leases more quickly.

As a result, the focus of Federal Reserve officials has turned to rent changes in new leases rather than rent changes in existing leases. Progress in this area is more encouraging, but it will take a long time before it is reflected in the inflation index.

Boston Federal Reserve Chairman Susan Collins said on November 20: “Housing inflation remains high because rents from existing tenants are still catching up with past increases. Although this catch-up process may be slow and uneven, as long as rent increases for new tenants remain sluggish and overall inflation expectations are stable, I'm not concerned about the sustainability of inflation returning to the 2% track.”

Housing rent inflation will still take a long time to complete this catch-up process, according to a recent study by Cleveland Federal Reserve researchers. Their model predicts that rent inflation won't fall below the pre-2020 average of 3.5% until mid-2026.

Policy prospects and future prospects

This does not take into account the new growth policies that the new US Congress and government might adopt. These policies may raise commodity inflation through tariffs, drive service inflation through labor shortages, or increase overall inflationary pressure through tax cuts to stimulate demand.

The October PCE price index, which will be released this Wednesday, is expected to rise 0.2% month-on-month, and the core index is expected to rise 0.3% month-on-month, in line with the increase in September. The PCE inflation rate is expected to reach 2.3% for the whole year, and the core inflation rate is 2.8%.

Despite this, the results of the Federal Reserve's December 17-18 meeting may not be significantly affected. Prior to that, there were only two key data points left: the November employment report on December 6 and the November CPI on December 11. If the inflation report is significantly higher than expected, it may prompt the Federal Reserve to suspend interest rate cuts; and if employment data weakens, it may support further interest rate cuts.

Federal Reserve officials believe that current interest rates are sufficient to limit economic activity, and they hope to gradually approach neutral interest rates without disrupting the economy. Although they may have to endure inflation above the target for a while, as long as inflation progress is concentrated in the housing sector and new rental inflation continues to fall, they seem to have accepted the reality that the 2% target cannot be achieved in 2025.

最初的进展相当快:到2023年6月,PCE价格指数的年度涨幅下降到3.3%。随后一个月,联邦基金利率达到了二十年来的最高水平,目标区间为5.25%至5.5%。

最初的进展相当快:到2023年6月,PCE价格指数的年度涨幅下降到3.3%。随后一个月,联邦基金利率达到了二十年来的最高水平,目标区间为5.25%至5.5%。