Matthews International Corporation (NASDAQ:MATW) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

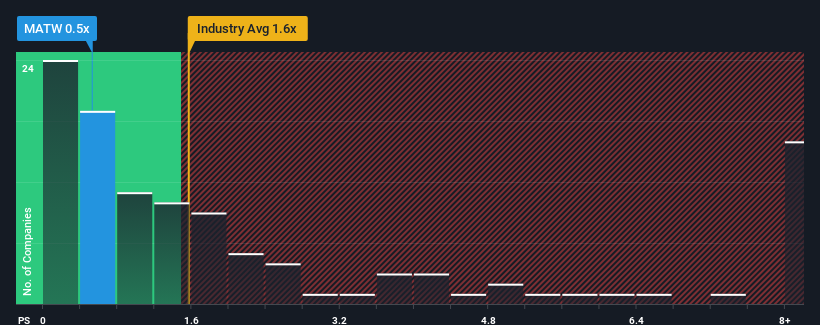

Even after such a large jump in price, Matthews International's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a buy right now compared to the Commercial Services industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Matthews International Has Been Performing

Matthews International hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Matthews International's future stacks up against the industry? In that case, our free report is a great place to start.How Is Matthews International's Revenue Growth Trending?

In order to justify its P/S ratio, Matthews International would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Matthews International would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.5% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 0.1% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 8.7% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Matthews International's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Matthews International's P/S?

Despite Matthews International's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Matthews International's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Matthews International (1 is a bit concerning!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.