Despite an already strong run, Ganfeng Lithium Group Co., Ltd. (SZSE:002460) shares have been powering on, with a gain of 28% in the last thirty days. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

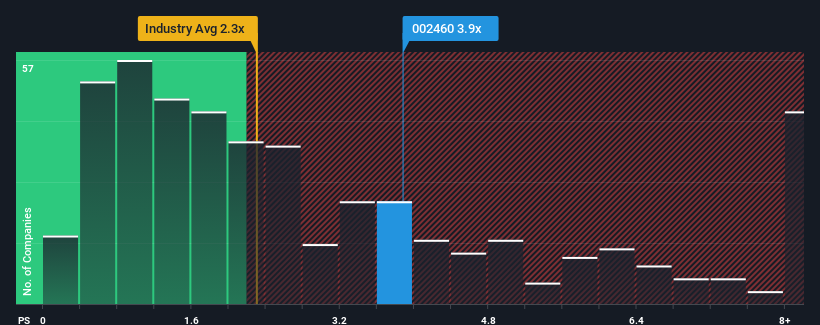

After such a large jump in price, given close to half the companies operating in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Ganfeng Lithium Group as a stock to potentially avoid with its 3.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Ganfeng Lithium Group Has Been Performing

While the industry has experienced revenue growth lately, Ganfeng Lithium Group's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ganfeng Lithium Group.Is There Enough Revenue Growth Forecasted For Ganfeng Lithium Group?

The only time you'd be truly comfortable seeing a P/S as high as Ganfeng Lithium Group's is when the company's growth is on track to outshine the industry.

The only time you'd be truly comfortable seeing a P/S as high as Ganfeng Lithium Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 47% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 144% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 18% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 27% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Ganfeng Lithium Group's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Ganfeng Lithium Group's P/S

Ganfeng Lithium Group shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ganfeng Lithium Group, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Ganfeng Lithium Group has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Ganfeng Lithium Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.