Despite an already strong run, Yidu Tech Inc. (HKG:2158) shares have been powering on, with a gain of 26% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.9% in the last twelve months.

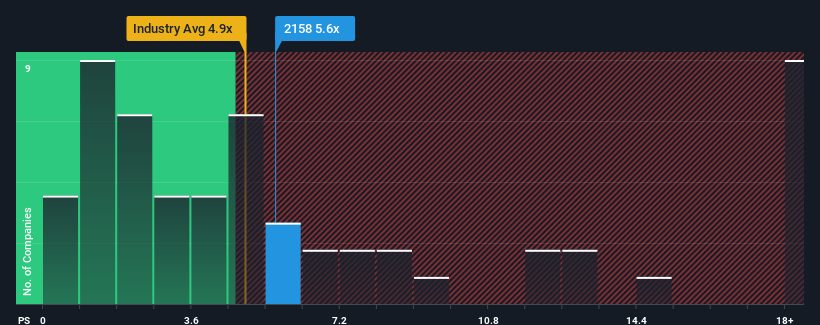

Following the firm bounce in price, Yidu Tech's price-to-sales (or "P/S") ratio of 5.6x might make it look like a sell right now compared to the wider Healthcare Services industry in Hong Kong, where around half of the companies have P/S ratios below 4.6x and even P/S below 2x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Yidu Tech's Recent Performance Look Like?

Recent times haven't been great for Yidu Tech as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yidu Tech.Do Revenue Forecasts Match The High P/S Ratio?

Yidu Tech's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Yidu Tech's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Still, lamentably revenue has fallen 26% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 19% each year during the coming three years according to the four analysts following the company. That's shaping up to be similar to the 18% per annum growth forecast for the broader industry.

In light of this, it's curious that Yidu Tech's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Yidu Tech shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given Yidu Tech's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Yidu Tech is showing 3 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.