不動産業務から段階的に撤退します。

M&A分野では大きなニュースがあります。

今週の金曜日(11月22日)、gree不動産(600185)は重要な資産再編案を公表しました。上海healian、shanghaobaolian、shanghai Tailian、三亚healian、重慶二江の100%の株式のうち、及び上場企業が持つ横琴金融投資集団有限公司への50億元の貸付金を免税集団の51%の株式と交換し、評価差額は現金で補填されます。

つまり、gree不動産はこの再編を通じて、不動産事業から段階的に撤退し、免税事業を投入し、免税事業を中心に据え、大消費運営などの産業連鎖に組み込まれる上場企業になります。

つまり、gree不動産はこの再編を通じて、不動産事業から段階的に撤退し、免税事業を投入し、免税事業を中心に据え、大消費運営などの産業連鎖に組み込まれる上場企業になります。

gree不動産の再編事業は長らく続いており、元の再編計画では、上場企業が珠海国有資産委員会と城建集団が持つ珠海免税集団の100%の株式を株式発行および現金支払いで購入し、さらに条件を満たす35人以下の特定の対象者に株式を発行して資金を調達する予定であり、この計画は2023年4月に臨時株主総会で承認されました。

しかし、2024年7月に開催された理事会会議では、元の再編案の申請書を取り下げ、再編計画を大幅に見直すことを決定し、そして今週金曜日に公表されたのが最終の再編計画です。

この再編はgree不動産の事業の大きな転換を意味し、企業に与える影響は深刻です。やはり不動産業は下り坂にあり、免税事業の収益力、キャッシュフロー状況、そして将来性は比較的良好です。

株価の面では、今年の9月初めからこのたび、gree不動産の株価は累計で60%以上上昇しました。最近の数日間も連続して上昇し、11月22日にはさらに6%以上上昇しました。再編のニュース刺激のもと、明日の株価の動向も期待されます。

画像出典:IPOプロスペクトス

01

不動産開発の減速により、グリー不動産の当期純利益が連続してマイナスとなっています。

公開情報によれば、グリー不動産は広東省珠海市を登記地とし、2009年に上海で主板に上場しています。同社は不動産業、消費財産業、生物医学ヘルスケア業を中心に発展している総合企業です。

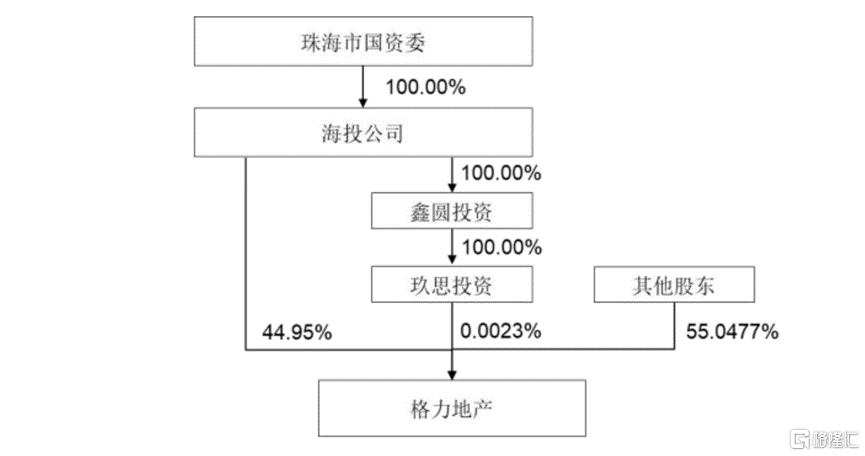

グリー不動産の主要株主は珠海投資公司であり、海投公司の背後には珠海市国有資産監督管理委員会があり、したがって珠海市国有資産監督管理委員会が実質的な経営者となっています。

グリー不動産の株式所有構造図は、重大な資産の置換および関連取引報告書(案)から引用されています。

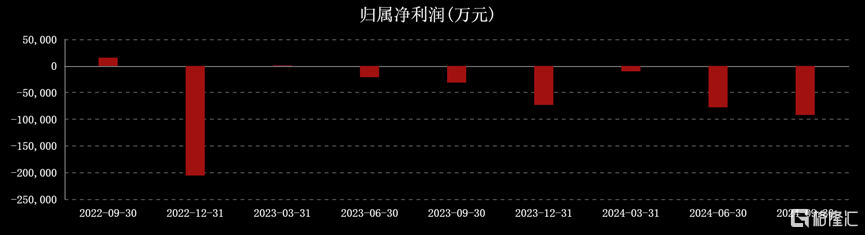

財務諸表データから見ると、2022年から2024年上半期まで、gree real estateの売上の80%以上が不動産業から得られており、同期の当期純利益は絶えず赤字状態です。

gree real estateの親会社の当期純利益状況、画像出典:Choice

近年、景気成長の鈍化、人口構造の変化、都市化のペースの低下、住民の所得期待の弱化などの要因により、不動産業は低調に推移しています。

国家統計局のデータによると、2023年における不動産開発投資は前年比-5.7%から-9.6%まで落ち込み、商品房の販売面積と販売額はそれぞれ8.5%、6.5%減少し、業界全体が底堅い揺れる状況を維持しています。

この背景のもと、いくつかの不動産企業はプロジェクトの販売を促進し売却するため、値引きを厭わずに行なっていますが、今のタイミングで多くのプロジェクトを売却する不動産企業は数年前に高値で取得した土地が多いです。土地の調達コストが高いため、後続の販売段階で市場が続落していることが貢献しており、多くの不動産企業の収益力が危うい状態となっています。

現在、多くの不動産企業が赤字状態にあります。今年の第三四半期には、gree real estate、ワンケ、華僑城、cccg real estate corporation、china fortune land development、深振業、shenzhen centralcon investment holdingなどの不動産企業が赤字に陥っています。

最近、国が市場信頼を高めるための一連の措置を講じており、住宅の頭金割合と住宅ローン金利の引き下げ、購入制限緩和など、一定程度楼市を活性化し、不動産業界の境目の改善を促進できますが、不動産業界の凋落を完全に扭転するのは難しいでしょう。結局、不動産業界の黄金時代は過ぎ去っています。

本次重組では、gree不動産は不動産開発事業を主要な収入源として売却しようとしており、中高層住宅、商業オフィス、ビジネスなど多様な形態の製品をカバーし、自己開発と販売を主体としています。

たとえば、shanghai main businessはshanghai pudong new area qiantan 38-01地区のpujiang haidi住宅プロジェクトの開発と建設です。

shanghai baolianの主要業務はshanghai pudong new area qiantan 32-01地区のhaidi 1号住宅プロジェクトの開発と建設です。

shanghai tailianの主要業務はshanghai songjiang district sijing town SJSB0003単位10-05号地区の広場ハイデ住宅プロジェクトの開発と建設です。

sanya coordinatingの主要業務はsanya central business district phoenix coast unit地区のsanyawan 1号プロジェクトの開発と建設です。

chongqing liangjiangの主要業務はchongqing liangjiang総部公園プロジェクトの開発と建設です。

2年以上の損失を被り続けている不動産企業として、gree不動産は、再編による不動産事業の売却を通じて、実務面での一環としても免税グループの置換はどのような状況ですか?

02

china tourism group duty free corporation 今年の上半期の当期純利益は40億を超えました

免税集团のフルネームは「珠海市免税企業集団有限公司」で、免税商品の販売事業を主に行い、国内で最も早く免税商品の販売事業を開始した企業の1つであり、その歴史は1981年12月に設立された珠海市友誼公司免税品商店まで遡ることができます。

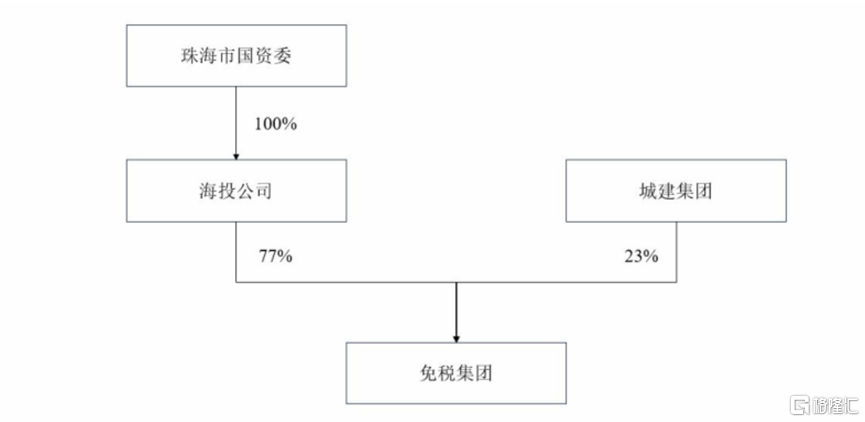

gree real estateと同様に、免税集団の実質的な支配者は珠海市国有資産管理委員会です。興味深いのは、最近の多くのM&Aケースは、同じ実質的な支配者のもとでの資産統合です。最近ホットな双城製薬、オーラ半導体、h.b.フラー、富楽化粧品、科源製薬、宏基堂などが該当します。

china tourism group duty free corporationの株主と資産権利の支配関係は、画像出典: 重大な資産置き換えおよび関連取引報告書(草案)

報告書署名日までに、china tourism group duty free corporationの子会社の中で、china tourism group duty free corporationの最近の監査済み財産総額、売上高、純資産額または当期純利益の20%以上を構成する子会社は、珠免国際有限公司(通称「珠免国際」)です。珠免国際は中国香港での輸出入貿易、卸売小売り免税品の供給およびサービス、クロスボーダーコマース、倉庫管理物流、対外投資などの業務を主に行っています。

珠免国際以外にも、china tourism group duty free corporationは珠海免税(マカオ)有限公司、珠免集団(海南)免税品有限公司、珠免集団(珠海横琴)商業有限公司などの主要子会社を持っています。

gree real estateの慶幸とは異なり、過去2年間、china tourism group duty free corporationの業績は成長傾向にあります。

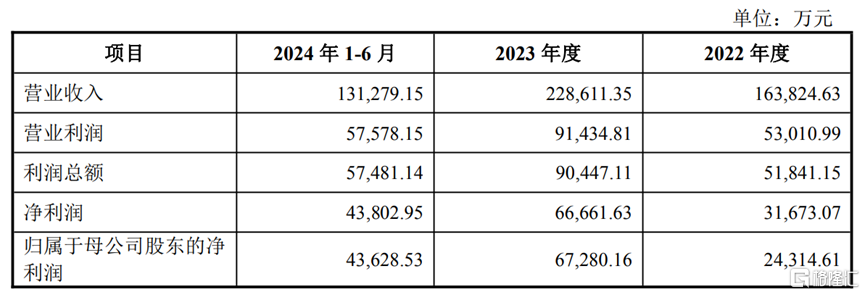

2022年、2023 年及 2024 年上半年、免税グループはそれぞれ約16.38億元、22.86億元、13.13億元の売上高を実現し、それに応じて約3.17億元、6.67億元、4.38億元の純利益を達成しました。

免税グループの損益計算書、画像出典:重大資産置換および関連取引報告書(草案)

重組完了後、免税グループは上場企業の持株会社子会社となり、上場企業は既存の事業セクターに免税品事業を追加します。

同時に、産業の統合とリソースの最適化を通じて持続可能な発展能力を高めます。一方、珠海港の免税事業を強化し、将来的には珠海市、横琴、海南などの免税事業を展開し、全国の空港などの口岸免税ビジネスを拡大し、免税品の多様な品目と多様な形態の販売を実現します。他方で、上場企業のプラットフォームの利点を活用し、旅行小売業のサプライチェーン上流・下流の成熟した事業を拡大し、免税、保税、納税などの事業を中心とした大消費産業の構築に焦点をあてます。

免税業界は一部の国や地域が企業に、その交通手段、口岸、または市内に店舗を設立することを認め、出入国旅客が免税商品を購入するための旅行小売業の分野に属しています。

国内外の大手免税業者は数年にわたる発展を経て、事業モデルが比較的成熟しており、国内外の大手免税運営業者の市場シェアがさらに拡大し、供給チェーンの交渉力が強化されると、販売する免税品のグローバルな価格競争優位性が持続的に向上し、免税業界市場競争が激化するでしょう。

前瞻産業研究院のデータによると、2022年の中国の免税市場の売上規模は365.31億元です。現在、中国の免税業界市場の集中度は比較的高く、一強多強の状況が見られます。

2022年の免税トップ企業である中国中免は、市場シェア71.3%で業界トップであり、海旅免税は9.3%の市場シェアで2位にランクされ、珠海免税、深圳免税、王府井がトップ5に入る。

中国中免は免税ライセンス数、売上高、免税店舗数などの中核的な指標でリードし、免税グループは市場シェアで中国中免と比較してまだ大きな差がある。

也就是说,格力地产要通过这次重组,

也就是说,格力地产要通过这次重组,