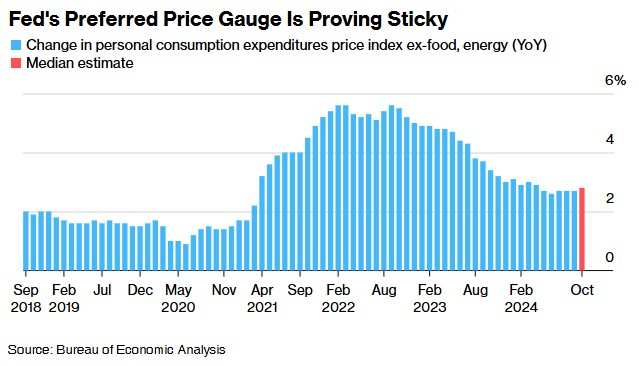

The inflation data favored by the Federal Reserve is expected to show stubborn price pressures and reinforce the Fed's cautious attitude towards future rate cuts.

Finance and Economics APP learned that the US October PCE price index data will be released on the evening of November 27 (Wednesday) Beijing time. This inflation data favored by the Federal Reserve is expected to show stubborn price pressures and strengthen the Fed's cautious attitude towards future rate cuts.

Currently, the market expects the US October PCE price index to increase by 2.3% year-on-year, higher than September's 2.1%; it is expected that the October core PCE price index excluding food and energy will increase by 2.8% year-on-year - this will be the largest year-on-year increase since April, and higher than the previous value of 2.7%, with a month-on-month increase of 0.2% - unchanged from the previous value.

At the same time, other data to be released on the same day is expected to show the resilience of consumer spending and stable income growth. The market currently expects that US personal spending will increase by 0.4% month-on-month in October, lower than the previous value of 0.5%; it is expected that US personal income will increase by 0.3% month-on-month in October, unchanged from the previous value.

At the same time, other data to be released on the same day is expected to show the resilience of consumer spending and stable income growth. The market currently expects that US personal spending will increase by 0.4% month-on-month in October, lower than the previous value of 0.5%; it is expected that US personal income will increase by 0.3% month-on-month in October, unchanged from the previous value.

Although Federal Reserve policymakers will receive US November CPI and PPI data before their policy meeting on December 17-18, they will not have received US November PCE data when discussing whether to cut interest rates.

Economists such as Anna Wong have stated: "Recent discussions by several Federal Reserve officials on the US economic conditions echo a theme proposed by Fed Chairman Powell recently - the rate cut in December is not set in stone. Given that economic risks are receding, the central bank can slow down its easing pace."

In addition to the October PCE, personal spending and income data, the economic data to be released on Wednesday will also include: the revised annualized real GDP growth rate for the third quarter in the USA, the initial value of the monthly rate of durable goods orders in October in the USA, and the initial claims for unemployment insurance in the USA for the week ending November 23rd.

Furthermore, the Federal Reserve will release the minutes of the November monetary policy meeting on November 27th, Beijing time. Investors will try to determine from these minutes the policymakers' intentions to cut interest rates next month. As of last Friday, market participants believed that the likelihood of the Federal Reserve cutting rates by 25 basis points next month is slightly higher than 50%.

与此同时,将于同一天公布的其他数据预计将显示出消费者支出的韧性和收入的稳定增长。市场目前预计,美国10月个人支出将环比增长0.4%,低于前值0.5%;预计美国10月个人收入将环比增长0.3%,与前值持平。

与此同时,将于同一天公布的其他数据预计将显示出消费者支出的韧性和收入的稳定增长。市场目前预计,美国10月个人支出将环比增长0.4%,低于前值0.5%;预计美国10月个人收入将环比增长0.3%,与前值持平。