信达证券称,A股牛市还在,但会通过震荡降速,因为当前居民资金流入强度不足以让指数快速突破。

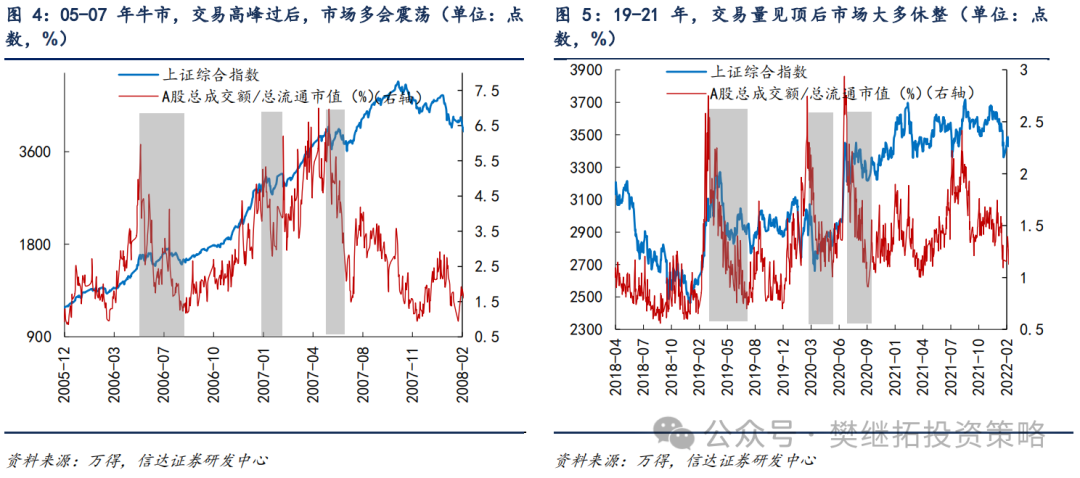

智通财经APP获悉,信达证券发布研究报告称,A股牛市还在,但会通过震荡降速,因为当前居民资金流入强度不足以让指数快速突破。牛市初期换手率下降后,震荡时间往往比牛市中后期更长,重点关注政策效果和行业盈利。建议配置顺序:金融地产(政策最受益)>传媒互联网&消费电子(成长股中的价值股)>上游周期(产能格局好+需求担心释放已经充分)> 出海(长期逻辑好,短期美国大选后政策空窗期)> 消费(超跌)。

近期市场有所调整,有少部分投资者担心牛市是否还在。信达证券认为,这一次熊牛转折,最重要的力量是来自股市政策驱动股权融资减少,带来股市供需格局的转变。2023年下半年开始,股权融资规模低于上市公司分红。历史上1995年、2005年、2013年,也出现过,随后不管经济是否改善,股市出现了较大级别的牛市。牛市的第二个力量是经济政策转变,关于这一点,信达证券认为方向比短期结果更重要。美国次贷危机后,房价持续下降了6年,但股市的熊市时间很短,主要是因为从2008年底开始,美联储开启了量化宽松。短期来看,第一个力量没有问题,第二个变量略有分歧,但方向性问题依然不大。市场震荡休整,本质上可能是很多短期博弈性资金的降温。之前的历轮牛市中,短期换手率过快的回升过后,往往股市都会出现季度级别的震荡休整,牛市初期休整的时间往往更久。不过由于长期资金和政策方向的转变,指数的中枢很难跌回原点。

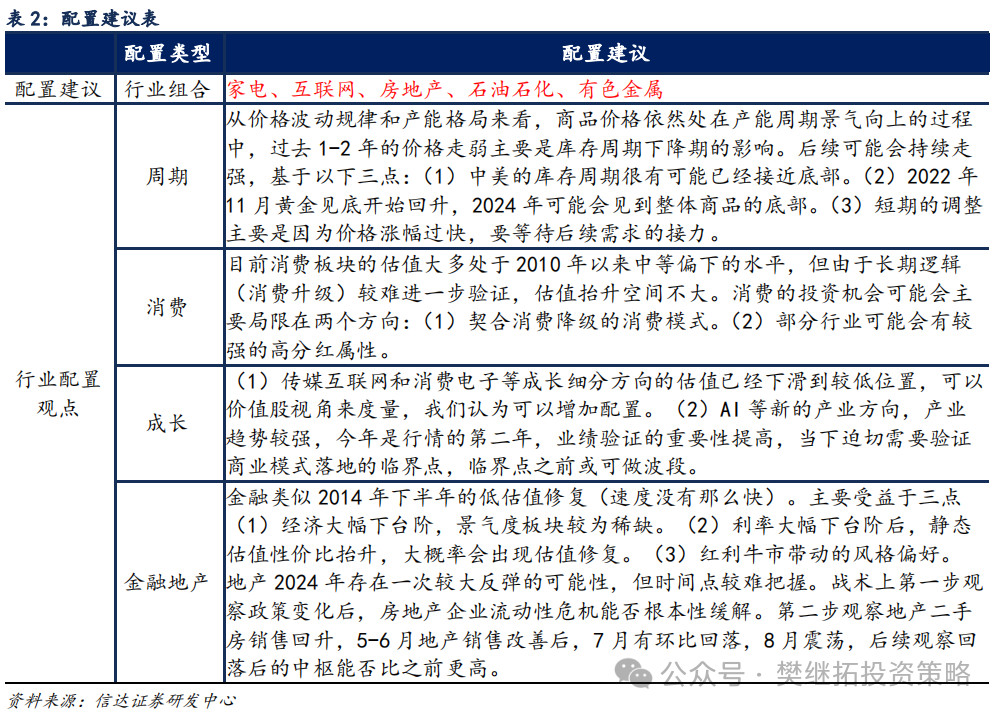

(1)牛市最重要的力量:股市政策驱动股权融资减少,股市的供需格局转变。近期市场有所调整,有少部分投资者担心牛市是否还在。信达证券认为这一次熊牛转折,背后有两大力量,最重要的力量是来自股市政策驱动股权融资减少,带来股市供需格局的转变。A股的投资者结构中,其实最重要的是上市公司和大股东的力量,历史上大部分时候,A股都是融资市(融资规模大于分红),但少部分时候,也出现过股权融资规模低于上市公司分红。分别是1995年、2005年、2013年,这几次过后,不管经济是否改善,股市都会出现较大级别的牛市。2023 年下半年以来,随着股市政策驱动股权融资减少,股市的供需格局转变,信达证券认为这是牛市最重要的力量。而且可以预见的是,短期内股权融资规模尚难快速回升。

(1)牛市最重要的力量:股市政策驱动股权融资减少,股市的供需格局转变。近期市场有所调整,有少部分投资者担心牛市是否还在。信达证券认为这一次熊牛转折,背后有两大力量,最重要的力量是来自股市政策驱动股权融资减少,带来股市供需格局的转变。A股的投资者结构中,其实最重要的是上市公司和大股东的力量,历史上大部分时候,A股都是融资市(融资规模大于分红),但少部分时候,也出现过股权融资规模低于上市公司分红。分别是1995年、2005年、2013年,这几次过后,不管经济是否改善,股市都会出现较大级别的牛市。2023 年下半年以来,随着股市政策驱动股权融资减少,股市的供需格局转变,信达证券认为这是牛市最重要的力量。而且可以预见的是,短期内股权融资规模尚难快速回升。

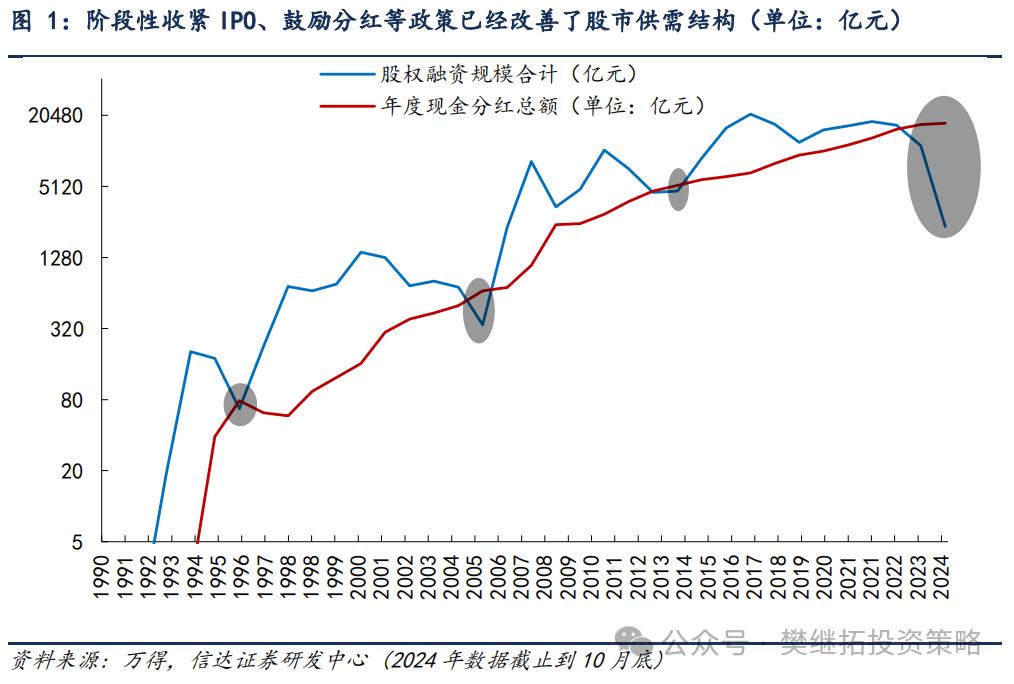

(2)牛市的第二个力量:经济政策对冲房地产风险。二级市场投资者关注更多的是经济政策,特别是房地产政策和财政政策。关于这一点,信达证券认为方向比短期结果更重要。美国次贷危机后,房价持续下降了6年,但股市的熊市时间很短,主要是因为从2008年底开始,美联储开启了量化宽松,第一次量化宽松(QE1)后,经济依然偏弱,后续还有QE2、QE3,直到2014年量化宽松才停止,但股市的反转在QE1后就开始了。

国内2014-2015年的货币宽松和房地产棚改政策也是类似的,确认经济企稳回升是在2016年之后,但股市牛市已经在政策全面转向的2014年下半年就展开了。所以当下来看,9月的政策拐点,方向上也标志着熊市的结束,短期效果和力度如何只会影响节奏。

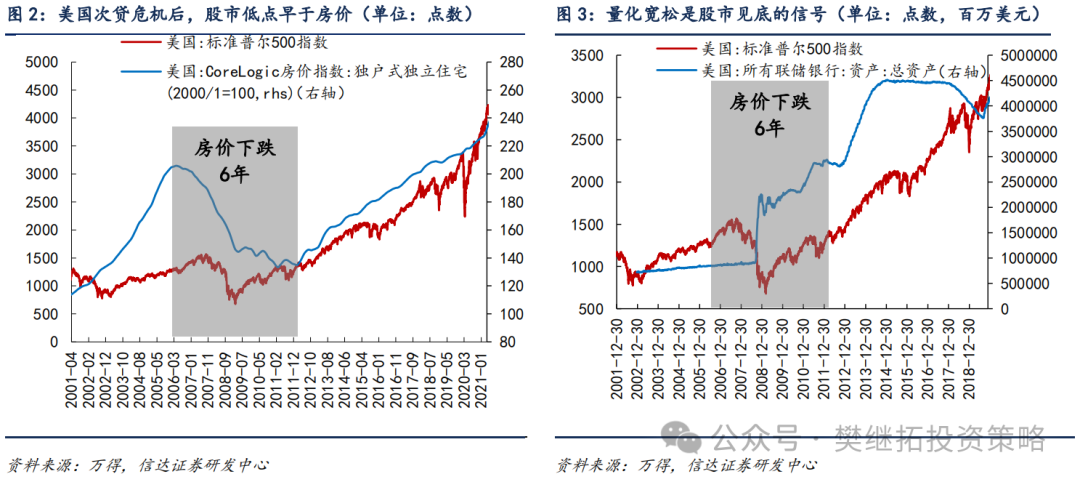

(3)交易量是由短期资金决定的,过高的交易量大多是阶段性高点的标志。最近的调整,信达证券认为表面上是投资者对政策预期和效果的分歧,但本质上可能是很多博弈性短期资金热情过高后的降温。之前的历轮牛市中,短期换手率过快的回升过后,往往股市都会出现季度级别的震荡休整。如果以换手率来看,牛市中后期虽然指数会比牛市初期高很多,但股市整体换手率并不会持续抬升。比如2006-2007年牛市中,2006年5月、2007年1月、2007年5月,三个换手率的高点相差不大,但指数点位越来越高。2019-2021年牛市中,2019年3月、2020年2月、2020年月,三个换手率高点也相差不大。信达证券认为背后很重要的原因是,短期交易性资金对交易量影响更大,长期增量资金对指数中枢影响更大。当短期资金和长期资金形成合力,股市交易量会快速回升,随后,随着短期资金减仓,交易量下降,但由于长期资金的托底,指数不会完全跌回去。如此多次,在换手率没有持续增长的情况下,指数高点多会持续上涨。

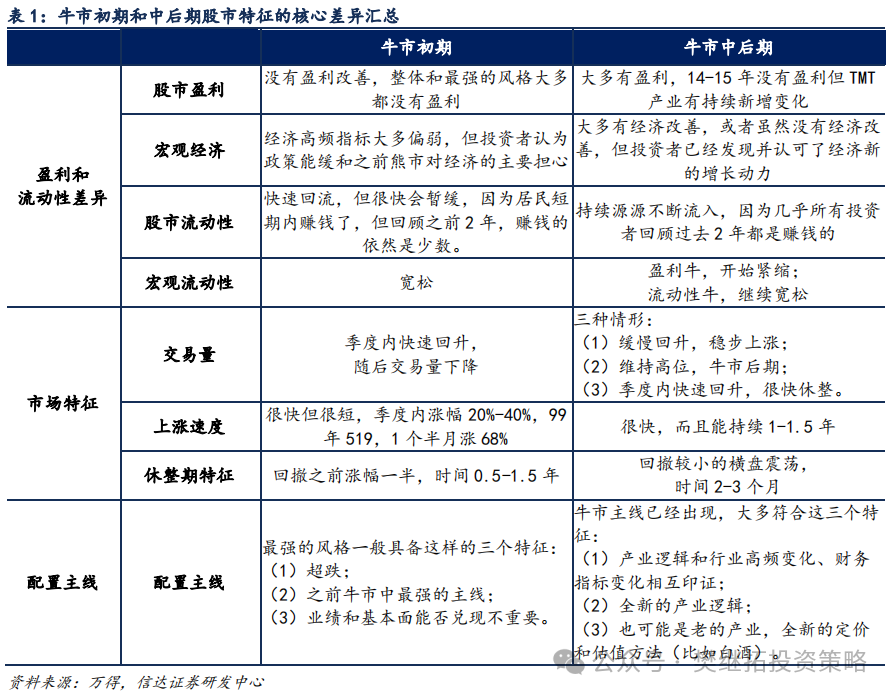

牛市初期换手率下降后,震荡时间往往比牛市中后期更长,重点关注政策效果和行业盈利。一般来说,不管一轮牛市有没有盈利支持,牛市初期大多是没有盈利支撑的,整个市场和大部分行业的上涨都是以估值抬升为主。如果以市场上涨的速度和交易量回升的速度来看,上涨期间牛市初期和牛市中后期差异不大,都会是快速放量上涨。主要差异会表现在交易量下降后,牛市初期震荡休整的时间更长,而牛市中后期交易量下降期,市场震荡休整的时间和幅度均会较小。

(4)短期A股策略观点:牛市还在,但会通过震荡降速,因为当前居民资金流入强度不足以让指数快速突破。随着股市供需结构的变化,特别是居民热情的回升,股市大概率已经进入牛市。但这一次牛市的速度可能很难维持之前那么快,因为居民资金流入的速度并没有2014-2015年那么快:(1)最近1个月的融资余额,表现确实比指数强很多,但如果把9-10月加在一起来看,融资余额回升幅度和指数涨幅差别不大,这比2014-2015年居民资金加杠杆流入时慢很多。(2)个人投资者开户数9-10月暴涨,单月开户数已经快接近2015年高点。但如果观察百度股票开户搜索指数,能够看到10月下旬开始,开户热度明显下降。(3)与2014-2015年牛市不同的是,这一次居民资金大幅申购ETF,ETF规模已经和主动产品规模相当。不过从增长速度来看,ETF增长虽然快,但并没有2020年公募主动权益产品规模增长的那么快。

建议配置顺序:金融地产(政策最受益)>传媒互联网&消费电子(成长股中的价值股)>上游周期(产能格局好+需求担心释放已经充分)> 出海(长期逻辑好,短期美国大选后政策空窗期)> 消费(超跌)。10月的市场风格分化很大,交易性资金非常活跃,但机构相关重仓个股表现较弱。如果以低价股和业绩预亏指数来看,10月下旬到11月上旬超额收益大幅上行。参考2019-2021年牛市期间,低价股和业绩预亏指数超额收益与市场的关系,能够发现,2019年2-4月、2020年7-9月、2021年7-9月,低位亏损个股的表现均强于指数。这三个阶段均是指数一波季度上涨的后期末期至震荡休整初期。所以信达证券认为在牛市中,低位亏损个股表现较强,可能是一个季度上涨波段后期,市场可能很快或正在震荡休整的标志,市场风格可能很快会由游资风格变为机构风格。