It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like United Overseas Bank (SGX:U11). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

United Overseas Bank's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years United Overseas Bank grew its EPS by 17% per year. That growth rate is fairly good, assuming the company can keep it up.

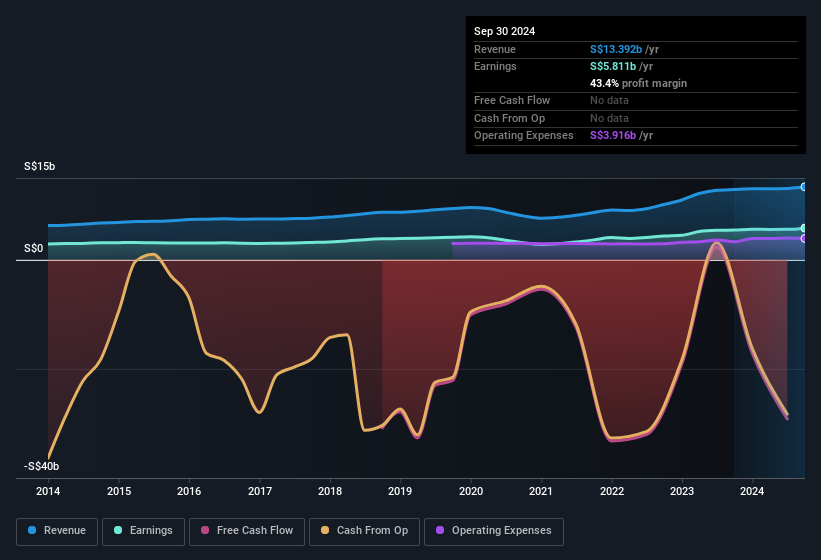

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that United Overseas Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note United Overseas Bank achieved similar EBIT margins to last year, revenue grew by a solid 3.8% to S$13b. That's encouraging news for the company!

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that United Overseas Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note United Overseas Bank achieved similar EBIT margins to last year, revenue grew by a solid 3.8% to S$13b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for United Overseas Bank's future profits.

Are United Overseas Bank Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for United Overseas Bank is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. Indeed, Deputy Chairman & CEO Ee Cheong Wee has accumulated shares over the last year, paying a total of S$2.8m at an average price of about S$28.50. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

Along with the insider buying, another encouraging sign for United Overseas Bank is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth S$3.3b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add United Overseas Bank To Your Watchlist?

One important encouraging feature of United Overseas Bank is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. Before you take the next step you should know about the 1 warning sign for United Overseas Bank that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of United Overseas Bank, you'll probably love this curated collection of companies in SG that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.