Due to the ageing population, health awareness, and consumer spending.

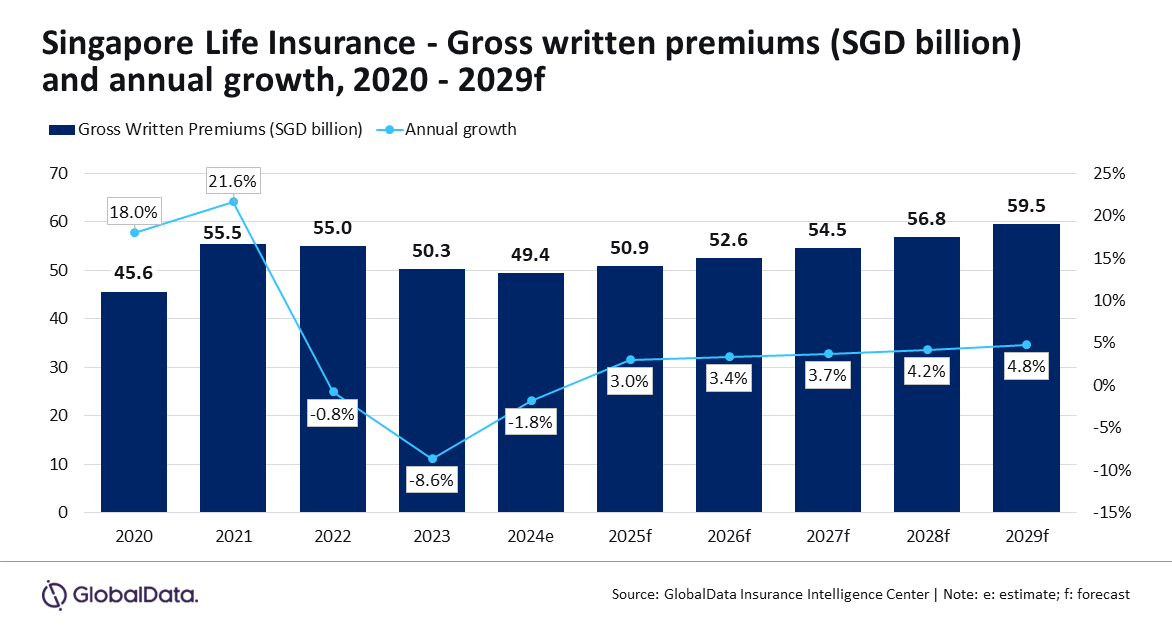

The life insurance sector in Singapore is forecast to bag $43.6b in gross written premiums (GWP) by 2029, possibly recording a compound annual growth rate (CAGR) of 4.0% beginning 2025, according to GlobalData.

This growth is expected to be driven by an ageing population, increased health awareness, and a rebound in consumer spending.

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.

"The industry is expected to gain momentum in 2025, supported by changing demographics and increasing health awareness that will drive the demand for personal accident and health (PA&H), and whole life insurance policies," analyst from GlobalData, Manogna Vangari, said in the report.

Whole life insurance is the largest segment, accounting for an estimated 44.0% of GWP in 2024.

Although demand is expected to decline by 4.1% in 2024 due to inflation and rising interest rates, the segment is predicted to rebound with a 2.1% growth in 2025 and achieve a 3.1% CAGR over 2025 to 2029.

This growth will be supported by Singapore's ageing population, which is projected to make up 18.0% of the total population by 2030.

Endowment insurance, the second-largest segment, is expected to account for 32.8% of GWP in 2024 and grow at a 3.7% CAGR through 2029, driven by rising interest rates and a shift toward wealth-focused products.

PA&H insurance, which is projected to hold a 14.2% market share in 2024, is expected to grow at a CAGR of 6.6% over the same period due to increasing healthcare costs and heightened health awareness.

The remaining 8.9% of the market in 2024 will comprise term life, general annuity, and other insurance products.

"The life insurance industry growth in Singapore is largely attributed to demographic shifts, bolstering demand for life and health insurance products, particularly amongst an increasingly affluent population," Vangari said.

"The development of products tailored to the needs of the rapidly ageing demographic is expected to be a significant area of focus for the insurers over the next five years," concluded Vangari.

人口の高齢化、健康意識、消費者支出のせいで。

GlobalDataによると、シンガポールの生命保険セクターは、2029年までに総保険料(GWP)が436億ドルに達すると予測されており、2025年以降、複合年間成長率(CAGR)が4.0%に達する可能性があります。

この成長は、人口の高齢化、健康意識の高まり、消費者支出の回復によって推進されると予想されます。

このセクターは、世界経済の不確実性、インフレ、不安定な市場による2024年の減少から回復し、2025年には3.0%拡大すると予測されています。

このセクターは、世界経済の不確実性、インフレ、不安定な市場による2024年の減少から回復し、2025年には3.0%拡大すると予測されています。

GlobalDataのアナリスト、マノーニャ・ヴァンガリはレポートの中で、「人口動態の変化と健康意識の高まりに支えられて、この業界は2025年に勢いを増すと予想されています。これにより、個人事故と健康(PA&H)、終身保険の需要が高まるでしょう」とレポートで述べています。

終身保険は最大のセグメントで、2024年にはGWPの44.0%を占めると推定されています。

インフレと金利上昇により、需要は2024年に4.1%減少すると予想されていますが、このセグメントは2025年には2.1%の成長で回復し、2025年から2029年にかけて3.1%のCAGRを達成すると予測されています。

この成長は、2030年までに総人口の 18.0% を占めると予測されているシンガポールの高齢化によって支えられます。

2番目に大きいセグメントである寄付保険は、金利の上昇と富に焦点を当てた商品への移行により、2024年にはGWPの32.8%を占め、2029年までに3.7%のCAGRで成長すると予想されています。

PA&H保険は、2024年に14.2%の市場シェアを占めると予測されていますが、医療費の増加と健康意識の高まりにより、同時期に6.6%のCAGRで成長すると予想されています。

2024年の市場の残り8.9%は、定期生金、一般年金、その他の保険商品で構成されます。

「シンガポールの生命保険業界の成長は、主に人口動態の変化によるもので、特にますます豊かになる人口の間で、生命保険と健康保険商品の需要が高まっています」とヴァンガリ氏は言います。

「急速に高齢化する人口動態のニーズに合わせた商品の開発は、今後5年間で保険会社にとって重要な重点分野になると予想されます」とVangari氏は結論付けました。

このセクターは、世界経済の不確実性、インフレ、不安定な市場による2024年の減少から回復し、2025年には3.0%拡大すると予測されています。

このセクターは、世界経済の不確実性、インフレ、不安定な市場による2024年の減少から回復し、2025年には3.0%拡大すると予測されています。

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.

The sector is forecast to expand by 3.0% in 2025, recovering from a decline in 2024 attributed to global economic uncertainty, inflation, and volatile markets.