Bank of America believes that the market focus has entered the second phase of transactions benefiting from AI — software stocks and Agentic AI. With the arrival of the “AI moment” of software, its monetization is expected to begin in 2025, and become meaningful in 2026 as corporate adoption accelerates.

Currently, there are doubts about the slowdown in AI innovation in the market, but Bank of America believes that AI technology transformation is actually accelerating, and the market focus has already entered the second stage of the transaction — software stocks and AI agent Agentic AI.

Bank of America stated in its November 21 report:

AI technology is developing rapidly, and new breakthroughs are being made almost every day. AI has a wide range of capabilities, including completing software engineering tasks, providing customer service, booking trips, and even for precision surgery or vehicle assembly. The Agentic AI wave will catalyze the accelerated development and deployment of AI-driven applications, as well as industrial and commercial robots.

Bank of America further pointed out that with the popularity of AI applications, the market focus has also shifted to the second phase of AI beneficiaries:

Don't underestimate the short-term disruptive potential of AI at this stage. The entire AI investment sector, especially software stocks, is unlikely to be fully priced in the market. With the arrival of the software “AI moment”, AI monetization is expected to begin in 2025 and become meaningful in 2026 as enterprise adoption accelerates.

From knowledge workers to manual workers, AI applications continue to expand

Specifically, Bank of America notes that AI applications continue to flourish:

New, disruptive AI capabilities seem to be appearing at a weekly or even daily rate, and AI capabilities are developing so fast that AI agents may complete end-to-end software engineering tasks. We anticipate that the latest wave of Agentic AI will catalyze the accelerated development and deployment of AI-driven applications, as well as industrial and commercial robots, which could transform the global economy sooner than investors expected.

Bank of America said that advances in AI proxy technology have not only improved existing tools, but also spawned new applications.

What AI software is currently showing is just the tip of the iceberg of future possibilities. Models from OpenAI and Anthropic have recently demonstrated doctoral-level abilities, and Mistral's new model excels at visual ability tasks. Microsoft and Google have also launched new products that enhance the AI agent function, Google Gemini AI launched a memory function to achieve personalization, Perplexity collaborated with Stripe to launch the Buy With Pro shopping platform, and even the benchmarks used to evaluate model performance are improving.

Bank of America emphasized that robots have broadened the scope of AI applications:

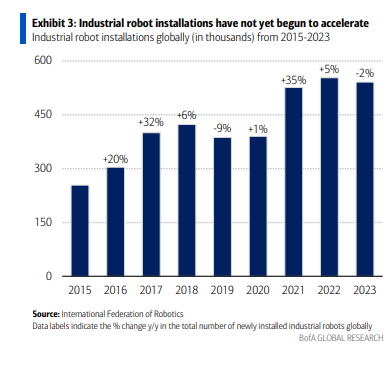

Emerging robotic capabilities may have a disruptive impact in various fields such as warehousing, catering, and construction. Although the growth in global industrial robot installations has yet to accelerate, it is expected that general robots will enter the market at a lower cost by 2026. Among them, China accounted for 51% of new installations and 41% of the share of operating robots in 2023.

Regarding the impact on the labor market, Bank of America stated:

Advances in AI technology are likely to affect a wide range of occupations, from knowledge workers to manual workers. Although large-scale AI-driven labor replacement is unlikely to occur in the short term, competition will become increasingly intense as AI agents and robots become more popular. Proxy AI could fill the 10 million global health worker shortage by 2030.

Investors' focus shifts to the second phase of AI

Bank of America further pointed out that with the popularity of AI applications, the market focus has also shifted to the second phase of AI benefits:

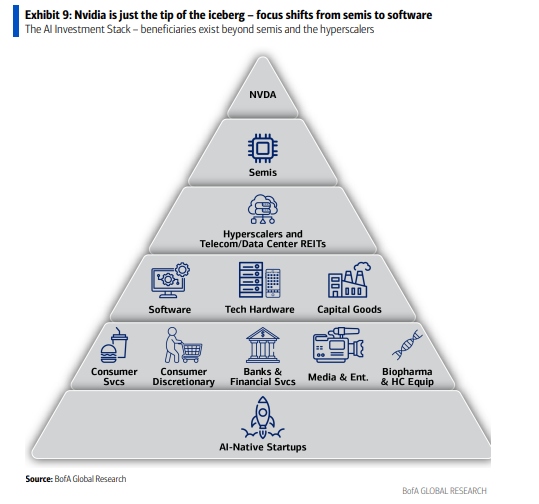

More than semiconductor companies and large cloud service providers, S&P Index companies are increasingly referring to AI in earnings reports and conferences. As enterprise AI adoption increases in 2025 and accelerates in 2026, the next year's focus will shift to the second phase of AI beneficiaries, particularly software companies. Due to its layout on Agentic AI, Bank of America favors large companies such as Microsoft, Salesforce, and Adobe, while small to medium market capitalization companies such as NICE, Informatica, and Zeta are also seen as potential target companies.

Bank of America has listed the three stages of development where AI benefits:

Phase 1: AI beneficiaries are expected to expand from Nvidia to the broader semiconductor sector and cloud service providers (CSPs), which include large cloud service providers, as well as data center real estate investment trusts (REITs) within the communications sector.

Phase 2: Beneficiaries may expand to software companies that produce AI-driven applications, as well as technology hardware and capital goods companies that produce data center infrastructure, such as servers, networking equipment, and electrical and air conditioning equipment.

Phase 3: Beneficiaries may expand to companies integrating AI products and services, such as consumer service companies such as restaurants, retailers, non-essential consumer goods companies such as banks and financial services companies, media and entertainment companies, and biopharmaceuticals and medical device companies.

AI技术快速发展,几乎每天都有新的突破。AI能力范围广泛,包括完成软件工程任务、提供客户服务、预订旅行,甚至可以用于精密手术或车辆组装等。Agentic AI浪潮将催化加速开发和部署AI驱动的应用程序,以及工业和商业机器人。

AI技术快速发展,几乎每天都有新的突破。AI能力范围广泛,包括完成软件工程任务、提供客户服务、预订旅行,甚至可以用于精密手术或车辆组装等。Agentic AI浪潮将催化加速开发和部署AI驱动的应用程序,以及工业和商业机器人。