① In two-dimensional culture, millet refers to peripheral products such as animation and games. The millet economy is a form of consumer economy dominated by young people; ② The core link in the industrial chain is IP development and operation, and the popularity of IP is directly related to the sales volume of peripheral products.

“Science and Technology Innovation Board Daily”, November 25 (Editor Song Ziqiao) On November 25, the A-share “millet economy” concept rose strongly. Shifeng Culture and Guangbo Co., Ltd. both rose and stopped, and both ushered in 4 consecutive boards. Furthermore, concept stocks such as Xinghui Entertainment, Jinyun Laser, and Huali Technology rose and stopped 20 centimeters, Aofei Entertainment rose and stopped by 10 centimeters, and concept stocks such as Deyi Culture and Innovation, Jinghua Laser, and Park Xinglong soared.

Terms such as millet, barbeque, and pain pack come from two-dimensional culture. Millet is a product derived from content IP (intellectual property rights). These products can be content products such as novels, anime, TV series, etc., or game products. Simply put, they refer to peripheral products such as anime, games, etc., and originated from the English word “goods” (goods). Since the pronunciation (goods) in Japanese is similar to “millet,” it is widely used by Chinese two-dimensional enthusiasts to refer to peripheral products.

Millet includes various types of products, and barbeque is one of them. It specifically refers to badges (derived from the Japanese word “badge,” which sounds similar to the Chinese word “bar”, and is also the Chinese empty word for English badge). Other millet also include peripheral products such as posters, cards, pendants, stands, figures, and dolls. A pain bag is a bag full of anime character badges, dolls, etc.

Millet includes various types of products, and barbeque is one of them. It specifically refers to badges (derived from the Japanese word “badge,” which sounds similar to the Chinese word “bar”, and is also the Chinese empty word for English badge). Other millet also include peripheral products such as posters, cards, pendants, stands, figures, and dolls. A pain bag is a bag full of anime character badges, dolls, etc.

Generally speaking, the millet economy is a form of consumption economy dominated by young people. The above company is known as Millet Economic Concept Stock because its business involves licensing, production, and sales of animation and game IP.

Why are “millet economy” concept stocks strengthening?

Regarding the millet economy, Bubble Mart has set a good example.

Bubble Mart focuses on the creation of independent IPs and channel construction. Its products cover various forms such as blind boxes, figures, and BJD (spherical joint figures). The blind box is Bubble Mart's iconic product, and it has now incubated and operated many well-known IPs such as MOLLY, SKULLPANDA, and DIMOO.

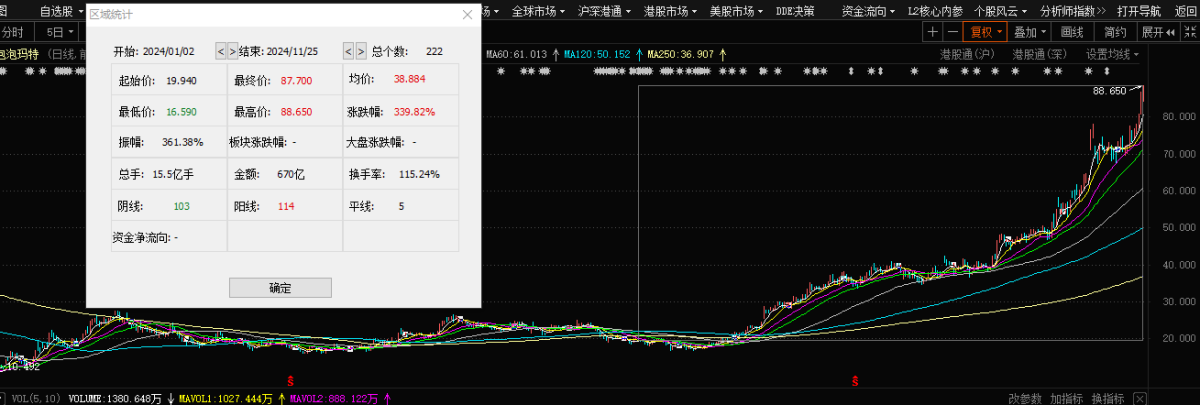

Supported by rapid growth in business performance in the third quarter of this year, Bubble Mart's stock price continued to strengthen. On November 25, Bubble Mart (09992.HK)'s increase once extended to nearly 6%, and the stock price hit a new high since March 2021. The stock has risen more than 3.3 times since the beginning of the year.

According to the third quarter results data, Bubble Mart's overall revenue increased 120% to 125% compared to 2023. Among them, revenue within China increased 55% to 60% year over year, and revenue from Hong Kong, Macao, Taiwan and overseas increased 440% to 445% year over year. Judging from the growth rate, Bubble Mart has surpassed market expectations for several consecutive quarters, and the four-fold increase in overseas markets in the third quarter has dazzled many eyes.

According to data from the Forward-looking Industry Research Institute, in 2016-2023, the scale of China's quadratic industry grew from 18.9 billion yuan to 221.9 billion yuan, with a compound growth rate of 42%; among them, the scale of the peripheral derivatives industry grew from 5.3 billion yuan to 102.3 billion yuan, with a compound growth rate of 53%. Looking ahead, the scale of the two-dimensional industry is expected to grow from 221.9 billion yuan to 590 billion yuan in 2023-2029, with a compound growth rate of 18%.

According to the latest research report by Zheshang Securities, according to incomplete statistics, more than 60 core business districts in China are currently building two-dimensional consumer city landmarks one after another. In addition to Shanghai leading the way, there are at least 220 food stalls in Beijing, nearly 300 Gu stores in Guangzhou and Shenzhen. Chengdu, Chongqing, Wuhan, Zhengzhou, Xi'an, Nanjing, and Hangzhou have more than 170 millet stores, 140, 120, 100, 80, 80, 80, and 90, respectively.

The AI line behind “millet”

Bubble Mart is a model for the millet economy. Investors are anxious to find an A-share map of Bubble Mart. In addition to being optimistic about the two-dimensional culture and the growth potential and consumption boom in the surrounding commodity market, it is also related to the AI line hidden behind “millet” — the millet economy is one of AIGC's important application scenarios.

Today, the role of AI technology in the millet economy is becoming more and more prominent. It plays an important role in product design, marketing, IP licensing, etc., mainly reflected in the following aspects:

Platform innovation: Bubble Mart has developed a fully self-developed AI integration platform “HeyLisa”. HeyLisa integrates multiple large natural language models and advanced AI voice models, supports custom agent functions, and realizes seamless connection between AI and enterprise business APIs, with the aim of helping enterprises reduce new product development costs and improve efficiency.

Product innovation: AI toys are becoming a trend in the toy industry. Millet includes and is not limited to products such as dolls, models, and music boxes. After connecting to AI, Millet products are more interactive and are expected to attract more consumers.

AI stimulates creativity: AI is expected to help enterprises achieve efficient content production and reduce creative costs. For example, through AI technology, enterprises can quickly generate IP-related design drawings, accelerate the process of products from design to market, and enhance the commercial value of IP.

The core of the industrial chain: IP development and operation

Millet Economy emphasizes IP licensing and operation capabilities, supply chain capabilities, and channel consumer reach. Its industrial chain mainly includes IP creation and licensing, product development and design, and channel sales.

The most important part is IP development and operation. The popularity of IP is directly related to the sales volume of peripheral products. According to some data, Miha's “Genshin” “Bar” of the e-commerce platform's flagship store alone sold more than 0.1 million or 0.3 million pieces, and the single store sold more than 5 million units; tinplate badges sold during the birthday of a protagonist in the popular game “Love and Deep Space” had a unit price of 18 yuan. The unit price of the first 0.3 million used inventory on the e-commerce platform's official flagship store was all sold out within 30 seconds, and it also boosted sales of 1 million within a few hours of replenishment; it also boosted sales volume by 1 million. millet It spread rapidly. On a second-hand trading platform, two acrylic tiles from the anime “Volleyball Boy” were auctioned for 0.083 million yuan.

Zheshang Securities divides companies within the industry into two categories:

1) Upstream and midstream operating companies: Close integration with the IP industry chain to become an important participant in IP derivative development to provide consumers with more differentiated IP experiences, so they can stand out from the fierce competition.

2) Downstream retailers: Currently, domestic two-dimensional related retail channels include millet stores, miscellaneous goods, stationery and gift stores, Japanese retail stores, card stores, and “two-dimensional plus traditional stores.”

The agency said that high-profile millet store chains generally rely on upstream IP resources, are growing rapidly, have strong explosiveness, and are in the phase of speeding up store opening. Currently, companies or brands with a wide range of retail channels are expected to enjoy the industry beta in the early stages. In the medium to long term, core competitiveness will return to product development and product selection capabilities, and eventually settle down to differentiated product supply.

Debon Securities believes that the “millet economy” is based on the IP licensing and operational capabilities behind it, with supply chain capabilities as a guarantee, and channels as the key to reaching consumers. It is recommended to focus on leading targets with the ability of the entire industry chain and rapid dissemination of its IP.

According to comprehensive institutional research, these companies were established earlier:

(1) Guangbo Co., Ltd.: The current IP matrix includes but is not limited to: Hello Kitty, Kuromi, Big Eared Dog, Pacha Dog, Melody, Blanket Bear, Hanton the Half Mermaid, Detective Conan, Hatsune Miku, Tenguan Shifu, Master of Magic, Tomb Stealing Notes, etc., and game and animation IP reserves are being accelerated;

(2) Aofei Entertainment: It has multiple animation IPs such as “Bala La Little Magic” and “The Goat and the Grey Wolf”, and collaborates with well-known corporate brands around classic IPs;

(3) Chenguang Co., Ltd.: Many of its brands are involved in millet, producing brands such as “Strange”. In July 2023, Qizhuo and “Genshin” collaborated with “Genshin” to sell 6 peripheral products for the two game characters (“Tinary” and “Abedo”), including writing notebooks, storage bags, acrylic cards, tinplate badges, etc., and are sold through channels such as Jiumu Sundries.

谷子包括各种形式的商品,吧唧是其中的一种,专指徽章(来源于日语单词“バッジ”,与汉语“吧唧”发音相近,也是英语Badge的中文空耳),是“吃谷首选”,其他谷子还包括海报、卡片、挂件、立牌、手办、娃娃等周边商品。痛包则指挂满动漫人物徽章和玩偶等周边的包包。

谷子包括各种形式的商品,吧唧是其中的一种,专指徽章(来源于日语单词“バッジ”,与汉语“吧唧”发音相近,也是英语Badge的中文空耳),是“吃谷首选”,其他谷子还包括海报、卡片、挂件、立牌、手办、娃娃等周边商品。痛包则指挂满动漫人物徽章和玩偶等周边的包包。