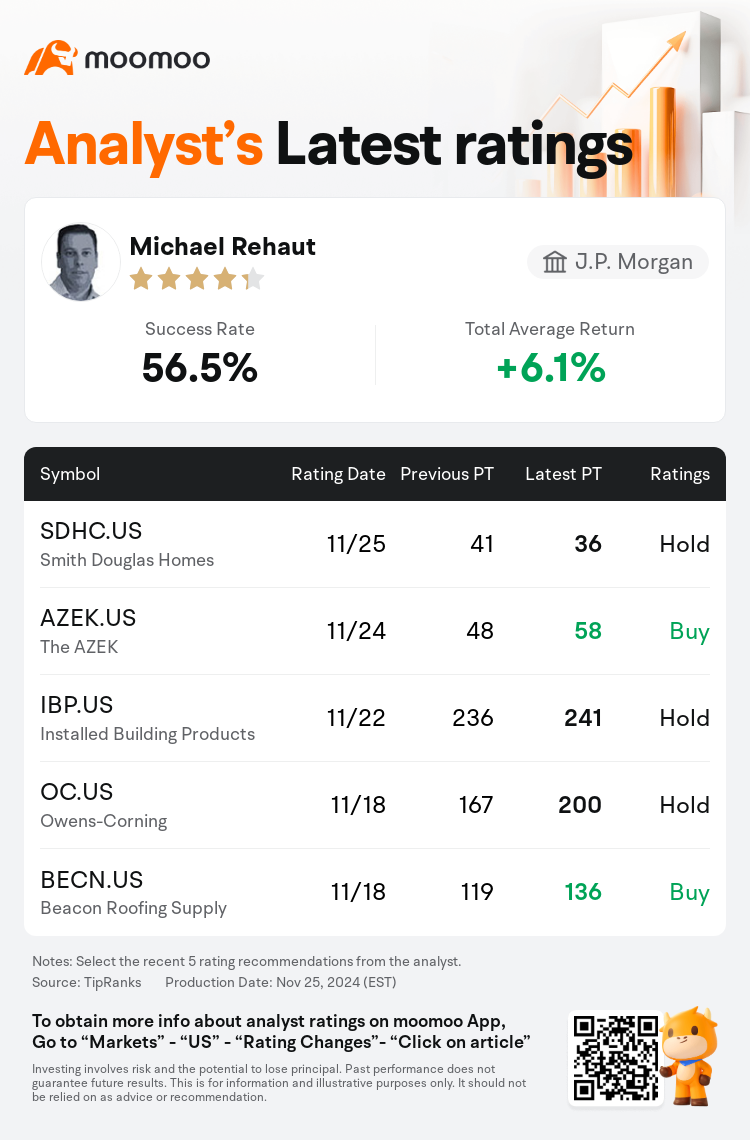

J.P. Morgan analyst Michael Rehaut maintains $The AZEK (AZEK.US)$ with a buy rating, and adjusts the target price from $48 to $58.

According to TipRanks data, the analyst has a success rate of 56.5% and a total average return of 6.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $The AZEK (AZEK.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $The AZEK (AZEK.US)$'s main analysts recently are as follows:

Following the fiscal Q4 report, it appears that the company's Q1 sales growth forecast of 10%-12% may be understated, not accounting for a potential $5M lift from recent distribution expansions. The firm is viewed positively, particularly for its robust leadership in the composite decking and rail sector. The current stock valuation might not adequately capture the company's accelerated growth in the composite decking arena and its fundamental outlook for the forthcoming two years.

The company is outperforming in areas such as growth, share gain, execution of channel inventory, and productivity. Notably, the firm's 'strong' guidance for 2025 is seen as becoming more conservative as the year progresses.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

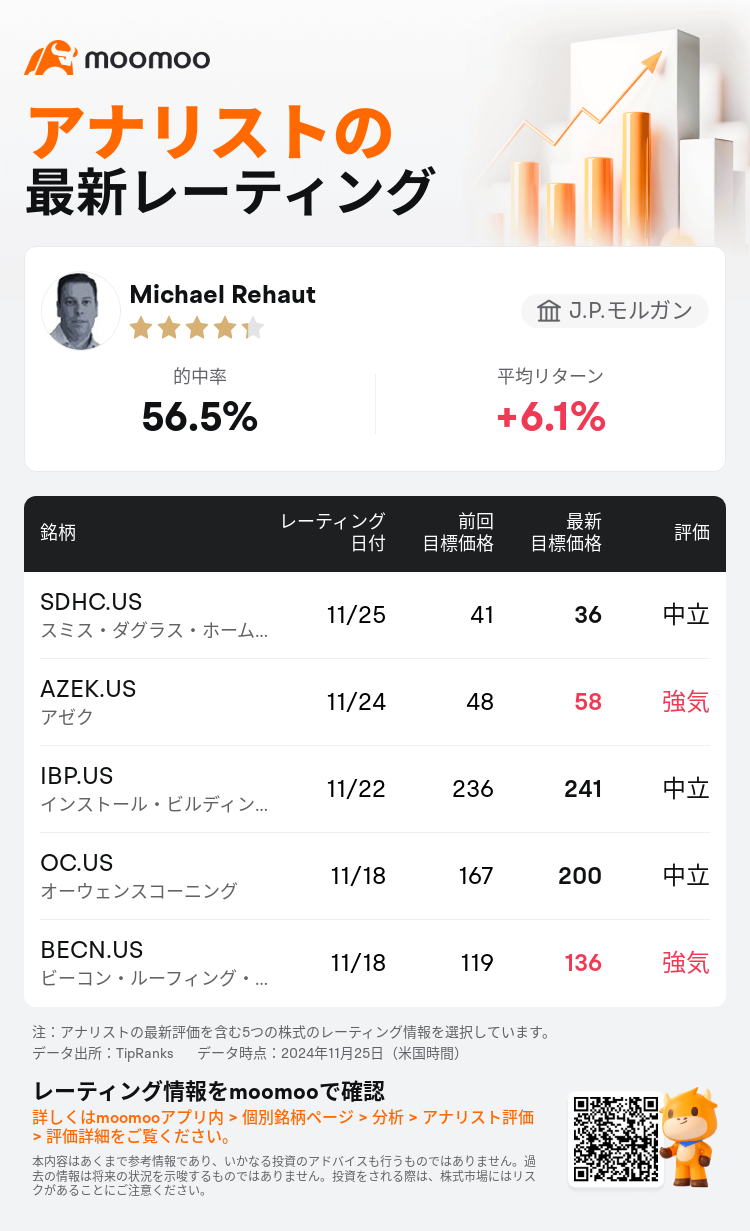

J.P.モルガンのアナリストMichael Rehautは$アゼク (AZEK.US)$のレーティングを強気に据え置き、目標株価を48ドルから58ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は56.5%、平均リターンは6.1%である。

また、$アゼク (AZEK.US)$の最近の主なアナリストの観点は以下の通りである:

また、$アゼク (AZEK.US)$の最近の主なアナリストの観点は以下の通りである:

第4四半期のレポートによると、同社の第1四半期の売上高成長予測は 10% ~ 12% と過小評価されているようです。これは、最近の流通拡大による500万ドルの増加の可能性を考慮していないためです。同社は、特に複合デッキと鉄道部門における確固たるリーダーシップで好評を博しています。現在の株価評価額は、複合デッキ分野における同社の加速する成長と、今後2年間の基本的な見通しを十分に捉えていない可能性があります。

同社は、成長、シェア?$#@$ン、チャネルインベントリの実行、生産性などの分野で優れた業績を上げています。特に、同社の2025年の「強い」ガイダンスは、年が進むにつれてより保守的になると見られています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$アゼク (AZEK.US)$の最近の主なアナリストの観点は以下の通りである:

また、$アゼク (AZEK.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of