The analyst team from ubs group has issued a warning regarding policies that may benefit the company; since the USA presidential election day, the stock price of this electric vehicle manufacturer has surged.

According to the Zhito Finance APP, the analyst team from international banking giant ubs group warned in a report that the stock price of electric vehicle leader Tesla (TSLA.US), led by the world's richest man Elon Musk, has skyrocketed after the USA presidential election, with the logic behind it driven almost entirely by the sentiment of the "animal spirit" of the US stock market, not by actual improvements in its business fundamentals. Although Tesla's stock price has recently surged over 40%, ubs remains firmly bearish on Tesla, reaffirming its most negative rating of "sell" for the stock, setting a target price of only $226. The ubs analyst team also warned about those policies that may benefit the company.

"Animal Spirits" is a term in economics and finance, originally introduced by economist John Maynard Keynes in his 1936 classic work "The General Theory of Employment, Interest and Money," in which Keynes described it as "the emotional and confidence factors of human beings in economic activities, specifically, the psychological drivers that push investment, consumption, and economic decisions," emphasizing that these drivers are often based on irrational factors. In modern economics, "animal spirit" is used to explain the "irrational factors" behind market fluctuations, economic cycles, and other phenomena, particularly when traditional economic models cannot fully account for them. For example, the phenomenon of short-term surges and falls in the stock market.

Since Donald Trump, fully supported by Musk, won the USA presidential election, there have been some potential proposals for electric vehicle policies that might be very beneficial for Tesla FSD (Full Self-Driving) and Robotaxi, but the ubs analyst team led by Joseph Spak wrote that these unrealized changes are not entirely positive for the company.

Since Donald Trump, fully supported by Musk, won the USA presidential election, there have been some potential proposals for electric vehicle policies that might be very beneficial for Tesla FSD (Full Self-Driving) and Robotaxi, but the ubs analyst team led by Joseph Spak wrote that these unrealized changes are not entirely positive for the company.

In just one week after Trump's victory, Tesla's stock price has fully broken through the long-elusive $300 mark. Since Trump announced his win in the USA presidential election, the company's stock price has risen more than 40%. As of last Friday's close of US stock trading, Tesla's stock price rose 3.8% to $352.560. Musk began pouring massive investments to support Trump after "King of Understanding" Trump was assassinated, and the globally richest person Musk has recently become "richer than ever." The top investment institution on Wall Street, Wedbush Securities, known for being a loyal fan of Tesla, has raised its 12-month target price for Tesla from $300 to $400 significantly following Trump's victory.

For investors bullish on Tesla's stock price and Musk's fans, Trump's return to the White House and his announcement that Musk will lead the "US Government Efficiency Department" will fundamentally change the narrative logic for Tesla and the companies under CEO Musk in the areas of ai, self-driving, and Tesla's ai supercomputing system in the coming years. They believe that for Musk's long-standing complaints about the "inefficiency of the federal government," and the regulatory challenges surrounding "Tesla FSD and Robotaxi that have yet to see progress," a quality change may occur with accelerated review.

However, the optimism surrounding the aforementioned expectations and the so-called Tesla "animal spirit" was dampened by the ubs under Spak's leadership. The analysts led by Spak wrote that, for example, the elimination of the sales tax exemption for purchasing electric vehicles might force Tesla to significantly reduce its prices. They also pointed out that although the regulatory environment under Trump's administration might be more favorable for cutting-edge technology companies, including FSD technology and self-driving cars, Tesla is still not prepared to utilize relaxed rules to launch its Robotaxi service network compared to competitors like Waymo.

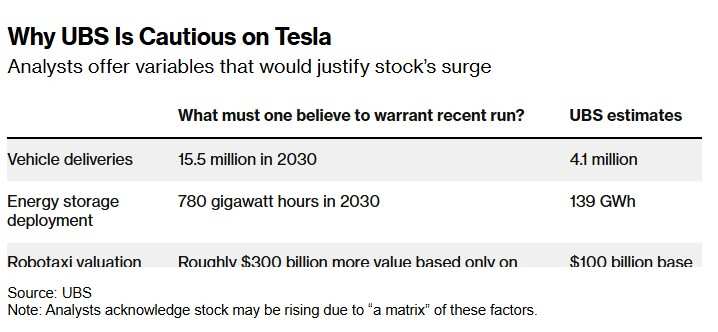

"The rise in Tesla's stock price is mainly driven by animal spirits and some technical momentum," wrote the analyst team led by ubs group in their report. They reiterated their "sell" rating for the stock in the latest research report but slightly raised their target price for Tesla from $197 to $226. The ubs group analyst team pointed out in the report that regarding the market's pricing of the expectation that the federal government may accelerate the approval of Robotaxi, ubs group expects this expectation to bring only a baseline market cap increase for Tesla of $100 billion, rather than the currently presented over $300 billion.

Tesla's stock price closed at $352.56 last week, and since election day, Tesla's market cap has increased by an astonishing over $350 billion, with Musk's wealth also surging alongside Tesla's stock price. In Monday's pre-market trading in the usa, "animal spirits" continued to drive Tesla's stock price, which rose 2.6% to $361.85.

尽管自马斯克本人全力支持的唐纳德·特朗普获得美国总统选举胜利以来,出现了一些可能非常有利于特斯拉FSD(完全自动驾驶)以及Robotaxi的电动汽车政策潜在提案,但以约瑟夫·斯帕克(Joseph Spak)为首的瑞银分析师们团队写道,这些未实际发生的变化对该公司来说并不完全是积极的。

尽管自马斯克本人全力支持的唐纳德·特朗普获得美国总统选举胜利以来,出现了一些可能非常有利于特斯拉FSD(完全自动驾驶)以及Robotaxi的电动汽车政策潜在提案,但以约瑟夫·斯帕克(Joseph Spak)为首的瑞银分析师们团队写道,这些未实际发生的变化对该公司来说并不完全是积极的。