①杭州銀行の最新の公告によれば、中国人寿の今回の保有の減少が完了し、累計で約77億元の減少資金が達成された。②今回の減少は総資本金の1.00%にあたる。元々の計画では減少割合は1.86%を超えない予定だったが、今後の追加の減持については未発表である。③本年度中に杭州銀行、齐鲁銀行、寧波銀行などの上場銀行が株主や役員の減持を公表しており、その理由は様々である。

財聯社11月25日の報道によると(記者:邹俊涛)、中国人寿の今回の杭州銀行の保有減少が3か月をかけて完了した。

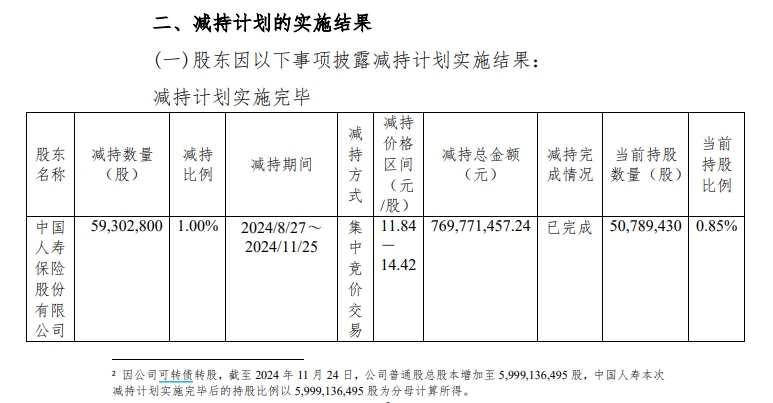

11月25日の夜、杭州銀行は公告を発表し、中国人寿から「杭州銀行株式減持計画実施状況に関する通知」を受け取ったと伝えた。2024年11月25日現在、中国人寿は集中競売方式で合計59,302,800株の同社株を減持し、これは今回の減持計画の実施前における同社普通株総資本金に対して1.00%にあたる。これにより、中国人寿の今回の減持計画は完了した。

公告によれば、中国人寿の今回の杭州銀行の保有減少に関わる資金は約77億元である。

公告によれば、中国人寿の今回の杭州銀行の保有減少に関わる資金は約77億元である。

財聯社の記者は、元々の計画では中国人寿は杭州銀行の株式を1.86%を超えない程度で減持することを予測していたことに注意を払った。今晩の公告によると、中国人寿は今回の減持が完了した後も杭州銀行の0.85%の株式を保有している(転換社債の株式転換による杭州銀行の普通株資本金の増加の影響を受けた)。杭州銀行の今晩の公告には、中国人寿が今後さらに減持するかどうかは未発表である。

さらに、財聯社の記者は、銀行株が高配当ゆえに市場で人気を集めているにも関わらず、本年度中には多くの上場銀行が株主による減持を受けたことに注意を払った。

元々の計画では「清算」する予定だったが、最終的に0.85%の株式を保持している。

2024年8月21日、杭州銀行は「杭州銀行股份有限公司5%以下株主減持計画公告」を公開し、中国人寿は減持計画公告の日から3営業日後の3か月以内に、集中競売または大宗取引方式で同社の株式を合計110,092,230株(本数を含む)減持する計画を立てている。これは同社普通株総資本金の1.86%を超えない。

その中で、集中競売方式で保有を減らす場合、任意の連続90日間に減らす株式の合計数は59,302,800株を超えず(つまり、会社の普通株資本金総額の1%を超えない);大口取引方式で減らす場合、任意の連続90日間に減らす株式の合計数は110,092,230株を超えない。この減持計画を実施する前に、中国人寿は会社の株式110,092,230株を保有しており、これは会社の普通株総資本金の1.86%に相当する。

今日の夜、杭州銀行は公告を発表し、中国人寿が2024年8月27日から2024年11月25日の間に集中競売方式で合計59,302,800株の会社株式を減持したことを発表した。これは、実施する前の会社の普通株総資本金の1.00%に相当する。減持した総金額は769,771,457.24元である。

公告によると、中国人寿の今回の減持はすでに完了している。2024年11月25日の市場閉鎖後、中国人寿は杭州銀行の株式50,789,430株を保有しており、現在の杭州銀行の普通株総資本金の0.85%に相当する。

年内に多くの上場銀行が株主または取締役会の上級管理職により保有を減らされた。

財連社の記者が注意を払ったところ、杭州銀行が中国人寿により保有を減らされたほか、年内に他の上場銀行も株主または取締役会の上級管理職により保有を減らされる事例があった。

10月23日、齐鲁銀行は公告を発表し、2024年10月22日現在、重慶華宇はこの減持計画を実施完了し、集中競売と大口取引方式で合計63,698,900株を減持した。これは会社の総資本金に対する比率が1.32%である。本次減持後、重慶華宇は194,438,142株を保有しており、会社の総資本金に対する比率が4.02%を占めている。

10月16日、宁波銀行は公告を発表し、会社の独立取締役である李浩から「宁波銀行股份有限公司株式減持計画に関する通知」が届いたと述べ、2024年11月7日から2025年2月6日の間に41,250株を超えない範囲で減持する意向を示した。これは会社の総資本金の0.0006%に相当する。

減持の理由について、杭州銀行は中国人寿が資産配置の必要性からであると明示した。齐鲁銀行は、株主重慶華宇が自らの発展の必要性からであると開示した。宁波銀行は、李浩が個人的な資金ニーズからであると開示した。

しかし、全体として見ると、銀行セクターは依然として保険資金の「重点注目」を受けています。最新の第3四半期報告によれば、保険資金の上位10銘柄の中で、銀行株が絶対的な主導的地位を占めており、中国民生銀行、浦発銀行、華夏銀行などが含まれています。粤開証券のリサーチレポートは、銀行株が保険資金などの低リスク志向資金が集まるシンボルとなっているのは、高配当という基本的特性に加え、価格変動レベルが低く、業績や配当がより安定しているためだと考えています。

公告显示,中国人寿本轮减持杭州银行涉及资金约7.7亿元。

公告显示,中国人寿本轮减持杭州银行涉及资金约7.7亿元。