Despite an already strong run, Triumph Group, Inc. (NYSE:TGI) shares have been powering on, with a gain of 32% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 76% in the last year.

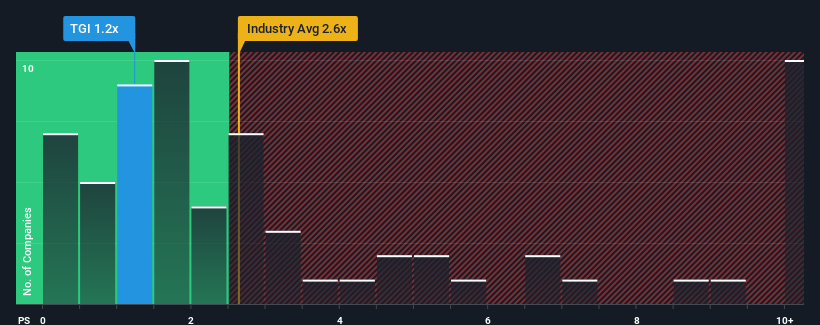

Although its price has surged higher, Triumph Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.2x, since almost half of all companies in the Aerospace & Defense industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Triumph Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Triumph Group has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Triumph Group.How Is Triumph Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Triumph Group's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Triumph Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.7% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 26% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 7.4% per annum as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.3% each year, which is noticeably less attractive.

With this information, we find it odd that Triumph Group is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Triumph Group's P/S Mean For Investors?

Despite Triumph Group's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Triumph Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Triumph Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.