Eastman Kodak Co. (NYSE:KODK) shares closed Monday's session up more than 18% after the company announced plans to terminate its U.S. pension program. Here's what you need to know.

What To Know: In a new regulatory filing, Kodak said the Kodak Retirement Income Plan Trust entered into a purchase and sale agreement with Mastercard Foundation in which Mastercard will purchase certain private equity ownership interests and other illiquid assets.

Kodak will sell the illiquid assets with a value of $764.4 million for a purchase price of $550.6 million in cash. Additional buyers will acquire $87.3 million in assets.

According to The Wall Street Journal, Kodak's pension plan is overfunded, with $3.5 billion in assets and $2.3 billion in liabilities. The termination process will involve selling illiquid assets, settling liabilities and replacing the plan with a new retirement program.

According to The Wall Street Journal, Kodak's pension plan is overfunded, with $3.5 billion in assets and $2.3 billion in liabilities. The termination process will involve selling illiquid assets, settling liabilities and replacing the plan with a new retirement program.

The termination is expected to result in a cash gain of $530 million to $585 million after taxes. Kodak plans to use these proceeds to reduce its $460 million in long-term debt, which includes a 12.5% term loan. Under its credit agreement, the company must reduce its debt balance to $200 million with proceeds of this size.

This move is aimed at improving Kodak's financial health, reducing interest expenses and investing in core business areas like pharmaceutical chemicals. The process is expected to take over a year and plan participants will retain the full value of their benefits through annuities or lump-sum payouts.

Kodak closed its latest quarter with $214 million in cash after reporting a quarterly profit of $18 million.

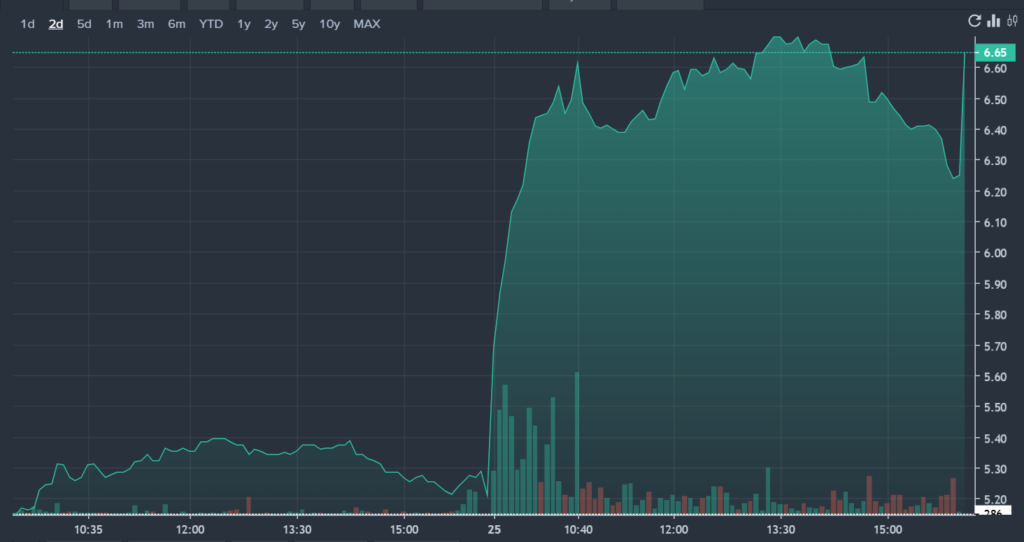

KODK Price Action: Eastman Kodak shares closed Monday at $6.24 after gaining 18.4% during regular trading hours, according to Benzinga Pro.

- Streaming, Vinyl Propel Music Copyright Value To $45.5 Billion

Photo: Gregor Mima from Pixabay.