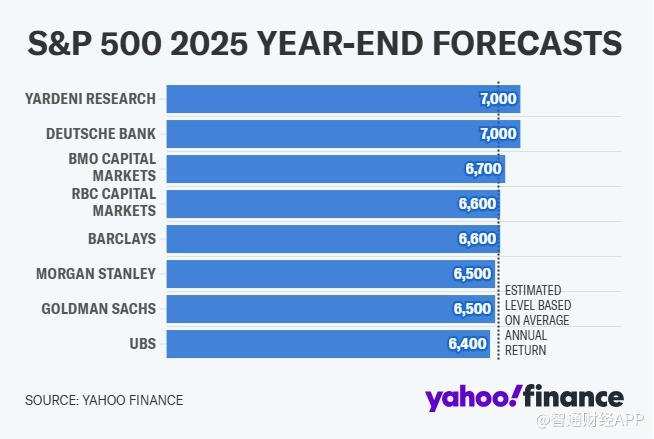

Barclays and RBC Capital Markets' equity strategy teams respectively forecast that the s&p 500 index will reach 6,600 points by the end of 2025.

According to Zhitong Finance APP, on Monday, Barclays and RBC Capital Markets' equity strategy teams respectively predicted that the s&p 500 index will reach 6,600 points by the end of 2025. This target implies that the benchmark index will increase by approximately 10.5% over the next 12 months, roughly in line with the long-term historical average annual return rate over the past century.

Lori Calvasina, head of US equity strategy at RBC Capital Markets, stated in a report to clients: "The data tells us that another year of solid economic and corporate profit growth, coupled with some political bullish signals and further alleviation of inflation (which will keep the s&p 500's pe high), will drive the stock market to continue rising next year."

Venu Krishna, head of US equity strategy at Barclays, believes that "as inflation continues to normalize, macroeconomic resilience strengthens, and large technology stocks maintain their leadership in eps growth, the s&p 500 index will continue to rise."

Venu Krishna, head of US equity strategy at Barclays, believes that "as inflation continues to normalize, macroeconomic resilience strengthens, and large technology stocks maintain their leadership in eps growth, the s&p 500 index will continue to rise."

The forecasts of the two institutions continue the overall optimism on Wall Street, suggesting that the stock market will continue to rise next year.

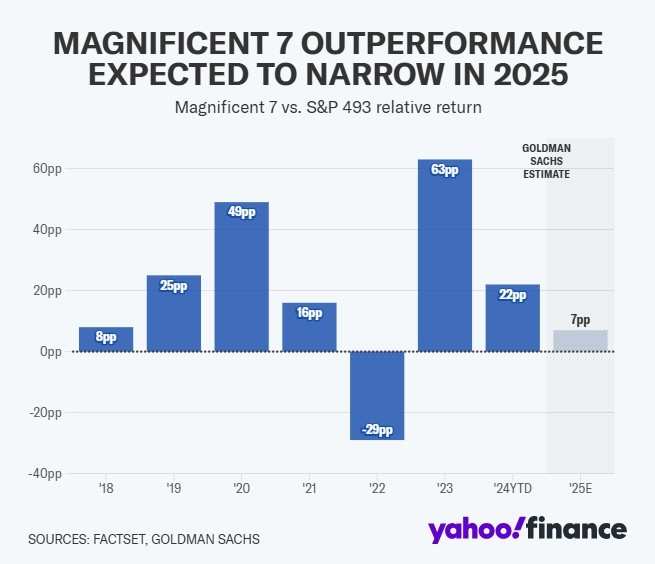

However, one of the most controversial questions regarding market performance in 2025 is whether the trend dominated by the 'seven giants' technology stocks will continue for the first 18 months of the bull market, or if profits will be more widely distributed across other sectors.

Calvasina believes that the diffusion of market leadership is most likely to occur, which aligns with goldman sachs' recent prediction that the performance advantage of large technology stocks will "narrow" by 2025. She noted that the current growth trade is too crowded, which may lead to more capital flowing towards the value stock sector. Additionally, compared to large technology stocks, other stocks have more attractive valuations. At the same time, earnings forecasts for 2025 indicate that earnings growth for large technology stocks will slow down, while earnings growth for the other 493 stocks in the s&p 500 index is expected to accelerate.

"In recent years, value stocks have needed slightly faster GDP growth to outperform," Calvasina said. She expects GDP growth in 2025 to fall between 2.1% and 3%, above bloomberg's current consensus forecast of 2%. "We tend to believe that the diffusion of market leadership or the shift towards value stocks will prevail, but this trend remains to be seen."

Meanwhile, Krishna pointed out that in the recent quarter, apple (AAPL.US), alphabet (GOOGL.US, GOOG.US), microsoft (MSFT.US), amazon (AMZN.US), meta (META.US), tesla (TSLA.US), and nvidia (NVDA.US) all exceeded Wall Street expectations, indicating that the market's expectations for earnings growth of large technology stocks in 2025 might still be insufficiently optimistic.

Krishna stated, "Large technology stocks may still play a significant role in the growth of eps for the s&p 500, just as they have this year." However, whether this will directly translate into stock price increases remains uncertain. "The past two earnings seasons have shown that merely exceeding EPS expectations may not be enough to drive stock prices higher, due to market concerns about the capital intensity that the next phase of growth (such as AI construction) might bring."

Nevertheless, Wall Street's forecasts for rising stock markets are also accompanied by certain warnings.

RBC's Calvasina warned that as the s&p 500 index rises to 6,600 points by the end of 2025, there is a higher likelihood of a 5%-10% correction in the short term. "We are increasingly worried that the s&p 500 may experience a 5%-10% correction in the short term, primarily due to current market positioning being too high, investor sentiment being overly heated, and the valuation levels for 2024 seeming somewhat high, making the s&p 500 more sensitive to negative news; perhaps it just needs a breather."

Additionally, Calvasina is closely monitoring potential adverse factors such as further rises in the yield of 10-year US Treasury bonds, the Federal Reserve's adjustments to interest rate cut expectations for 2025, and the strengthening of the US dollar.

Overall, despite the risk of a pullback, analysts generally believe that the bull market in the usa stocks will continue in 2025.

巴克莱美国股票策略主管Venu Krishna则认为,“随着通胀继续正常化,宏观经济韧性增强,以及大型科技股保持每股收益(EPS)增长的领导地位”,标普500指数将继续上行。

巴克莱美国股票策略主管Venu Krishna则认为,“随着通胀继续正常化,宏观经济韧性增强,以及大型科技股保持每股收益(EPS)增长的领导地位”,标普500指数将继续上行。