Despite an already strong run, Henan Huaying Agricultural Development Co., Ltd. (SZSE:002321) shares have been powering on, with a gain of 26% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.4% in the last twelve months.

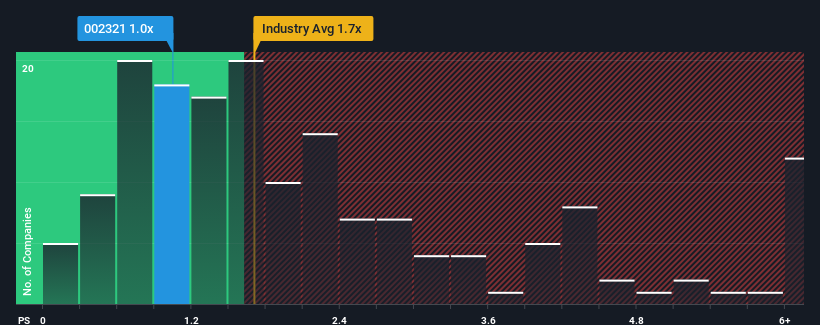

In spite of the firm bounce in price, Henan Huaying Agricultural Development's price-to-sales (or "P/S") ratio of 1x might still make it look like a buy right now compared to the Food industry in China, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Henan Huaying Agricultural Development Has Been Performing

Henan Huaying Agricultural Development certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Henan Huaying Agricultural Development will help you shine a light on its historical performance.How Is Henan Huaying Agricultural Development's Revenue Growth Trending?

In order to justify its P/S ratio, Henan Huaying Agricultural Development would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Henan Huaying Agricultural Development would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 45%. Pleasingly, revenue has also lifted 51% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 16% shows it's about the same on an annualised basis.

With this in consideration, we find it intriguing that Henan Huaying Agricultural Development's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does Henan Huaying Agricultural Development's P/S Mean For Investors?

Despite Henan Huaying Agricultural Development's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Henan Huaying Agricultural Development currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Henan Huaying Agricultural Development with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Henan Huaying Agricultural Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.