Shenzhen Sinovatio Technology Co., Ltd. (SZSE:002912) shares have continued their recent momentum with a 27% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.7% in the last twelve months.

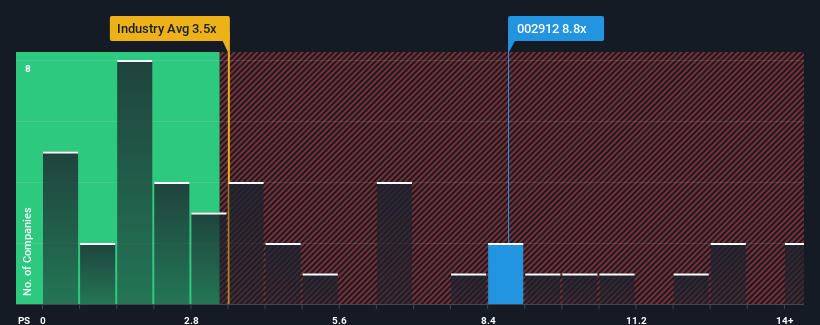

Following the firm bounce in price, you could be forgiven for thinking Shenzhen Sinovatio Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.8x, considering almost half the companies in China's Tech industry have P/S ratios below 3.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Shenzhen Sinovatio Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Shenzhen Sinovatio Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Sinovatio Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Shenzhen Sinovatio Technology?

Shenzhen Sinovatio Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Shenzhen Sinovatio Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 37% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 17% growth forecast for the broader industry.

With this information, we can see why Shenzhen Sinovatio Technology is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Shenzhen Sinovatio Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Shenzhen Sinovatio Technology shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Shenzhen Sinovatio Technology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.