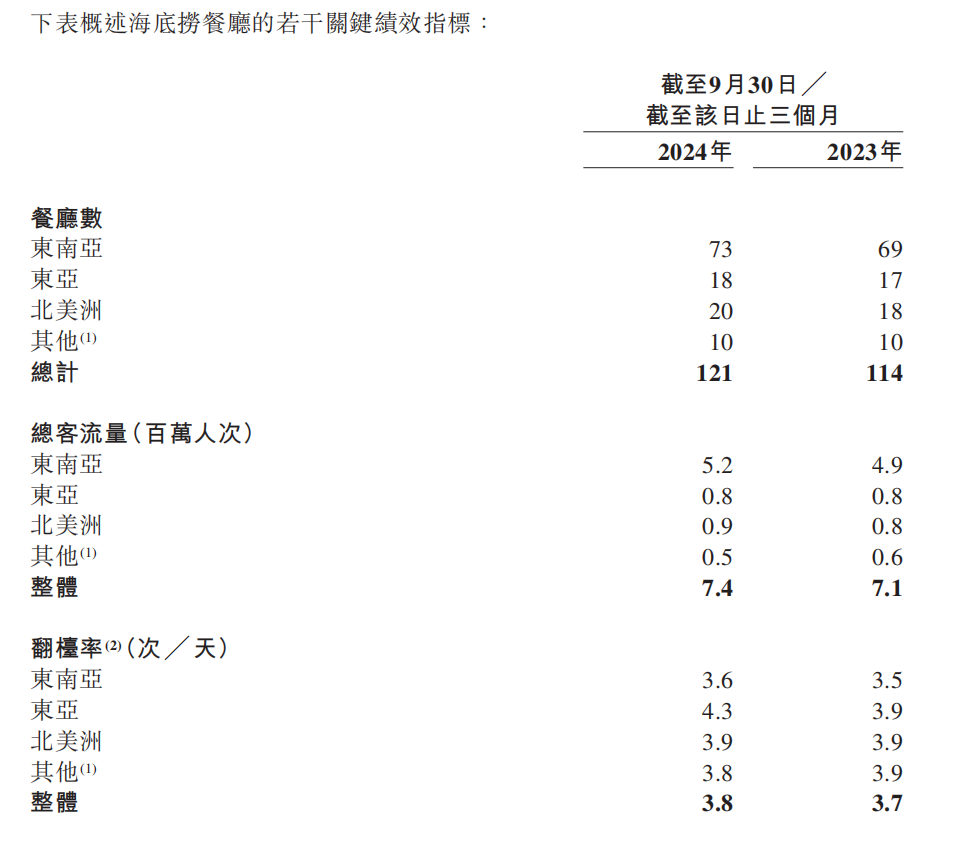

①对于投资者关心的未来海外的开店布局以及策略。特海国际高管在业绩会上表示,未来渗透率和开店力度,会根据各地区的市场需求来布局,不会设置最高的开店空间;②特海国际全球餐厅总数为121家,较2023年底净增加6家。其中东南亚有73家、东亚18家、北美洲20家。

《科创板日报》11月26日讯(记者 徐赐豪) 原海底捞CEO杨利娟堪称“救火队长“,上任后特海国际就交出了一份扭亏为盈的的财报。

昨日晚间(25日)海底捞的海外业务特海国际披露了2024年第三季度财报业绩。财报显示,2024年第三季度收入为1.99亿美元,较2023年同期的1.73亿美元增长14.6%。

净利润方面,特海国际今年第三季度为3770万美元,2023年同期为亏损140万美元。对此特海国际在财报中解释称主要是由于业务持续扩张带动收入增长,以及为提升客流量及翻台率做出的努力;公司运营效率提升;特别是汇兑收益净额较2023年同期增加3460万美元。

净利润方面,特海国际今年第三季度为3770万美元,2023年同期为亏损140万美元。对此特海国际在财报中解释称主要是由于业务持续扩张带动收入增长,以及为提升客流量及翻台率做出的努力;公司运营效率提升;特别是汇兑收益净额较2023年同期增加3460万美元。

海底捞于1994年在四川简阳创立,直到2012年,其首次走出国门,在新加坡开设了第一家海外门店,之后两年,先后进驻美国、韩国等地。

2022年底,海底捞决定将其海外业务即特海国际分拆出来,单独上市。2022年12月30日,特海国际以介绍上市的方式登陆港交所上市,今年5月份特海国际又在美国上市。

不过此前特海国际一直处于亏损状态,虽然去年顺利扭亏为盈,但今年上半年再度亏损。

据此前披露的财报数据,2019-2022年,特海国际分别实现营业收入2.33亿美元、2.21亿美元、3.12亿美元、5.58亿美元,年度净亏损分别为3301.9万美元、5376.0万美元、1.51亿美元、4124.8万元。而在2023年,特海国际营收为6.68亿美元(约合48.27亿元人民币),净利润为2565.3万美元(约合1.85亿元人民币)。截至2023年12月底,特海国际拥有门店115家,其中70家餐厅位于东南亚地区。

救火队长杨利娟再战海外

值得一提的是,就在7月1日,海底捞原公司CEO和执行董事杨利娟辞任,随后被任命为特海国际CEO,再战海外市场。

根据特海国际此前的公告,杨利娟曾主导了海底捞品牌的出海进程,分别于2012年、2013年在新加坡、美国成功布局,打下特海国际目前在国际市场的经营基础。

最新的财报数据显示,截至2024年9月30日,特海国际全球餐厅总数为121家,较2023年底净增加6家。其中东南亚有73家、东亚18家、北美洲20家。

整体平均翻台率为3.8次/天,2023年同期为3.7次/天。总客流量超过740万人次,较2023年同期的710万人次同比增长4.2%。同店销售额增长率为5.6%。经营溢利率为7.5%,2023年同期为5.7

值得一提的是东亚的翻台率由去年同期的3.9次/天同比增长10.26%至4.3次/天,同时东亚的每间门店的日均收入由去年同期的1.3万美元增长至1.77万美元。

对于东亚的收入的增长,特海国际高层在业绩财报中表示,主要对菜品价格调整,让部门菜品回到价格区间,从而实现翻台率和收入的增长。

对于投资者关心的未来海外的开店布局以及策略。特海国际高管在业绩会上表示,未来渗透率和开店力度,会根据各地区的市场需求来布局,不会设置最高的开店空间。

截至发稿,特海国际港股报收13.2港元,上涨3.12%,市值85.84亿港元,特海国际美股报收16.54美元,上涨1.53%,市值10.76亿美元。