With EPS Growth And More, Spring Airlines (SHSE:601021) Makes An Interesting Case

With EPS Growth And More, Spring Airlines (SHSE:601021) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

一些投機者對於能夠扭轉乾坤的公司投資的興奮是巨大的吸引力,所以即使是沒有營業收入、沒有盈利並且一直做不到期望的公司也可以找到投資者。不幸的是,這些高風險的投資往往幾乎沒有可能有所回報,許多投資者會爲此付出代價。虧損的公司可能就像資本的海綿一樣,投資者應該謹慎,以免把好錢投向投機。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Spring Airlines (SHSE:601021). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

因此,如果這種高風險高收益的理念不適合你,你可能會更感興趣於盈利增長的公司,比如春秋航空(SHSE:601021)。雖然這並不一定表明它被低估,但該業務的盈利能力足以值得一些認可——特別是如果它在持續增長的話。

Spring Airlines' Improving Profits

春秋航空的盈利改善

In the last three years Spring Airlines' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Spring Airlines' EPS skyrocketed from CN¥1.43 to CN¥2.24, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 57%.

在過去三年中,春秋航空的每股收益迅速增長;以至於使用這些數據來推測長期估計有些不真實。因此,我們的分析更好地關注過去一年的增長率。春秋航空的每股收益在短短一年內從1.43元飆升至2.24元;這一結果肯定會讓股東們露出微笑。這是57%的可嘉增幅。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Spring Airlines remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to CN¥20b. That's progress.

營業收入的增長是可持續增長的一個重要指標,並且結合較高的利息和稅前利潤(EBIT)利潤率,這是公司在市場上保持競爭優勢的一個好方法。儘管過去一年春秋航空的EBIT利潤率基本保持不變,但公司應該高興地報告該期間的營業收入增長25%,達到200億人民幣。這是進步。

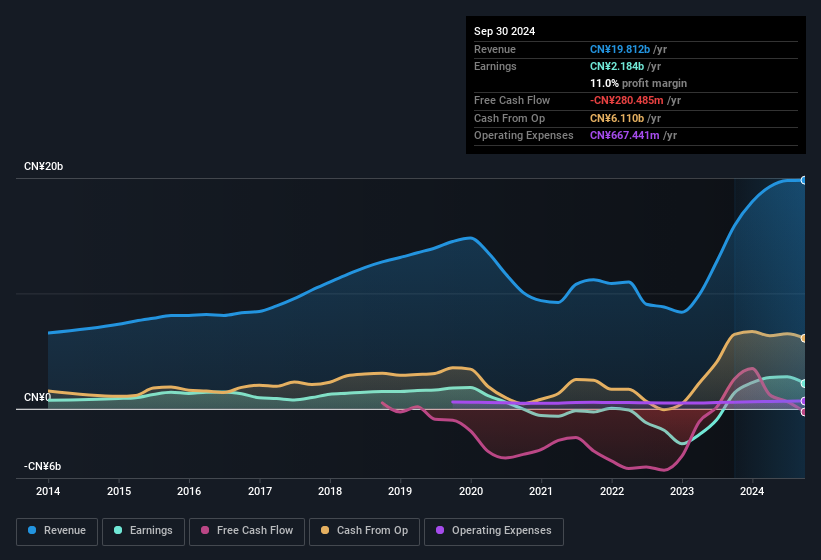

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

以下圖表展示了該公司營業收入和盈利增長的趨勢。單擊圖表可以查看準確數字。

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Spring Airlines' forecast profits?

在投資中,就像在生活中,未來比過去更重要。那麼爲什麼不查看這個春秋航空預測利潤的免費互動可視化呢?

Are Spring Airlines Insiders Aligned With All Shareholders?

春秋航空的內部人是否與所有股東的利益一致?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥29b and CN¥87b, like Spring Airlines, the median CEO pay is around CN¥1.9m.

在投資之前,檢查管理團隊的薪酬是否合理總是個好主意。薪酬水平接近或低於中位數,可能是股東利益得到充分考慮的標誌。對於市值在290億人民幣到870億人民幣之間的公司,如春秋航空,CEO的中位薪酬約爲190萬人民幣。

Spring Airlines' CEO took home a total compensation package worth CN¥1.5m in the year leading up to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

春秋航空的CEO在截至2023年12月的年度總薪酬包爲150萬人民幣。這看起來相當合理,尤其是它低於同類公司中位數。雖然CEO薪酬水平不應成爲公司形象的最大影響因素,但適度的薪酬是一種積極的信號,因爲這表明董事會關注股東的利益。這也可以是良好治理的一個標誌。

Should You Add Spring Airlines To Your Watchlist?

你應該將春秋航空加入你的自選嗎?

For growth investors, Spring Airlines' raw rate of earnings growth is a beacon in the night. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. We think that based on its merits alone, this stock is worth watching into the future. However, before you get too excited we've discovered 2 warning signs for Spring Airlines that you should be aware of.

對於成長型投資者來說,春秋航空的原始收益增長率如同夜空中的明燈。快速的增長預示着良好的前景,而合理的CEO薪酬也增強了對董事會的信懇智能。我們認爲,僅憑其優點,這隻股票值得關注。然而,在你過於興奮之前,我們發現了春秋航空的兩個警示信號,需要引起注意。

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

雖然不選取增長收益和缺少內部人買入的股票可能會產生效果,但是對於重視這些關鍵指標的投資者,這裏是一份精心挑選的具有巨大增長潛力和內部人信心的CN公司列表。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Spring Airlines remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to CN¥20b. That's progress.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Spring Airlines remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to CN¥20b. That's progress.