IPとチャネルは核心です

最近、谷子経済は投資の新たな風口となっています。

今日、IP経済セクターはA株市場で引き続き上昇しています。

発表時点で、広博股份は8日で6回のストップ高、実豊文化は5連続ストップ高、奥飛エンターテインメント、華立テクノロジーは2連続ストップ高、元隆雅图は5日で3回のストップ高です。

発表時点で、広博股份は8日で6回のストップ高、実豊文化は5連続ストップ高、奥飛エンターテインメント、華立テクノロジーは2連続ストップ高、元隆雅图は5日で3回のストップ高です。

創源股份、デ藝文創は20CMのストップ高、横店影视は初のストップ高、星辉娱乐は12%以上上昇、晨光股份は9.9%の上昇、華策影视は5%以上の上昇です。

香港株のポップマートは今日1.71%下落し、最新の株価は86.2香港ドル/株で、時価総額は1157.62億香港ドルです。今年に入ってから累計で332%以上上昇しています。

10月初めに中信建投のアナリスト、陳果が「泡腾資産」を提案しました。

彼は「泡腾資産」が古い経済周期との関連性が低く、国際化運営能力があり、新しい消費サービスや情緒消費の分野の核心企業を代表すると述べ、これが「再構築中の中国核心資産の第一梯隊」になると主張しました。

しかし、注意が必要なのは、この谷子経済投資の熱潮は9月中旬に始まったことで、一部の銘柄はすでにかなりの上昇を見せているため、高値追いには慎重であるべきです。

9月18日以来、実豊文化は累計で168%以上上昇し、広博股份は累計で133%以上の上昇を記録し、ポップマートは累計で約75%上昇しています。

最近の上昇幅が大きいため、広博股份と実豊文化は2件の株価異動公告を発表し、投資者に二次市場での取引リスクに注意を促し、慎重な意思決定と理性的な投資を呼びかけました。

IPとチャネルは核である

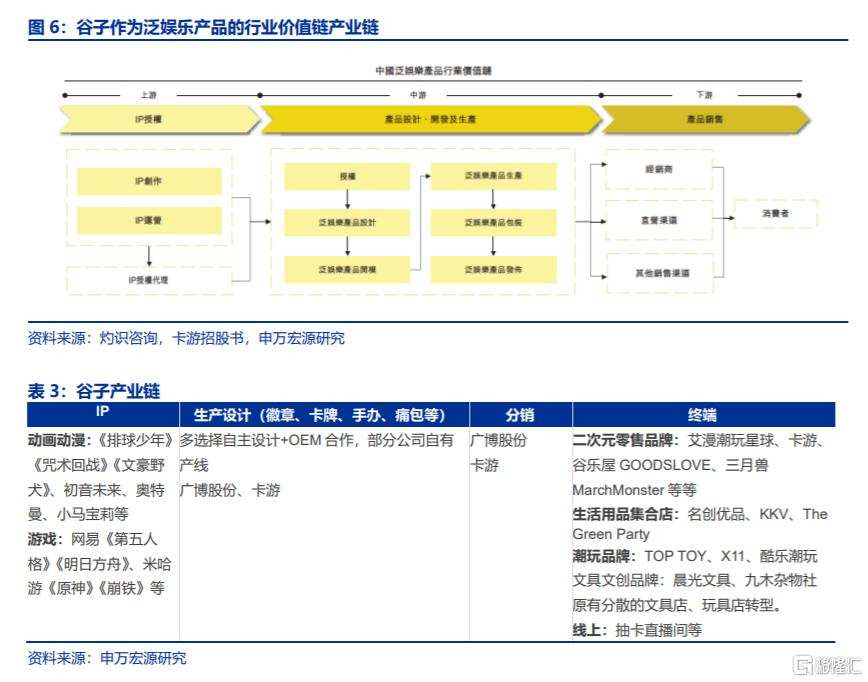

谷子は漫画、アニメ、ゲーム、アイドル、特撮など著作権作品の周辺商品を指し、精神的消費財であり、消費者に自己満足、コレクション、社交、取引などの価値をもたらす。

産業チェーンの観点から見ると、谷子経済の上流はコンテンツ制作の段階であり、アニメ、漫画、ゲーム制作などを受け持ち、米哈游、ネットイーズ、alpha groupが代表である。

中流は運営会社であり、コンテンツの伝播を担当し、細分化された作業にはIP代理やゲーム発行などが含まれ、ビリビリ、guangbo group stockなどがその中で深く取り組んでいる。

下流は商品販売であり、pop mart、ミニソーグループホールディングスなどが代表である。

その中で、IPとチャネルは核であり、大部分が二次元IPライセンスに基づいており、競争優位は主にチャネルにある。

マーケット規模について、前瞻産業研究院のデータによれば、2016年から2023年にかけて、中国の二次元産業規模は189億元から2219億元に成長し、複合成長率は42%である。

その中で、周辺衍生産業の規模は53億元から1023億元に増加し、複合成長率は53%に達しました。

将来を展望すると、2023年から2029年にかけて、二次元産業の規模は2219億元から5900億元に成長し、複合成長率は18%です。

現在、二次元周辺衍生市場の集中度は低く、供給業者の交渉力は弱く、消費者の交渉力は強く、既存の競争者の数は多く、市場の集中度は低く、利益が高く、製品の技術的なハードルは低いといった特徴があります。

したがって、潜在的な参入者は多く、市場競争は激しく、将来的には二次元周辺領域により多くのプレイヤーが参入する可能性があります。

投資において、申万宏源は「悦己」消費/谷子経済の景気背景を踏まえ、関連する投資機会を捉えることを推奨し、全産業チェーンのレイアウトを持つ泡泡玛特、強力なIPストックを持つ上海映画、カードゲーム分野に積極的に取り組む姚记科技、IP選品と供給チェーンが成熟し、チャネル能力が高い広博股份、閲文集団、阿里巴巴影業に注目することを重点的に見ています。

德邦証券は、「谷子経済」がその背後のIP権利の許可と運営能力を根本にし、供給チェーンの能力を保障し、チャネルを通じて消費者に到達する重要な要素であると指摘し、全産業チェーン能力を持ち、傘下のIPが迅速に拡散するリーダーシンボルに注目することを推奨しています。

1)広博股份:当社は文創分野に深く取り組み、国内外の多くの有名IPと提携し、独自の文創文房具や二次元周辺製品の一連を開発しました。

2)alpha group:二次元IPのリーダーであり、 「バララ小魔仙」、「喜羊羊与灰太狼」など複数のアニメIPを持ち、 クラシックIPと著名企業ブランドとのコラボレーションを行い、 若者向けのコンテンツとブランドを創造しています。

3)shanghai m&g stationery inc.:複数のブランドを展開し、 「奇只好玩」などのブランドを生産しています。

zheshangは、現在「谷子経済」がチャネル競争の段階にあると考えており、 広範な小売チャネルを持つ企業やブランドは、 初期段階で業界ベータを享受できる可能性があります。 中長期的には、コア競争力が製品開発と選定能力に戻り、 最終的には差別化された製品供給につながるでしょう。

guangbo group stockは人気IPのストック+製造研究開発能力+マーケティングプロモーション能力を有し、 谷子経済の新星が昇りつつあります。

截至发稿,广博股份8天6板,

截至发稿,广博股份8天6板,