Losses of more than 1.8 billion in 3 and a half years

Hong Kong stocks ushered in a rush to go public with an online car-hailing company.

On November 13, Shengwei Times Technology Co., Ltd. (“Shengwei Era” for short) submitted a prospectus to the Hong Kong Stock Exchange. The sponsor is CITIC Construction Investment International.

The company relies on Alibaba Travel, a subsidiary of Alibaba Group, and uses online car-hailing services as its main source of revenue; in the past few years, despite fluctuations in the industry, the company's revenue bucked the trend, but net profit continued to lose money.

The company relies on Alibaba Travel, a subsidiary of Alibaba Group, and uses online car-hailing services as its main source of revenue; in the past few years, despite fluctuations in the industry, the company's revenue bucked the trend, but net profit continued to lose money.

Next, let's take a look at the details of the company through the prospectus.

01

The former vice president of Yonyou Network started a business, and Ali supported it along the way

Shengwei Era was founded on September 28, 2012. The founder is Jiang Shengxi. He obtained a bachelor's degree in accounting from North China Jiaotong University (now known as Beijing Jiaotong University) in July 1998. He later obtained EMBA degrees from the Hong Kong University of Science and Technology and the Yangtze River Business School in November 2007 and September 2021, respectively.

Jiang Shengxi has more than 20 years of experience in the software industry. For 12 years from February 2001 to March 2013, he worked for Yonyou Network Technology Co., Ltd. (stock code: 600588.SH), and his last position was vice president.

In the Series A capital increase in July 2016, the company introduced Ali Travel. Since then, Ali Travel has increased its capital and became the largest shareholder in the Shengwei era; in addition, the company also attracted well-known investment institutions such as Ningbo SoftBank, Guiyang SoftBank, Shanghai Minghe, Hongxin Tianshi, and Guangzhou Tamsuiquan to participate.

Based on the consideration calculation for the last round of equity transfers in November 2024, Shengwei Era's valuation in the primary market was 2.216 billion yuan.

As of the filing, Ali Travel directly held 27.01% of the shares, making it the largest shareholder; Jiang Shengxi followed closely with 20.67% of the shares; SoftBank entities directly and indirectly controlled 10.72% of the shares in total.

However, the company's controlling shareholder is not Ali Travel. According to the prospectus, Jiang Shengxi and Mr. Wang Jiawei, Chengdu Yingchuang, Yingchuang Century, Mr. Yu Lang, Haidai Zhushi, Mr. Chen Shulin, Shidai Zhongcheng, and Shidai Xincheng jointly have the right to control the exercise of about 42.20% of voting rights at the company's shareholders' meeting, forming a group of controlling shareholders of the company.

02

Online car-hailing services contribute more than 80% of revenue

Shengwei Times is an intercity and intra-city road passenger transport information service provider. It mainly provides intercity road passenger transport services and intra-city online car-hailing services. Its business covers more than 30 provinces, autonomous regions and municipalities across the country. The platforms it operates include “Travel 365,” as well as the information systems “Cloud Station Service” and “Passenger Delivery.”

The company's business includes the following major sectors:

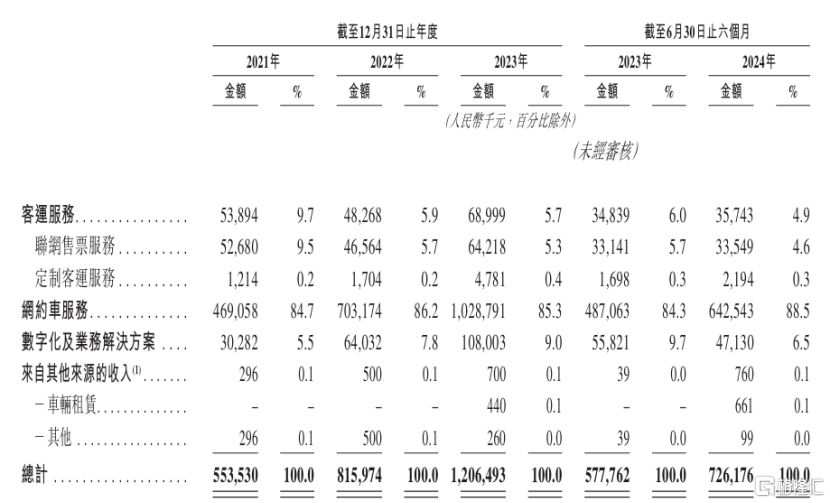

1. Passenger service: It will account for 5.7% of the company's revenue in 2023. According to Frost & Sullivan, the company became the largest intercity road passenger transport information service provider in China in terms of ticket sales in 2023; it can be subdivided into online ticketing services and customized passenger transport services.

2. Online car-hailing service: It will account for 85.3% of the company's revenue in 2023. As of June 30, 2024, the company is the second-largest online car-hailing platform in China based on the number of “Online Taxi Reservation Business Permits”. As of the last practical date, the company has obtained 191 “Online Taxi Reservation Business Permits”, and the total number of registered drivers has reached about 1.5 million.

3. Digitalization and business solutions: It will account for 9% of the company's revenue in 2023. The company's digital and business solutions mainly include (i) software development, delivery and maintenance; (ii) hardware procurement, implementation and maintenance; and (iii) providing customers with system integration of such software and hardware components.

The proportion of the company's various businesses, source: prospectus

The proportion of the company's various businesses, source: prospectusOnline car-hailing services are the company's main source of revenue.

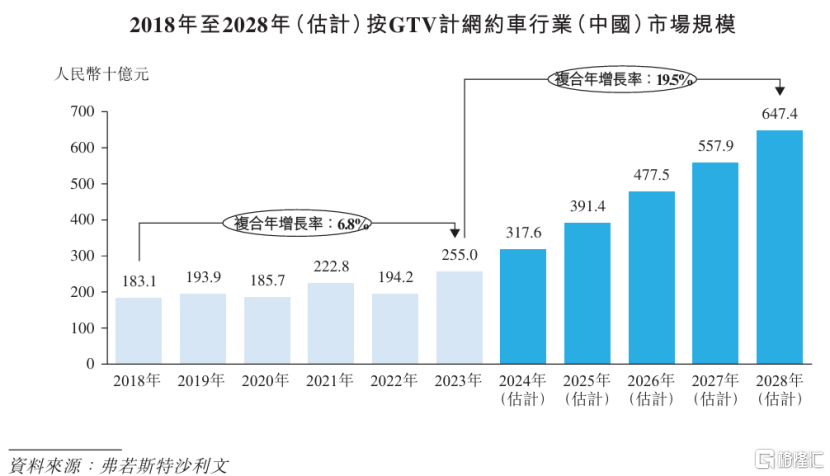

From an industry perspective, since 2018, China's online car-hailing market has grown from 183.1 billion yuan to 193.9 billion yuan in 2019. From 2020 to 2022, China's online car-hailing industry declined due to the impact of COVID-19, the resurgence of the national epidemic, and travel restrictions.

In 2023, with the full liberalization of epidemic control and policies introduced by national and local governments, it is foreseeable that the overall policy will encourage the development of the online car-hailing industry while ensuring the future development of the industry through continuous updates to practices and standards. The market will grow at a CAGR of 19.5% and is expected to reach RMB 647.4 billion by 2028.

Online car-hailing market size, source: prospectus

Online car-hailing market size, source: prospectus03

No increase in revenue, no increase in profit, loss of more than 1.8 billion in three and a half years

Compared with fluctuations in the overall scale of the online car-hailing industry, the revenue growth rate of the Shengwei era remained high during the reporting period.

In 2021, 2022, 2023, and January-June 2024 (reporting period), the company's revenue was 0.55 billion yuan, 0.816 billion yuan, 1.21 billion yuan, and 0.726 billion yuan, respectively, with a compound annual growth rate of 47.6% from 2021 to 2023.

However, the company's net profit continued to lose money. Losses during the reporting period were 0.587 billion yuan, 0.499 billion yuan, 0.482 billion yuan, and 0.285 billion yuan, respectively, with a cumulative loss of 1.85 billion yuan over 3 and a half years.

After deducting the effects of items such as changes in the book value of redemption rights issued to investors and share-based payments based on equity settlement, the adjusted net loss amounts (measured in non-IFRS) were $55.6 million, $50.5 million, $17.8 million, and $16.7 million, respectively.

Key financial indicators of the company, source: prospectus

Key financial indicators of the company, source: prospectusDuring the reporting period, the comprehensive gross margin of the Shengwei era was 8.6%, 6.6%, 7.1%, and 3.5%, respectively, with fluctuations.

Among them, the gross margin of the passenger transport service business is relatively high, with a gross margin of 57.0% from January to June 2024 because revenue is accurately determined on a net basis.

However, the gross margin of the online car-hailing service business, which accounts for the majority of the company's revenue, is relatively low, falling from 2.3% in 2021 to -0.5% in January-June 2024. Mainly because the company has established a competitive pricing mechanism and provides incentives for drivers to compete in the online car-hailing market.

It's also understandable that the biggest component of the company's sales costs is the driver's service fee. From January to June 2024, the total service fee paid by the company to drivers (including applicable driver incentives) was $0.567 billion, accounting for 81% of sales costs.

The company's gross margin by business, source: prospectus

The company's gross margin by business, source: prospectusUnder a meager gross margin, sales, marketing, and R&D expenses also made up the two largest expenses in the Shengwei era. From January to June 2024, sales and marketing expenses accounted for 2.8%, and R&D expenses accounted for 2.2%.

It is worth noting that the online car-hailing service business in the Shengwei era relied on cooperation with a limited number of aggregation platforms, especially with Gaode, a subsidiary of Ali.

During the reporting period, GTV generated by the company through Gaode accounted for 95.3%, 92.9%, 89.5% and 93.4% of the total GTV in the online car-hailing service business, respectively. In 2019, Shengwei Era began providing users with integrated online car-hailing services through Gaode. Passengers can use the company's online car-hailing service through major aggregation platforms such as Gaode and 365 Car-hailing, the company's own platform.

这家公司背靠阿里巴巴集团旗下的阿里旅行,以网约车服务为主要收入来源;过去几年内,尽管行业经历了波动,但是公司营收逆势增长,不过净利润却持续亏损。

这家公司背靠阿里巴巴集团旗下的阿里旅行,以网约车服务为主要收入来源;过去几年内,尽管行业经历了波动,但是公司营收逆势增长,不过净利润却持续亏损。