Those holding Airship AI Holdings, Inc. (NASDAQ:AISP) shares would be relieved that the share price has rebounded 39% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 74% share price decline over the last year.

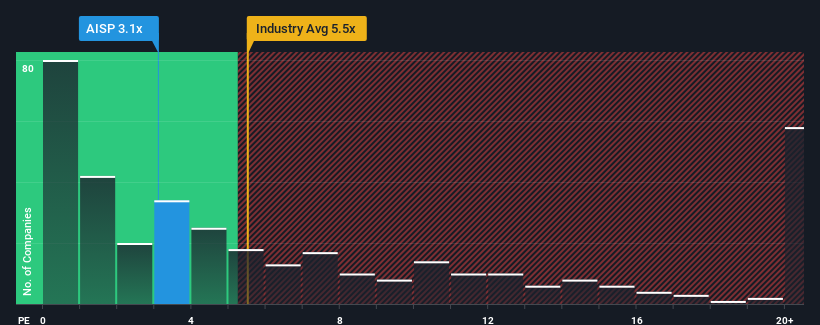

In spite of the firm bounce in price, Airship AI Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.1x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 5.5x and even P/S higher than 13x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Airship AI Holdings Performed Recently?

Recent times have been advantageous for Airship AI Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Airship AI Holdings will help you uncover what's on the horizon.How Is Airship AI Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Airship AI Holdings' to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Airship AI Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 148% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 84% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 24% over the next year. That's shaping up to be similar to the 27% growth forecast for the broader industry.

In light of this, it's peculiar that Airship AI Holdings' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Airship AI Holdings' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Airship AI Holdings' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 6 warning signs we've spotted with Airship AI Holdings (including 3 which are potentially serious).

If you're unsure about the strength of Airship AI Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.