①Taikang Life disclosed on November 14th that it sold part of its holdings in Taikang SSE A500ETF, with a selling amount of nearly 16 million RMB; ②According to the company's official website, this is the first time they sold this fund after frequent purchases in the past. ③Multiple insurance companies have previously participated in the subscription of the A500ETF, with the industry attaching importance to its long-term fund influence.

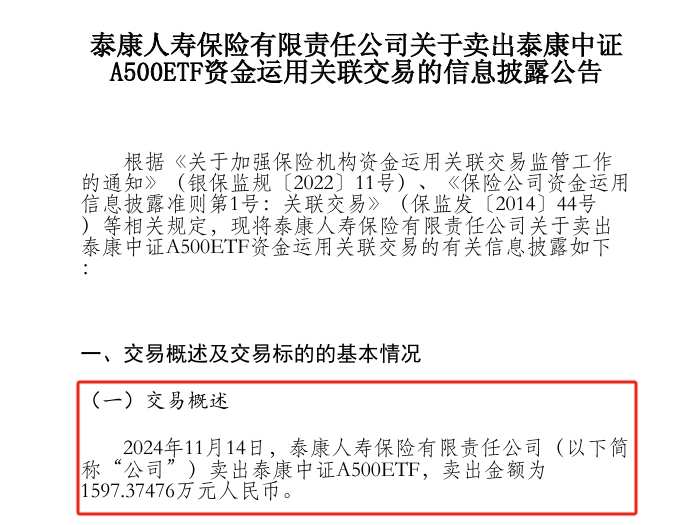

On November 26th, according to Cailian Press (Reporter Zou Juntao), Taikang Life disclosed on its official website that it sold Taikang SSE A500ETF on November 14th, with a selling amount of 15.9737476 million RMB.

Regarding the reason for selling Taikang SSE A500ETF, Cailian Press learned today from relevant persons at Taikang that this is a normal operation. 'There are buys and sells, and because it involves related party transactions, it needs to be disclosed,' the related party stated.

According to the information disclosed on Taikang Life's official website, Taikang Life has bought Taikang SSE A500ETF multiple times before, and this is the first time they sold this index fund.

According to the information disclosed on Taikang Life's official website, Taikang Life has bought Taikang SSE A500ETF multiple times before, and this is the first time they sold this index fund.

Taikang Life sold Taikang SSE A500ETF for the first time.

It is understood that Taikang SSE A500ETF is one of the first batch of publicly issued A500ETF products linked to the CSI A500 that Taikang Fund launched on October 15th this year. According to previous related transaction disclosure reports, Taikang Life began buying the Taikang SSE A500ETF in late October.

On October 25th, Taikang Life bought Taikang SSE A500ETF for 32.32627 million RMB; on November 5th, they bought it for 29.81930982 million RMB; on November 6th, they bought it for 4.2829878 million RMB; on November 7th, they bought it for 11.69312344 million RMB; on November 13th, they bought it for 17.999967 million RMB.

According to the information disclosed on Taikang Life's official website, in less than 20 days, Taikang Life made at least 5 purchases of Taikang SSE A500ETF, totaling more than 96 million RMB.

It is worth noting that the latest data shows that Taikang Life recently stopped buying and instead sold off. According to Taikang Life's official website today (November 26th), the disclosure of the related-party transaction information disclosure report shows that Taikang Life recently sold part of its holdings of Taikang CSI A500ETF for 15.9737476 million yuan RMB, with the transaction officially taking effect on November 14th.

Wind data shows that the net value of the Zhongzheng A500ETF (560510) has been continuously on the rise since its listing, breaking the net value of 1 for the first time on November 7th and forming a small peak in net value trend between November 8th and 12th. Subsequently, the net value of the Zhongzheng A500ETF started to decline, with a net value below 1 for the entire day on November 14th. As of the close on the 26th, the net value of the Zhongzheng A500ETF closed at 0.933, with a daily decline of 0.53%.

Several insurance funds had previously participated in the subscription of the Zhongzheng A500ETF.

Financial Association journalists noticed that on October 15th of this year, the first batch of Zhongzheng A500ETF collectively listed on the Shanghai and Shenzhen Stock Exchanges, with multiple insurance funds participating in the subscription.

Specifically, Taikang Life holds approximately 0.513 billion shares of Taikang CSI A500ETF; Anbang Life respectively holds approximately 31.962 million shares of Jiashi CSI A500ETF and 13.1649 million shares of Fujian CSI A500ETF; Ping An Life Insurance holds approximately 0.447 billion shares of Morgan CSI A500ETF, with a holding ratio exceeding 20%.

According to publicly reported information, at that time, the industry greatly valued insurance funds becoming the main subscribers of the Zhongzheng A500ETF, and hoped to attract more insurance funds and other medium- to long-term funds to provide support for the capital markets.

Zhongzheng A500ETF fund manager Su Huaqing stated that on one hand, the Zhongzheng A500 index is suitable for investors seeking long-term investment returns and hoping to share the long-term economic growth dividends of China, especially suitable for incorporating it as an important part of A-share asset allocation, which can smooth market fluctuations through regular investments; on the other hand, it is also suitable for investors who can grasp market style rotation and small-cap rotation. The Zhongzheng A500 index is one of the tools more suitable for short-term operations.

Looking ahead, Su Huaqing believes that passive funds, insurance funds, and other incremental funds may be key factors determining this year's market style, while changes in economic expectations are the key variables determining the market direction.

West Securities believes that compared to traditional broad-based indices, the CSI A500 Index can better reflect the characteristics of China's new and old economic momentum conversion, in line with the development train of thought of new quality productivity, and is more growth-oriented and industry-balanced. The launch of A500-linked funds is also expected to introduce incremental funds to the market and potential medium- to long-term capital in the future.

据泰康人寿官网披露信息显示,泰康人寿此前多次买入泰康中证A500ETF,此次为首次卖出该指数基金。

据泰康人寿官网披露信息显示,泰康人寿此前多次买入泰康中证A500ETF,此次为首次卖出该指数基金。