On November 26 (Tuesday), in pre-market trading of the usa, the three major stock index futures all rose.

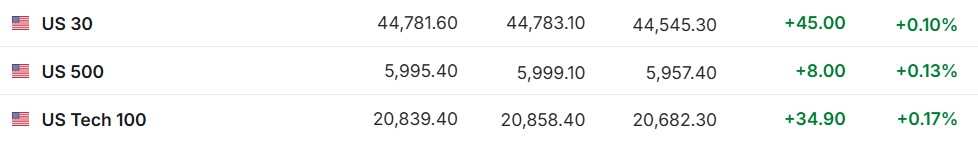

1. On November 26 (Tuesday), in pre-market trading of the usa, the three major stock index futures all rose. As of the time of writing, Dow futures rose by 0.10%, s&p 500 index futures rose by 0.13%, and Nasdaq futures rose by 0.17%.

2. As of the time of writing, deguodaxzhishu fell by 0.35%, uk ftse100 index fell by 0.19%, france cac40 index fell by 0.38%, and europe stoxx 50 index fell by 0.52%.

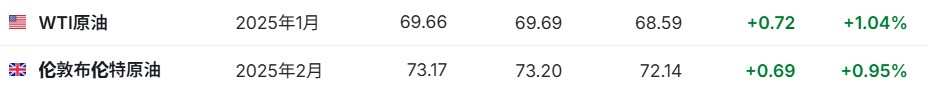

3. As of the time of writing, crude oil rose by 1.04%, reported at $69.66 per barrel. Brent crude rose by 0.95%, reported at $73.17 per barrel.

3. As of the time of writing, crude oil rose by 1.04%, reported at $69.66 per barrel. Brent crude rose by 0.95%, reported at $73.17 per barrel.

Market News

Important moment for interest rate cuts! The Federal Reserve will soon release the minutes from the November monetary policy meeting. At 3:00 AM Beijing time on Wednesday (the 27th), the Federal Reserve will publish the minutes from the November monetary policy meeting. Although interest rates will not be adjusted this month, the descriptions regarding inflation data, policy stance, and economic outlook in the minutes are of great importance. A series of hawkish statements from Federal Reserve officials have cast a shadow over the anticipated interest rate cuts in December. Chicago Fed President Goolsbee stated in a speech that he supports further rate cuts and is open to acting at a slower pace. This means that the speed and magnitude of future cuts are more significant for Federal Reserve officials than whether to cut rates at all. Market expectations for the Federal Reserve not to cut rates in December continue to rise. According to cme's FedWatch tool, the market currently expects a 47.3% chance of pausing rate cuts in December, up from 38.1% last week.

The Biden administration proposed to expand coverage for obesity drugs under Medicare and Medicaid. On Tuesday, the Biden administration introduced a new regulation that could significantly expand the coverage of weight loss drugs by Medicare and Medicaid in the USA. Currently, these government health insurance plans cover the use of weight loss drugs for specific diseases like diabetes. The proposed regulation would expand the use of these advanced weight loss drugs to approximately 3.4 million Americans. The Biden administration had previously negotiated price reductions for the top ten drugs under the federal Medicare Part D program as part of the Inflation Reduction Act. Former President Donald Trump had previously stated his intention to partially repeal the Inflation Reduction Act. This latest move to expand weight loss drug coverage could impact major players in the field, including market leaders novo-nordisk (NVO.US) and eli lilly and co (LLY.US), as well as Hims & Hers Health (HIMS.US), viking therapeutics (VKTX.US), and amgen (AMGN.US).

Another record high! US federal debt surpasses 36 trillion dollars, Trump's 'Department of Government Efficiency' inherits a hot potato. According to data from the US Treasury, as the national debt of the USA exceeds 36 trillion dollars for the first time, setting a historical record, the USA will end this year with a significant deficit. The USA now reaches astonishing fiscal deficit 'milestones' every few months, with the deficit hitting 35 trillion dollars at the end of July and reaching 34 trillion dollars earlier this year. This also encourages the US government to address this issue, prioritizing it for the next administration as it prepares to take over the White House. In response, Trump initially proposed the idea of creating an efficiency committee in September to improve the operational efficiency of the US government and cut spending. Since then, Musk has posted on his social media platform X referring to the committee as the 'Department of Government Efficiency' or 'D.O.G.E.'.

Trump wields the 'tariff big stick'! The dollar surges, and the Mexican peso and Canadian dollar plummet. On November 25 local time, elected US President Trump announced that he would impose a 25% tariff on all products from Mexico and Canada entering the USA, as well as a 10% tariff on all goods imported from China. Following this news, the dollar index surged significantly, up 0.41% to 107.25 at the time of reporting. Meanwhile, the exchange rates of the Mexican peso against the dollar and the Canadian dollar against the dollar both fell by over 1%, with the offshore renminbi against the dollar also declining. The prospect of Trump imposing high tariffs has made traders more cautious about the currencies of US trading partners. Data from the US Commodity Futures Trading Commission (CFTC) shows that as of the week ending November 19, asset management firms have been unwinding their bullish bets on the Mexican peso, while leveraged funds have turned bearish on the peso.

The market bets that Basent will ease Trump's policies, US Treasuries rebound, and the dollar 'cools off.' Wall Street veteran Scott Basent was nominated by elected President Donald Trump as the US Secretary of the Treasury last Friday, leading to a rise in US Treasuries. Investors anticipate that Basent will mitigate the impact of Trump's administration's more aggressive trade and economic policy proposals. In the context of falling oil prices, US Treasuries rose on Monday, dropping yields by over 10 basis points. The dollar recorded its largest decline in over two weeks but subsequently recovered. As global trade war prospects put pressure on global currencies, the dollar set a record for the longest weekly consecutive increase in over a year last Friday. Trump threatened to impose a 60% tariff on Chinese goods and a 10% tariff on all other countries' goods.

Federal Reserve officials' 'dovish tone' is emerging: continuing rate cuts remain appropriate. Chicago Fed President Goolsbee stated on Monday, 'Unless there is compelling evidence of economic overheating, I believe the federal funds rate will continue to decline.' Goolsbee mentioned that the Federal Reserve is expected to continue lowering rates, moving toward a position that neither restricts nor promotes economic activity. Meanwhile, Minneapolis Fed President Kashkari also indicated that considering a rate cut next month would be reasonable. Goolsbee added, 'The speed of this process will depend on the outlook and the environment, but for me, the entire process is very clear, we are on a path that will lead to lower rates, closer to what could be called a neutral level.' He stated that his prediction for the neutral rate is close to the official median forecast, which was estimated at 2.9% in September.

Conflicting views at Citigroup! Strategists shout that the Federal Reserve should pause rate cuts in December, while economists predict a 50 basis point cut. Citigroup's interest rate strategists stated that the Federal Reserve should pause rate cuts, which contradicts their own economists' predictions. While many others on Wall Street have long abandoned the suggestion of a 50 basis point cut, Citigroup's economists have continued to uphold this forecast. Citigroup strategists Jabaz Mathai and Alejandra Vazquez stated in a report on November 22: 'We believe the Federal Reserve should halt its easing policy unless the employment data in December is weak. Even if job growth is sluggish, one could argue that other labor market data indicate resilience, such as the number of unemployment claims.' They referred to the US non-farm payroll report for November, set to be released on December 6.

Having fallen from nearly 0.1 million dollars, bitcoin has faced its longest consecutive drop since Trump's election. Recently, bitcoin experienced its longest consecutive decline since Donald Trump won the U.S. presidential election, after having nearly reached 0.1 million dollars, while enthusiasm for the elected president's embrace of cryptos has cooled. As of the time of writing, the price of bitcoin is $92,271. By Monday, bitcoin has dropped about 6% over three consecutive days, and the broader crypto market, which has increased by $1 trillion since election day on November 5, has also stagnated. Noelle Acheson, author of the newsletter "Crypto is Macro now," noted that the difficulty in initially breaking through 0.1 million dollars "might lead traders to believe that the peak has been reached, and now profits should be locked in." However, she added that any such episode should be "short-lived."

Individual stock news

Lexinfintech (LX.US) reported Q3 revenue of 3.66 billion, with profits significantly increasing quarter-on-quarter, and all operating indicators improving. Lexinfintech's revenue for the third quarter of 2024 was 3.66 billion yuan, with a profit (Non-GAAP EBIT) of 0.409 billion yuan, representing a 33.2% quarter-on-quarter growth. Thanks to continuous construction of risk and data underlying capabilities, the quality of new assets has improved seasonally, and the large cap asset structure has become healthier. All risk indicators are improving, funding costs are decreasing, and performance has achieved high-quality growth. In terms of risk, over 75% of the high-quality assets in new acquisitions in the third quarter; early risk indicator FPD7 decreased by approximately 13% quarter-on-quarter; collection rate for large cap assets dropped about 9% compared to the second quarter. In Q3, high-quality asset quality gained favor with more financial institutions, resulting in funding costs hitting a historical low, down 98 basis points from the second quarter.

Agora (API.US) Q3 revenues fell short of expectations, with net losses widening year-on-year. Agora achieved revenue of $31.6 million in Q3, a year-on-year decrease of 9.8%, while the expected value was $40 million; each ADS loss was $0.26, compared to a loss of $0.23 in the same period last year. The net loss was $24.18 million, up from a net loss of $22.51 million in the same period last year. Agora, focusing on the Chinese market, achieved revenue of 0.1129 billion yuan, a year-on-year decrease of 20%; focusing on non-Chinese markets, Agora achieved revenue of $15.7 million, a year-on-year increase of 2.6%. Regarding customer scale, as of September 30, 2024, Agora had 3,641 active customers, a year-on-year decrease of 9.7%, with 1,762 active customers, a year-on-year increase of 5.9%. Based on currently available information, the company expects total revenue for the fourth quarter of 2024 to be between $34 million and $36 million, excluding revenue from certain low-margin terminal products.

Hesai (HSAI.US) exceeded guidance with Q3 revenue and is expected to achieve profitability in Q4 and for the entire year of 2024. Hesai Technology's third quarter revenue exceeded guidance, leading the global lidar market. In Q3, Hesai Technology achieved revenue of 0.54 billion yuan, a year-on-year increase of 21.1%. The total quarterly delivery volume of lidar reached 134,208 units, a substantial year-on-year growth of 182.9%; among them, ADAS product deliveries were 129,913 units, a year-on-year increase of 220.0%. Thanks to the positive flywheel effect of cost and scale cycles and the boost from development services revenue, this quarter's combined gross margin for ADAS business and Robotaxi business was 47.7%. Looking to the future, Hesai expects to set new records in the fourth quarter, with the forecast quarterly lidar shipment volume reaching 0.2 million units, a figure nearly equal to Hesai's total shipment volume for 2023.

Ucloudlink (UCL.US) reported Q3 revenue growth of 5.6%, with net profits falling to $3.4 million. Ucloudlink's Q3 revenue was $25.2 million, a year-on-year increase of 5.6%; net profit was $3.4 million, compared to $3.5 million in net profit in the same period last year; basic and diluted earnings per ADS were $0.09, unchanged from the same period last year. The adjusted net profit (excluding the impact of the stock-based incentive plan, fair value gains and losses from other investments, and share of profits or losses from equity-method investments) after tax was $3.7 million, while the same period of 2023 was $3.8 million. Under non-GAAP, adjusted EBITDA was $4.4 million, while in the same period of 2023 it was $4.1 million. For the fourth quarter of 2024, Ucloudlink expects total revenue between $25 million and $30 million, an increase of 15.2% to 38.2% compared to the same period in 2023.

Subsidies finalized! The U.S. government has finally approved $7.86 billion in direct funding for Intel (INTC.US). As part of the "Chips and Science Act," the Biden administration has set up to $7.86 billion in direct funding for Intel. This is a decrease from the initially proposed $8.5 billion in March. Due to congressional demands to allocate the funds for a "Secure Enclave" project for the U.S. Department of Defense, the final total award is less than the initially proposed award. In September 2024, Intel won a manufacturing contract worth up to $3 billion for the "Secure Enclave" project. The $7.86 billion in direct financing will support the tech company's investment plan of over $100 billion to help expand chip production in the USA. Specifically, the company will utilize these funds to advance critical semiconductor manufacturing and advanced packaging projects at factories in Arizona, New Mexico, Ohio, and Oregon.

The nomination of Trump's FDA chief is seen as a major ally, with Hims & Hers Health (HIMS.US) surging to new heights. Hunterbrook Media stated that Hims & Hers Health will be the main beneficiary of President-elect Donald Trump's nomination of Marty Makary as the head of the FDA, causing the company's stock to rise by 24% to $31.35, marking a historic closing high. Hunterbrook reported on Monday that Hims & Hers may have a "key ally" in Makary, who is an executive at the startup company Sesame, which also sells compounded GLP-1 weight loss drugs. Hunterbrook Capital, a hedge fund, said it is taking a long position on Hims & Hers' stock, reversing its short position from June that primarily focused on the online sales of the company's compounded GLP-1 injectables.

The US low-cost airline Spirit Airlines (SAVE.US) has filed for bankruptcy protection, leaving its future uncertain. On November 18, Eastern Time, Spirit Airlines announced that it has applied for bankruptcy protection and will attempt to restructure. This move by Spirit Airlines has raised concerns among travelers about whether they will reach their destinations before the busy Thanksgiving travel period. Passengers can be relieved that under what Spirit Airlines calls Chapter 11 bankruptcy, the airline is not closing, but restructuring to maintain its business operations. Spirit Airlines informed passengers that flight operations at all 84 airports served by the company will continue normally, and passengers can use all tickets, points, and miles as if nothing has happened.

Tesla (TSLA.US) is facing "backstabbing" in its home state, as it may be excluded from California's new electric vehicle tax credit. The office of California Governor Gavin Newsom announced on Monday that if President-elect Trump cancels the federal tax credit for purchasing electric vehicles, Tesla's electric vehicles may not qualify for the proposed new state tax credit in California. Trump's transition team is considering revoking the $7,500 federal tax credit for purchasing electric vehicles. Tesla CEO Musk wrote on X: "Even though Tesla is the only company producing electric vehicles in California! This is crazy." Musk has previously stated that he supports ending subsidies for electric vehicles, oil, and gas. Newsom said on Monday that if Trump cancels the federal electric vehicle tax credit, he will propose the creation of a new version of the state clean car rebate program, which will end in 2023 and cost $1.49 billion to subsidize over 594,000 cars.

Important economic data and events notice

Beijing time 21:00: Revised monthly rate of US October construction permits (%).

Beijing time 21:55: Year-on-year rate of US Redbook commercial retail sales for the week ending November 18 (%).

Beijing time 22:00: Monthly rate of US September FHFA home price index (%), Year-on-year rate of US September S&P/CS 20-city unadjusted home price index (%).

Beijing time 23:00: US November Conference Board Consumer Confidence Index, number of new homes sold in October (annualized) in the US (10,000 units).

Next day at 05:30 Beijing time: Change in API crude oil inventory in the usa for the week ending November 22 (in ten thousand barrels).

Next day at 03:00 Beijing time: The Federal Reserve releases the minutes of the November monetary policy meeting.

Performance forecast.

Wednesday morning: Dell (DELL.US), hp inc (HPQ.US), nordstrom (JWN.US), joyy (YY.US), noah holdings (NOAH.US).

Wednesday pre-market trading: 111 inc (YI.US).

3. 截至发稿,WTI原油涨1.04%,报69.66美元/桶。布伦特原油

3. 截至发稿,WTI原油涨1.04%,报69.66美元/桶。布伦特原油