UBS said that “the share of the automobile business market value has fallen below average” has only occurred twice in the past four years, bringing about a correction of more than 30% and 70% in Tesla's stock price, respectively. Furthermore, currently Tesla's expected price-earnings ratio has reached 100 times, far exceeding the two-year average. Investors need to have a great sense of conviction if they want to continue to increase their holdings in this stock.

Since US election day, Tesla's stock price has increased by about 40%, and the company's market value once reached 1.1 trillion US dollars.

UBS analysts Joseph Spak, Alejandro Nuno, and Zachary Walljaspe warned in a research report released on November 25 that in Tesla's recent stock price rise, sentiment drivers are greater than fundamentals, and investors need to be careful.

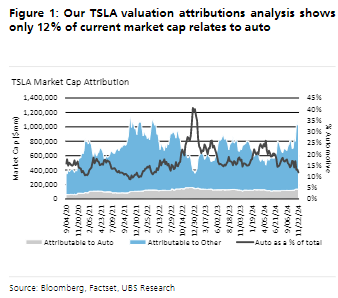

UBS believes that although Tesla is transforming itself into an AI company, as its core business, the automobile business is still the most important source of profit for the company. However, the current share of this business in the company's total market value has fallen below the recent average, which is likely to trigger a “downward channel” for stock prices.

UBS believes that although Tesla is transforming itself into an AI company, as its core business, the automobile business is still the most important source of profit for the company. However, the current share of this business in the company's total market value has fallen below the recent average, which is likely to trigger a “downward channel” for stock prices.

The higher you stand, the harder you fall?

According to the report, the recent sharp rise in Tesla's stock price is mainly due to the market's optimistic expectations of policy changes after Trump took office as US President, which is more driven by sentiment than by basic orientation.

Judging from the valuation, the market's positioning of Tesla has changed from an electric vehicle company to an AI company:

In our framework, Tesla's automotive and energy businesses are worth around $52 per share, while Tesla's other businesses (AI, RoboTaxi, Optimus, etc.) are already valued at $1 trillion at current stock prices.

This means that Tesla is seen as a player in the field of artificial intelligence rather than a traditional electric vehicle manufacturer.

According to the report, Tesla's automobile business currently accounts for only 12% of the total market value, reaching 10% at least once.

At the same time, UBS said that whenever the market capitalization share of the core automobile business reaches the recent average (about 17%), the stock price will often enter a “downward channel.” This has only happened twice in the past four years, bringing about a correction of more than 30% and 70% in Tesla's stock price, respectively.

As Tesla's valuations continue to rise, it is still unknown whether the automotive business can bring the company profits in line with expectations.

According to the report, starting in 2022, the expected price-earnings ratio corresponding to Tesla's stock price for the next 12 months has been fluctuating between 20-60 times, while the expected price-earnings ratio corresponding to the current stock price has exceeded 60 times, reaching a level of more than 100 times.

UBS said that if investors want to continue to increase their Tesla holdings at the current price level, then they must have an extraordinary sense of belief. For example, it is believed that Tesla can achieve the delivery target of 15.5 million vehicles by 2030 (the current market forecast is 4.8 million) and the energy storage deployment target of 780 GWh (currently the market forecast is 139 GWh).

瑞银认为,虽然特斯拉正在将自身转型为一家AI公司,但作为核心业务,汽车业务仍是公司当前最重要的盈利来源。

瑞银认为,虽然特斯拉正在将自身转型为一家AI公司,但作为核心业务,汽车业务仍是公司当前最重要的盈利来源。