Financial giants have made a conspicuous bearish move on IBM. Our analysis of options history for IBM (NYSE:IBM) revealed 18 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $339,800, and 14 were calls, valued at $810,114.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $185.0 to $300.0 for IBM over the last 3 months.

Analyzing Volume & Open Interest

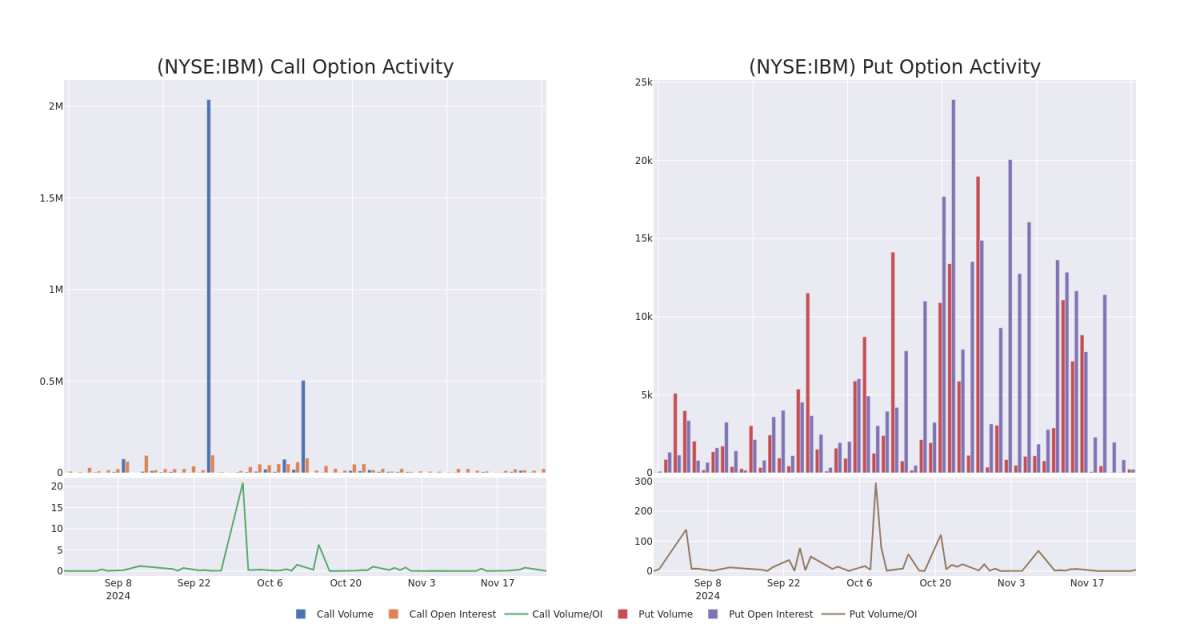

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for IBM's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of IBM's whale activity within a strike price range from $185.0 to $300.0 in the last 30 days.

IBM Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | PUT | SWEEP | BEARISH | 01/16/26 | $27.75 | $27.7 | $27.75 | $240.00 | $249.7K | 119 | 104 |

| IBM | CALL | SWEEP | BULLISH | 01/16/26 | $41.45 | $40.95 | $41.0 | $200.00 | $196.8K | 2.5K | 1 |

| IBM | CALL | SWEEP | BEARISH | 03/21/25 | $23.7 | $23.7 | $23.7 | $210.00 | $85.3K | 655 | 48 |

| IBM | CALL | SWEEP | BEARISH | 11/29/24 | $6.65 | $6.25 | $6.25 | $220.00 | $62.5K | 576 | 144 |

| IBM | CALL | SWEEP | BEARISH | 01/17/25 | $6.05 | $5.85 | $5.9 | $230.00 | $59.0K | 2.9K | 26 |

About IBM

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients, which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

Where Is IBM Standing Right Now?

- With a trading volume of 1,344,450, the price of IBM is down by -0.06%, reaching $225.99.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 57 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for IBM with Benzinga Pro for real-time alerts.