Smart Money Is Betting Big In Blackstone Options

Smart Money Is Betting Big In Blackstone Options

Financial giants have made a conspicuous bearish move on Blackstone. Our analysis of options history for Blackstone (NYSE:BX) revealed 13 unusual trades.

金融巨头对黑石展开了明显的看淡举动。我们对黑石(NYSE:BX)的期权历史进行分析后发现了13笔飞凡交易。

Delving into the details, we found 30% of traders were bullish, while 53% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $156,403, and 10 were calls, valued at $566,486.

深入细节我们发现30%的交易者看好,而53%表现出看淡倾向。在我们发现的所有交易中,有3笔看跌期权,价值$156,403,有10笔看涨期权,价值$566,486。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $230.0 for Blackstone during the past quarter.

分析这些合约的成交量和未平仓量,似乎大户一直将黑石在过去季度内的价格区间定在$135.0至$230.0之间。

Insights into Volume & Open Interest

成交量和持仓量分析

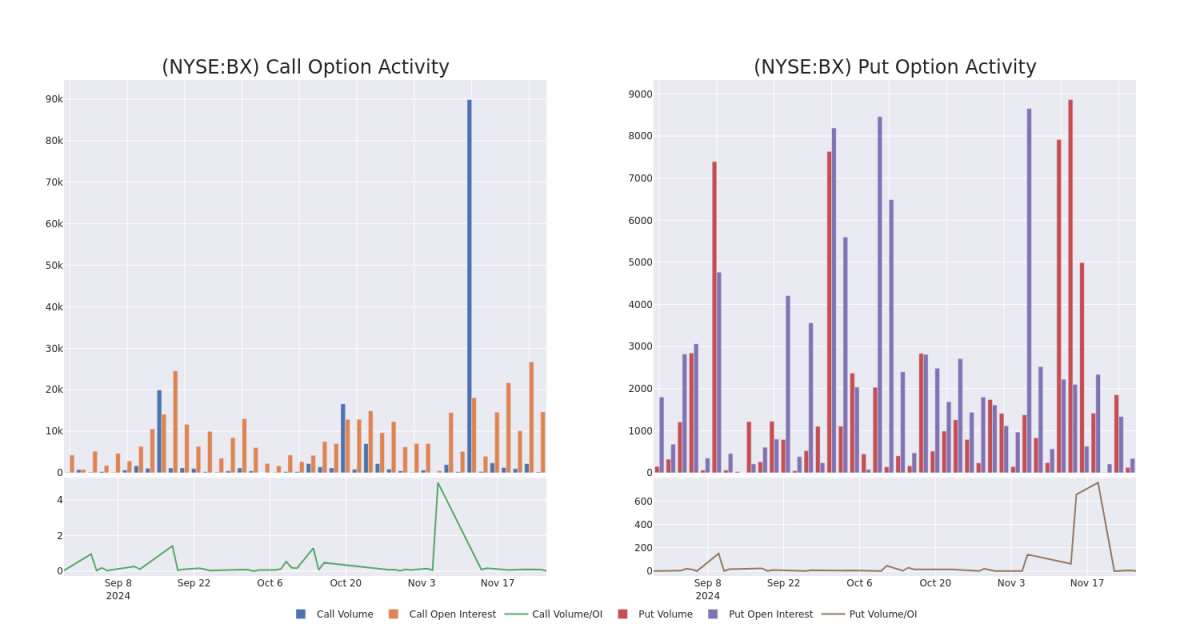

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Blackstone's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Blackstone's significant trades, within a strike price range of $135.0 to $230.0, over the past month.

检验成交量和未平仓量可以为股票研究提供关键见解。这些信息对于衡量特定行权价的黑石期权的流动性和兴趣水平至关重要。下面,我们呈现黑石重要交易中看涨和看跌期权的成交量和未平仓量趋势快照,在$135.0至$230.0的行权价区间内,过去一个月发生的交易。

Blackstone 30-Day Option Volume & Interest Snapshot

黑石30天期权成交量和未平仓合约快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | CALL | SWEEP | BULLISH | 01/17/25 | $19.65 | $18.8 | $19.49 | $175.00 | $119.4K | 2.4K | 61 |

| BX | CALL | TRADE | NEUTRAL | 01/17/25 | $44.8 | $42.4 | $43.5 | $150.00 | $82.6K | 2.8K | 20 |

| BX | CALL | SWEEP | BEARISH | 01/16/26 | $42.2 | $41.2 | $41.2 | $165.00 | $82.4K | 314 | 0 |

| BX | CALL | SWEEP | BEARISH | 12/20/24 | $58.2 | $56.9 | $56.9 | $135.00 | $79.6K | 334 | 14 |

| BX | PUT | SWEEP | BEARISH | 01/16/26 | $14.0 | $13.5 | $14.0 | $170.00 | $56.0K | 139 | 40 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 黑石 | 看涨 | SWEEP | BULLISH | 01/17/25 | $19.65 | $18.8 | $19.49 | $175.00 | $119.4K | 2.4K | 61 |

| 黑石 | 看涨 | 交易 | 中立 | 01/17/25 | $44.8 | 42.4美元 | $43.5 | $150.00 | $82.6K | 2.8K | 20 |

| 黑石 | 看涨 | SWEEP | 看淡 | 01/16/26 | $42.2 | $41.2 | $41.2 | $165.00 | $82.4K | 314 | 0 |

| 黑石 | 看涨 | SWEEP | 看淡 | 12/20/24 | $58.2 | $56.9 | $56.9 | $135.00 | $79.6K | 334 | 14 |

| 黑石 | 看跌 | SWEEP | 看淡 | 01/16/26 | $14.0 | $13.5 | $14.0 | $170.00 | 56000美元 | 139 | 40 |

About Blackstone

关于M&T Realty Capital Corporation() M&T Realty Capital Corporation()是M&T银行的全资子公司,M&T银行是M&T银行公司的主要银行子公司,该公司是美国前15家基于商业银行控股公司的公司之一。M&T Realty Capital Corporation专门为全国的多户型物业、商业出租物业和医疗保健设施提供有竞争力的融资。M&T Realty Capital Corporation是一家完全获得认可的Fannie Mae DUS贷方,是一家获得Freddie Mac Optigo贷方认证的公司,是一家获得FHA/HUD MAP和LEAN贷方认证的公司,也通过通讯关系提供人寿保险公司和CMBS融资。

Blackstone is the world's largest alternative-asset manager with $1.108 trillion in total asset under management, including $820.5 billion in fee-earning assets under management, at the end of September 2024. The company has four core business segments: private equity (25% of fee-earning AUM and 30% of base management fees), real estate (35% and 39%), credit and insurance (31% and 24%), and multi-asset investing (9% and 7%). While the firm primarily serves institutional investors (87% of AUM), it also caters to clients in the high-net-worth channel (13%). Blackstone operates through 25 offices in the Americas (8), Europe and the Middle East (9), and the Asia-Pacific region (8).

黑石是全球最大的另类资产管理公司,截至2024年9月底,总资产管理规模达到了1.108万亿美元,其中包括8205亿美元的收费资产管理规模。该公司拥有四个核心业务领域:私募股权(占收费AUM的25%和基础管理费的30%),房地产(占35%和39%),信贷和保险(占31%和24%)以及多资产投资(占9%和7%)。尽管该公司主要为机构投资者提供服务(占AUM的87%),但也为高净值客户提供服务(占13%)。黑石在美洲(8家)、欧洲和中东(9家)以及亚太地区(8家)共设有25个办公室。

Having examined the options trading patterns of Blackstone, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查了黑石的期权交易模式后,我们现在的注意力直接转向公司。这种转变使我们能够深入了解其当前的市场地位和表现

Present Market Standing of Blackstone

黑石的当前市场地位

- With a trading volume of 970,996, the price of BX is down by -0.93%, reaching $191.33.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 58 days from now.

- 交易量为970,996股,BX的价格下跌了-0.93%,达到191.33美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报将在58天后公布。

Professional Analyst Ratings for Blackstone

黑石的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $182.0.

在过去30天内,共有1位专业分析师对这支股票发表了看好意见,设定了182.0美元的平均目标价。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Blackstone, targeting a price of $182.

Benzinga Edge的飞凡期权板块可以提前发现潜在的市场变动。查看大额资金在您喜爱的股票上的仓位。单击此处进行访问。* 德意志银行的分析师继续持有看涨评级,并将黑石的目标价定为182美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Blackstone with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供更高利润的潜力。精明的交易员通过持续的教育、策略性的交易调整、利用各种因子以及保持对市场动态的敏感来降低这些风险。通过Benzinga Pro实时警报,了解黑石最新的期权交易。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Blackstone's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Blackstone's options at certain strike prices. Below, we present a snapshot of the