Whales with a lot of money to spend have taken a noticeably bearish stance on Wells Fargo.

Looking at options history for Wells Fargo (NYSE:WFC) we detected 35 trades.

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 45% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $202,502 and 30, calls, for a total amount of $1,887,466.

From the overall spotted trades, 5 are puts, for a total amount of $202,502 and 30, calls, for a total amount of $1,887,466.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $100.0 for Wells Fargo during the past quarter.

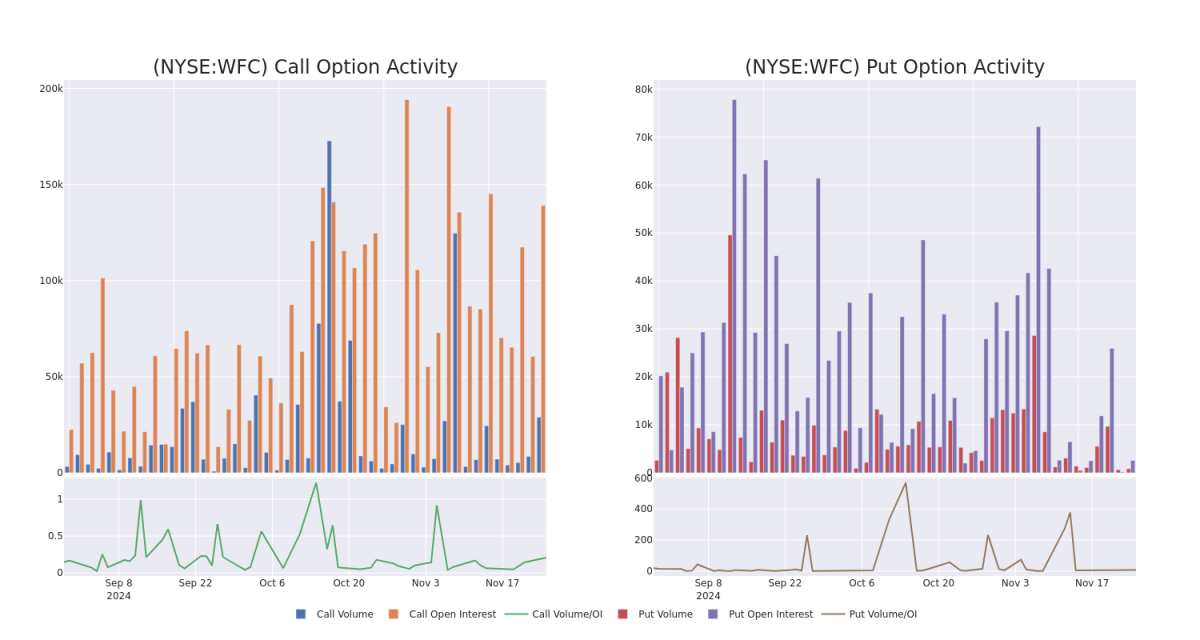

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Wells Fargo's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Wells Fargo's substantial trades, within a strike price spectrum from $50.0 to $100.0 over the preceding 30 days.

Wells Fargo Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | TRADE | BULLISH | 04/17/25 | $11.15 | $11.15 | $11.15 | $70.00 | $223.0K | 3.1K | 200 |

| WFC | CALL | TRADE | BEARISH | 06/20/25 | $20.0 | $19.9 | $19.9 | $60.00 | $198.9K | 10.2K | 150 |

| WFC | CALL | SWEEP | NEUTRAL | 04/17/25 | $9.75 | $8.25 | $9.1 | $72.50 | $182.0K | 485 | 0 |

| WFC | CALL | TRADE | BULLISH | 06/20/25 | $9.15 | $8.4 | $9.1 | $75.00 | $91.0K | 12.6K | 102 |

| WFC | CALL | SWEEP | NEUTRAL | 12/20/24 | $5.25 | $5.15 | $5.19 | $72.50 | $90.7K | 3.1K | 172 |

About Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

Where Is Wells Fargo Standing Right Now?

- With a trading volume of 12,434,040, the price of WFC is up by 0.7%, reaching $77.44.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 50 days from now.

Professional Analyst Ratings for Wells Fargo

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $79.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Wells Fargo with a target price of $82. * Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Wells Fargo with a target price of $77.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Wells Fargo with Benzinga Pro for real-time alerts.