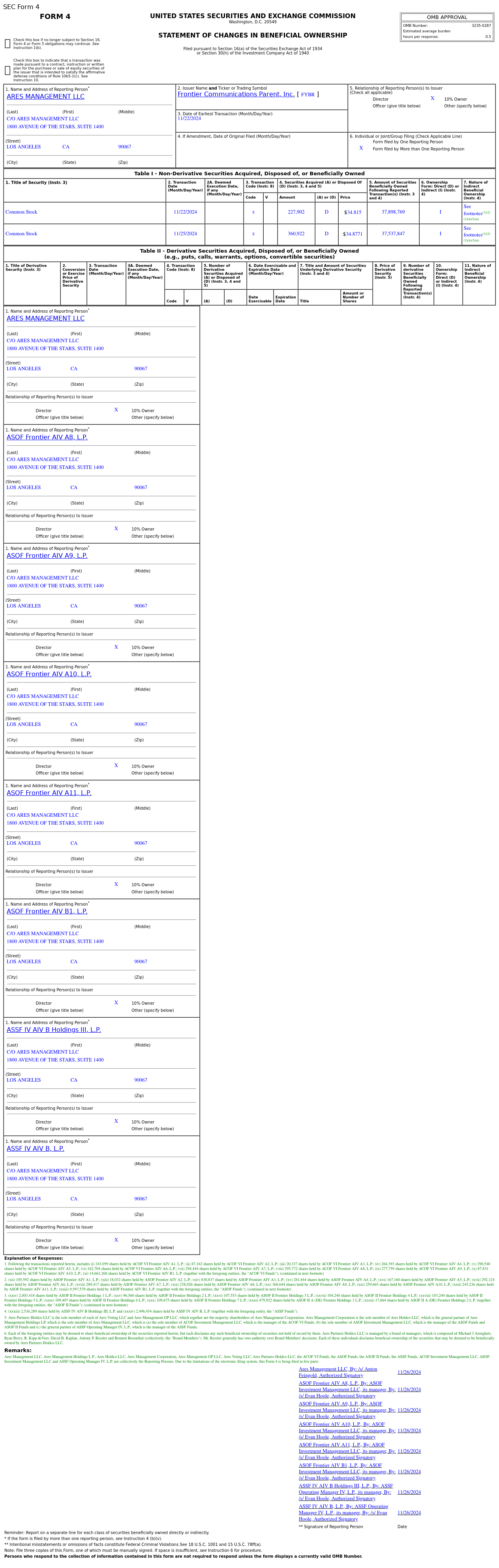

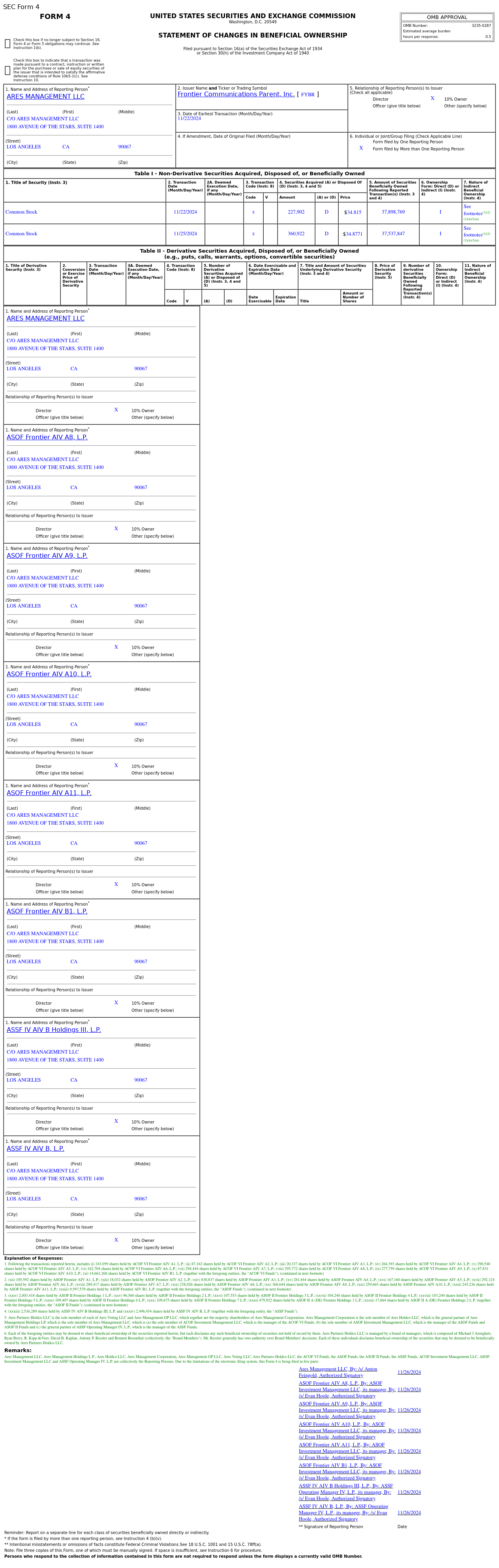

$Frontier Communications (FYBR.US)$ 10% Shareholder ARES MANAGEMENT LLC sold 588.82K shares of common stock on Nov 22, 25, 2024 at an average price of $34.8531 for a total value of $20.52 million.

This transaction involves other related parties: ASOF Frontier AIV A8, L.P., ASOF Frontier AIV A9, L.P., ASOF Frontier AIV A10, L.P., ASOF Frontier AIV A11, L.P., ASOF Frontier AIV B1, L.P., ASSF IV AIV B Holdings III, L.P., ASSF IV AIV B, L.P., ASOF II Frontier Holdings 1 L.P., ASOF II Frontier Holdings 2 L.P., ASOF II Frontier Holdings 3 L.P., ASOF II Frontier Holdings 4 L.P., ASOF II Frontier Holdings 5 L.P., ASOF II Frontier Holdings 6 L.P., ASOF II Frontier Holdings 7 L.P., ASOF II A (DE) Frontier Holdings 1 L.P., ASOF II A (DE) Frontier Holdings 2 L.P., ACOF VI Frontier AIV A10, L.P., ACOF VI Frontier AIV B1, L.P., ASOF Frontier AIV A1, L.P., ASOF Frontier AIV A2, L.P., ASOF Frontier AIV A3, L.P., ASOF Frontier AIV A4, L.P., ASOF Frontier AIV A5, L.P., ASOF Frontier AIV A6, L.P., ASOF Frontier AIV A7, L.P., ACOF Investment Management LLC, ASOF Investment Management LLC, ASSF Operating Manager IV, L.P., Ares Management Holdings L.P., Ares Holdco LLC, Ares Management Corp, Ares Management GP LLC, Ares Voting LLC, Ares Partners Holdco LLC, ACOF VI Frontier AIV A1, L.P., ACOF VI Frontier AIV A2, L.P., ACOF VI Frontier AIV A3, L.P., ACOF VI Frontier AIV A4, L.P., ACOF VI Frontier AIV A5, L.P., ACOF VI Frontier AIV A6, L.P., ACOF VI Frontier AIV A7, L.P., ACOF VI Frontier AIV A8, L.P. and ACOF VI Frontier AIV A9, L.P..

What is statement of changes in beneficial ownership of securities?

It is a requirement under federal securities laws that mandates individuals, including officers, directors, and those who hold more than 10% of any class of a company's securities (collectively known as "insiders"), to report their purchases, sales, and holdings of their company's securities by submitting Forms 3, 4, and 5.

米国証券取引委員会(SEC)が11月26日に開示した文書によると、$フロンティア・コミュニケーションズ (FYBR.US)$の主要株主ARES MANAGEMENT LLCは、11月22日、11月25日に1株平均34.8531ドルで普通株58.88万株を売却、合計額は約2,052.23万ドル。

該当取引には、ASOF Frontier AIV A8, L.P.、ASOF Frontier AIV A9, L.P.、ASOF Frontier AIV A10, L.P.、ASOF Frontier AIV A11, L.P.、ASOF Frontier AIV B1, L.P.、ASSF IV AIV B Holdings III, L.P.、ASSF IV AIV B, L.P.、ASOF II Frontier Holdings 1 L.P.、ASOF II Frontier Holdings 2 L.P.、ASOF II Frontier Holdings 3 L.P.、ASOF II Frontier Holdings 4 L.P.、ASOF II Frontier Holdings 5 L.P.、ASOF II Frontier Holdings 6 L.P.、ASOF II Frontier Holdings 7 L.P.、ASOF II A (DE) Frontier Holdings 1 L.P.、ASOF II A (DE) Frontier Holdings 2 L.P.、ACOF VI Frontier AIV A10, L.P.、ACOF VI Frontier AIV B1, L.P.、ASOF Frontier AIV A1, L.P.、ASOF Frontier AIV A2, L.P.、ASOF Frontier AIV A3, L.P.、ASOF Frontier AIV A4, L.P.、ASOF Frontier AIV A5, L.P.、ASOF Frontier AIV A6, L.P.、ASOF Frontier AIV A7, L.P.、ACOF Investment Management LLC、ASOF Investment Management LLC、ASSF Operating Manager IV, L.P.、Ares Management Holdings L.P.、Ares Holdco LLC、Ares Management Corp、Ares Management GP LLC、Ares Voting LLC、Ares Partners Holdco LLC、ACOF VI Frontier AIV A1, L.P.、ACOF VI Frontier AIV A2, L.P.、ACOF VI Frontier AIV A3, L.P.、ACOF VI Frontier AIV A4, L.P.、ACOF VI Frontier AIV A5, L.P.、ACOF VI Frontier AIV A6, L.P.、ACOF VI Frontier AIV A7, L.P.、ACOF VI Frontier AIV A8, L.P.、ACOF VI Frontier AIV A9, L.P.など、他の関連当事者も含まれている。

株式保有報告書とは何か

SECは上場会社の内部者 (インサイダー) に対し、株式取引や保有状況の公開を義務付けている。内部者 (取締役や執行役などの役員、株式10%以上を保有している主要株主など) の保有状況に変更があった場合、取引終了後一定期間内にSECにForm 3, 4, 5という保有報告書を提出する必要がある。