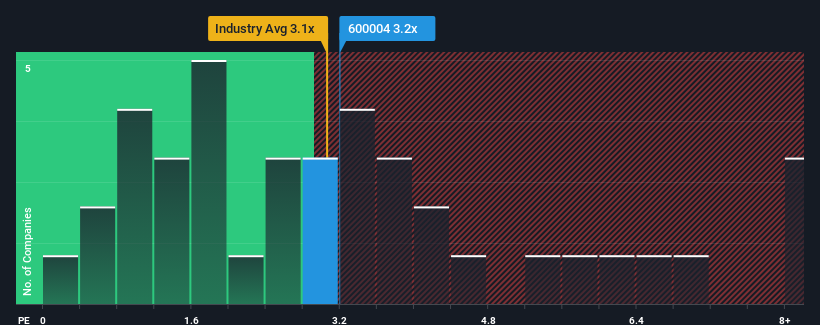

With a median price-to-sales (or "P/S") ratio of close to 3.1x in the Infrastructure industry in China, you could be forgiven for feeling indifferent about Guangzhou Baiyun International Airport Company Limited's (SHSE:600004) P/S ratio of 3.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Guangzhou Baiyun International Airport's Recent Performance Look Like?

Recent times have been advantageous for Guangzhou Baiyun International Airport as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangzhou Baiyun International Airport.Do Revenue Forecasts Match The P/S Ratio?

Guangzhou Baiyun International Airport's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 40% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 13% as estimated by the analysts watching the company. With the industry only predicted to deliver 7.6%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Guangzhou Baiyun International Airport's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Guangzhou Baiyun International Airport's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Guangzhou Baiyun International Airport you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.