On November 15, “People's Daily” published an article reporting the news that China's annual production of new energy vehicles has exceeded 10 million vehicles. It marks that China's NEV industry has ushered in a new stage of high-quality development. From an annual production of 0.013 million vehicles in 2013 to production exceeding 10 million in 2024, China has transformed from a major consumer of automobiles over the past ten years to become the world's top automobile manufacturing powerhouse.

The report pointed out that the automobile industry is an important sign of the country's manufacturing strength, and the “overtaking of the curve” of the NEV industry is an important factor in achieving breakthroughs in the Chinese automobile industry and an important manifestation of China's manufacturing strength. With the rapid rise in automobile sales in China, the upstream industry is also growing rapidly.

Coating is an important part of the automobile manufacturing process, and the automotive coating industry has ushered in rapid technological and market breakthroughs in recent years. The high-end and electrification of the automotive industry and the increasing pace of automobiles going overseas all place new demands on the automotive coatings industry. The improvement in the industry is also bringing opportunities for rapid development for individual companies.

The new energy industry is booming, and the automotive coatings market space is broad

The new energy industry is booming, and the automotive coatings market space is broad

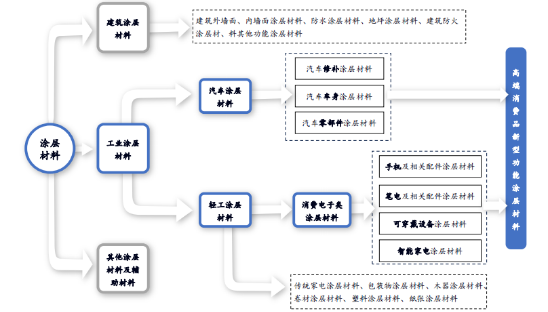

Automotive coatings are an important part of the automotive industry, and their development is closely related to automobile production. It generally refers to paint applied to the body and parts of various types of vehicles such as automobiles, or “paint” in the traditional sense. According to different uses, automotive coatings can be divided into categories such as automobile body paint, auto parts paint, automobile repair paint, etc., and there are certain differences in use, structural design, coating requirements, and sales models.

What may deviate from public perception is that automotive coatings are an industry with high technical content and high added value, reflecting a country's level of industrial technology to a certain extent. Automotive coatings have high requirements for weather resistance and wear resistance, and their color performance also has high technical barriers, which is clearly different from ordinary architectural coatings and light industrial coatings. Among industrial-grade coating materials, automotive coatings can be classified as new functional coating materials for high-end consumer products, and there is broad room for growth.

(Classification of coating material uses; image source: Open Source Securities Research Report)

The rapid growth in automobile sales in China, particularly new energy vehicles, has promoted the rapid development of the automotive coatings business. According to domestic paint industry media, the Coating Industry Data Research Institute estimates that in 2023, China's automotive paint market value increased 8% year on year to about 41.9 billion yuan. The increase in market value was mainly driven by the increase in passenger car production. At the same time, it also benefited from the increase in sales of “three electric (batteries, motors, electronic control)” coatings brought about by the rapid growth of new energy vehicles.

Young consumers from the electric vehicle market, individual demand for automotive interior and exterior colors is also the main driving force for the growth of the automotive coatings industry. In a context where new energy vehicle manufacturers are in full bloom and the market competition is fierce, car companies drive consumers' desire to buy by providing consumers with more colors to choose from. Judging from market research feedback, since 2024, the appearance of a car is the most considered factor by consumers in addition to intelligence and cost factors.

The rapid development of the domestic new energy industry has brought opportunities to domestic paint companies, and the competitiveness of automotive interior and exterior coatings companies that can provide innovation will be further highlighted, and it is expected to gain more market share.

The penetration rate of pearlescent car paint is rising rapidly, and domestic independent brands are making breakthroughs

In the ever-expanding automotive paint market, pearlescent car paint is gradually occupying the middle and high-end model market. According to Sullivan data, from 2016 to 2023, the market size of pearlescent materials used in the automotive sector increased rapidly at a compound annual growth rate of 33%, and the market size will maintain a compound growth rate of 16.4% within the next 7 years.

Compared to traditional metallic paint, pearlescent paint can make cars show different colors under different optical effects, showing unique changes in luster. This has also continued to increase its penetration rate in the automotive field. Among them, pearlescent paint made with mica as a base material is currently a type of paint that is widely used. Since mica itself has relatively stable properties, pearlescent paint with mica-based pearls has excellent performance in the fields of wear resistance, impact resistance, weather resistance, delayed aging, and corrosion resistance, and is therefore favored and loved by car companies. Although it is more expensive than metallic paint, some brands still use it as standard on flagship models due to its excellent performance. According to data disclosed by some listed companies, the development of automotive pearlescent paint requires long-term and strict verification, and the cycle is 5 to 8 years, so related companies have high barriers in terms of R&D strength and financial strength.

(The effect of pearlescent paint on cars; image source: CQV official website)

In the car paint market, foreign-led brands often occupy a monopoly position, and foreign-funded companies such as PPG, BASF, and Nippon occupy mainstream market shares. With the rapid development of domestic new energy vehicles in recent years, the market recognition of own-brand NEVs has increased rapidly, and the paint supply system with independent brands has also ushered in a breakthrough.

GLOBAL NEW MAT: A leading company in automotive-grade pearlescent materials

The development of the NEV industry has been accompanied by an increase in automotive product strength and the reshaping of the supply chain, and many industries have benefited from this. With its beautiful color and excellent performance, pearlescent car paint continues to increase its market penetration rate, which has also led to a rapid growth in demand for upstream automotive-grade pearlescent materials. GLOBAL NEW MAT (06616) is a pearlescent materials company that has developed rapidly in recent years. With years of deep cultivation in the field of pearlescent materials, GLOBAL NEW MAT currently has a variety of high-end automotive grade pearlescent materials, which are expected to continue to benefit from the development of the automotive industry.

According to public information, since its establishment, GLOBAL NEW MAT has focused on the research and development of various pearlescent materials. It has accumulated R&D patents and product processes over many years of industry experience, and has formed a pearlescent material product matrix centered on substrates such as natural mica, synthetic mica, silicon oxide, glass flakes, and flaky alumina. Among them, alumina-based and glass-based pearlescent materials are commonly used materials for high-end car paint, and are popular in the middle and high-end automotive sector. As of mid-2024, GLOBAL NEW MAT has a total of 154 patents and 73 registered trademarks. The company can provide more than 2,100 kinds of pearlescent material products, and has a full range of high-end pearlescent material products used in the cosmetics and automotive fields.

Under the strategic guidance of “putting equal emphasis on endogenous development and epitaxial expansion”, GLOBAL NEW MAT will take the high-end pearlescent pigment company CQV into its pocket in 2023. CQV is a leading manufacturer of automotive-grade pearlescent pigments in the industry. Its product lines, such as alumina base pearlescent materials and metallic aluminum pigments, are popular in the high-end car paint field, and enjoy a reputation in the global market.

In July of this year, GLOBAL NEW MAT announced a merger and acquisition agreement for Merck's surface performance business division in Germany, which has a huge influence in the industry. If the merger and acquisition is successfully implemented, it will significantly expand the global business footprint of GLOBAL NEW MAT.

In September 2024, GLOBAL NEW MAT announced its 2024 interim financial report as of June 30. The company achieved revenue of 0.775 billion yuan and an EBITDA profit of 0.267 billion yuan in the first half of the year, up 66.8% and 63.1% year-on-year respectively. According to the company's management, the increase in production capacity and price adjustments brought about by changes in the high-end product structure are the main factors driving revenue growth.

Thanks to the company's continuous investment in R&D and the addition of high-end products brought by CQV, the proportion of high-end products in the company's pearlescent pigment products is constantly increasing. As of mid-2024, the company's revenue share of synthetic mica-based pearlescent materials surpassed that of natural mica-based products, and the inclusion of alumina-based products further enhanced the competitiveness of its high-end products.

In addition to automotive coatings, GLOBAL NEW MAT is also actively exploring the application of synthetic mica in the field of insulation materials for new energy batteries. With the company's accumulated experience and technical patents in the field of synthetic mica, and adhering to the strategic guideline of “putting equal emphasis on endogenous development and epitaxial expansion”, the company is expected to seize the opportunities facing the Chinese automobile industry as the NEV market grows together.

Write it at the end

Looking back at the development of China's automobile industry over the past 20 years, the replacement of foreign investment by domestic brands continues to advance. The increase in comprehensive domestic manufacturing capabilities has ushered in a transformation of the automobile and the upstream automobile industry pattern. The era of foreign monopoly is gone, and the status of domestic enterprises has gradually changed from a catcher to a leader. The milestone of tens of millions of new energy vehicles produced and sold is probably just the prelude to this big drama.